Cimpress PLC (CMPR): Price and Financial Metrics

CMPR Price/Volume Stats

| Current price | $85.81 | 52-week high | $99.00 |

| Prev. close | $84.59 | 52-week low | $30.17 |

| Day low | $84.17 | Volume | 216,000 |

| Day high | $87.10 | Avg. volume | 133,730 |

| 50-day MA | $77.42 | Dividend yield | N/A |

| 200-day MA | $65.20 | Market Cap | 2.28B |

CMPR Stock Price Chart Interactive Chart >

CMPR POWR Grades

- Quality is the dimension where CMPR ranks best; there it ranks ahead of 97.34% of US stocks.

- CMPR's strongest trending metric is Quality; it's been moving up over the last 26 weeks.

- CMPR's current lowest rank is in the Momentum metric (where it is better than 34.23% of US stocks).

CMPR Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for CMPR is -5.1 -- better than just 2.81% of US stocks.

- CMPR's price/sales ratio is 0.63; that's higher than the P/S ratio of merely 20.81% of US stocks.

- Equity multiplier, or assets relative to shareholders' equity, comes in at -2.99 for CIMPRESS PLC; that's greater than it is for only 4.59% of US stocks.

- Stocks that are quantitatively similar to CMPR, based on their financial statements, market capitalization, and price volatility, are LFLY, LAB, RIGL, KERN, and QMCO.

- Visit CMPR's SEC page to see the company's official filings. To visit the company's web site, go to www.cimpress.com.

CMPR Valuation Summary

- CMPR's price/sales ratio is 0.7; this is 36.36% lower than that of the median Communication Services stock.

- CMPR's EV/EBIT ratio has moved up 60.9 over the prior 222 months.

Below are key valuation metrics over time for CMPR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CMPR | 2023-12-29 | 0.7 | -3.5 | -13.6 | 31.9 |

| CMPR | 2023-12-28 | 0.7 | -3.5 | -13.9 | 32.3 |

| CMPR | 2023-12-27 | 0.7 | -3.6 | -14.1 | 32.5 |

| CMPR | 2023-12-26 | 0.7 | -3.5 | -13.9 | 32.3 |

| CMPR | 2023-12-22 | 0.7 | -3.5 | -13.8 | 32.2 |

| CMPR | 2023-12-21 | 0.7 | -3.5 | -13.7 | 32.0 |

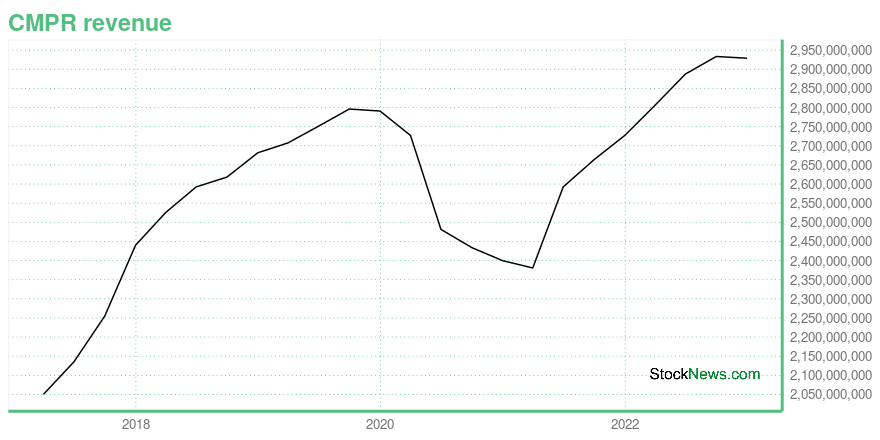

CMPR Growth Metrics

- The year over year net cashflow from operations growth rate now stands at -34.88%.

- The 4 year net cashflow from operations growth rate now stands at 109.47%.

- The year over year cash and equivalents growth rate now stands at 344.15%.

The table below shows CMPR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,928.857 | 95.5 | -267.863 |

| 2022-09-30 | 2,933.371 | 157.718 | -73.074 |

| 2022-06-30 | 2,887.555 | 219.536 | -54.331 |

| 2022-03-31 | 2,805.744 | 177.989 | -74.892 |

| 2021-12-31 | 2,727.183 | 188.964 | -42.125 |

| 2021-09-30 | 2,663.612 | 196.107 | -64.627 |

CMPR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CMPR has a Quality Grade of B, ranking ahead of 94.83% of graded US stocks.

- CMPR's asset turnover comes in at 1.318 -- ranking 71st of 561 Business Services stocks.

- PIXY, TBI, and NVEE are the stocks whose asset turnover ratios are most correlated with CMPR.

The table below shows CMPR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 1.318 | 0.491 | 0.038 |

| 2021-06-30 | 1.344 | 0.492 | 0.033 |

| 2021-03-31 | 1.295 | 0.493 | 0.050 |

| 2020-12-31 | 1.262 | 0.494 | 0.014 |

| 2020-09-30 | 1.264 | 0.498 | 0.032 |

| 2020-06-30 | 1.270 | 0.497 | 0.040 |

CMPR Price Target

For more insight on analysts targets of CMPR, see our CMPR price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $122.50 | Average Broker Recommendation | 1.25 (Strong Buy) |

Cimpress PLC (CMPR) Company Bio

Cimpress PLC operates as an online supplier of coordinated portfolios of marketing products and services to micro businesses worldwide. The company was founded in 1995 and is based in Venlo, the Netherlands.

Latest CMPR News From Around the Web

Below are the latest news stories about CIMPRESS PLC that investors may wish to consider to help them evaluate CMPR as an investment opportunity.

Strength in Vista Segment Aids Cimpress (CMPR) Amid Cost WoesCimpress (CMPR) stands to benefit from the solid momentum in the Vista segment, driven by order growth, particularly from new customers. However, cost inflation remains a concern. |

Cimpress releases FY2023 ESG ReportDUNDALK, Ireland, December 14, 2023--Cimpress plc (Nasdaq: CMPR) published its latest Environmental, Social, and Governance (ESG) Report, providing an in-depth overview of the company's advancements in environmental stewardship and social responsibility during the fiscal year 2023. |

Why Is H&R Block (HRB) Up 7.9% Since Last Earnings Report?H&R Block (HRB) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Cimpress plc (CMPR) Recovered in Q3Diamond Hill Capital, an investment management company, released its “Select Strategy” third-quarter 2023 investor letter. A copy of the same can be downloaded here. In Q3, the portfolio fell behind the Russell 3000 Index. Relative weakness was concentrated among staples holdings, and discretionary holdings also trailed benchmark peers, impacting the relative performance. On the other hand, […] |

Why Cimpress (CMPR) is a Top Momentum Stock for the Long-TermThe Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage. |

CMPR Price Returns

| 1-mo | 15.99% |

| 3-mo | 35.63% |

| 6-mo | 21.44% |

| 1-year | 118.68% |

| 3-year | -19.50% |

| 5-year | 9.72% |

| YTD | 7.20% |

| 2023 | 189.93% |

| 2022 | -61.44% |

| 2021 | -18.38% |

| 2020 | -30.24% |

| 2019 | 21.61% |

Continue Researching CMPR

Want to see what other sources are saying about CIMPRESS plc's financials and stock price? Try the links below:CIMPRESS plc (CMPR) Stock Price | Nasdaq

CIMPRESS plc (CMPR) Stock Quote, History and News - Yahoo Finance

CIMPRESS plc (CMPR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...