V.F. Corp. (VFC): Price and Financial Metrics

VFC Price/Volume Stats

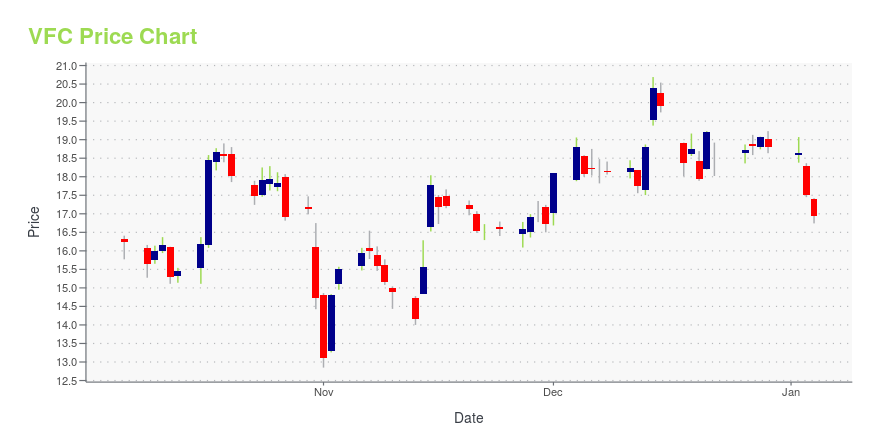

| Current price | $15.35 | 52-week high | $29.03 |

| Prev. close | $15.31 | 52-week low | $12.85 |

| Day low | $15.18 | Volume | 10,824,300 |

| Day high | $15.71 | Avg. volume | 8,093,722 |

| 50-day MA | $17.47 | Dividend yield | 2.18% |

| 200-day MA | $18.33 | Market Cap | 5.97B |

VFC Stock Price Chart Interactive Chart >

VFC POWR Grades

- VFC scores best on the Value dimension, with a Value rank ahead of 49.16% of US stocks.

- The strongest trend for VFC is in Quality, which has been heading down over the past 26 weeks.

- VFC ranks lowest in Sentiment; there it ranks in the 6th percentile.

VFC Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for VFC is 5.15 -- better than 91.04% of US stocks.

- With a one year PEG ratio of 527.24, V F CORP is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than 94.09% of US stocks.

- VFC's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- Stocks with similar financial metrics, market capitalization, and price volatility to V F CORP are CTRN, GPI, KSS, VHI, and LAZY.

- VFC's SEC filings can be seen here. And to visit V F CORP's official web site, go to www.vfc.com.

VFC Valuation Summary

- In comparison to the median Consumer Cyclical stock, VFC's price/earnings ratio is 294.29% lower, now standing at -34.

- VFC's price/sales ratio has moved down 0.3 over the prior 243 months.

Below are key valuation metrics over time for VFC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| VFC | 2023-12-29 | 0.6 | 3.3 | -34.0 | 20.8 |

| VFC | 2023-12-28 | 0.7 | 3.4 | -34.5 | 20.9 |

| VFC | 2023-12-27 | 0.6 | 3.3 | -34.1 | 20.8 |

| VFC | 2023-12-26 | 0.6 | 3.3 | -33.8 | 20.7 |

| VFC | 2023-12-22 | 0.6 | 3.3 | -33.6 | 20.6 |

| VFC | 2023-12-21 | 0.7 | 3.4 | -34.7 | 21.0 |

VFC Growth Metrics

- Its 4 year price growth rate is now at 11.89%.

- Its 4 year net cashflow from operations growth rate is now at -38.12%.

- Its 2 year net cashflow from operations growth rate is now at -1.17%.

The table below shows VFC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 11,697.53 | -766.564 | 414.318 |

| 2022-09-30 | 11,791.24 | 121.468 | 424.251 |

| 2022-06-30 | 11,908.88 | 424.96 | 1,006.736 |

| 2022-03-31 | 11,841.84 | 864.288 | 1,386.941 |

| 2021-12-31 | 11,599.85 | 968.549 | 1,395.619 |

| 2021-09-30 | 10,947 | 1,059.28 | 1,225.058 |

VFC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- VFC has a Quality Grade of C, ranking ahead of 69.93% of graded US stocks.

- VFC's asset turnover comes in at 0.797 -- ranking 26th of 32 Apparel stocks.

- RL, LEVI, and LULU are the stocks whose asset turnover ratios are most correlated with VFC.

The table below shows VFC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-02 | 0.797 | 0.542 | 0.135 |

| 2021-06-03 | 0.767 | 0.535 | 0.110 |

| 2021-03-31 | 0.698 | 0.527 | 0.052 |

| 2020-12-26 | 0.644 | 0.544 | 0.009 |

| 2020-09-26 | 0.718 | 0.548 | 0.023 |

| 2020-06-27 | 0.813 | 0.552 | 0.051 |

VFC Price Target

For more insight on analysts targets of VFC, see our VFC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $95.23 | Average Broker Recommendation | 1.65 (Moderate Buy) |

V.F. Corp. (VFC) Company Bio

VF Corporation (formerly Vanity Fair Mills until 1969) is an American global apparel and footwear company founded in 1899 and headquartered in Denver, Colorado. The company's 13 brands are organized into three categories: Outdoor, Active and Work. The company controls 55% of the U.S. backpack market with the JanSport, Eastpak, Timberland, and North Face brands. (Source:Wikipedia)

Latest VFC News From Around the Web

Below are the latest news stories about V F CORP that investors may wish to consider to help them evaluate VFC as an investment opportunity.

Industry Moves: Crocs Appoints John Replogle, Neeraj Tolmare to Its Board of Directors + More NewsWho's in, who's out, who's been promoted and who's been hired from across the footwear and fashion industry. |

3 Charts For Investors to Watch Tuesday: Enphase Energy, VF Corp., SLX ETFThese two stocks and one ETF are worth putting on your watchlist today. We look at the reasons why and identify important chart levels to watch. |

Vans and North Face Owner VF Corp. Tumbled Over 7%—Here's WhyVF Corp. (VFC) shares fell over 7% Monday after the owner of the Vans and North Face shoe and apparel brands warned that the company’s business operations were disrupted by a cyberattack. VF said in a regulatory filing Monday that the hacker encrypted some IT systems and stole data, including personal information. VF said the hack was first detected Dec. 13. |

S&P 500 Gains and Losses Today: Amazon Reportedly Aims To Expand Reach Into SportsThe S&P 500 advanced 0.5% on Monday, Dec. 18, 2023, carrying over good feelings about the economy and talk of interest rate cuts from last week. |

US STOCKS-Wall Street ends higher, extending rate-cut rallyU.S. stocks gained ground on Monday as market participants parsed mounting expectations of interest rate cuts from the Federal Reserve in the coming year and looked ahead to a week of crucial economic data. A broad but modest rally boosted the S&P 500 and the Nasdaq to solid gains, while the Dow ended flat. "Markets are heading in the direction of the Fed beginning to cut interest rates next year," said Tom Hainlin, national investment strategist at U.S. Bank Wealth Management in Minneapolis. |

VFC Price Returns

| 1-mo | -10.55% |

| 3-mo | 3.53% |

| 6-mo | -23.96% |

| 1-year | -43.33% |

| 3-year | -78.74% |

| 5-year | -77.41% |

| YTD | -18.35% |

| 2023 | -28.51% |

| 2022 | -60.38% |

| 2021 | -12.05% |

| 2020 | -12.00% |

| 2019 | 51.76% |

VFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VFC

Want to see what other sources are saying about V F Corp's financials and stock price? Try the links below:V F Corp (VFC) Stock Price | Nasdaq

V F Corp (VFC) Stock Quote, History and News - Yahoo Finance

V F Corp (VFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...