Park Hotels & Resorts Inc. (PK): Price and Financial Metrics

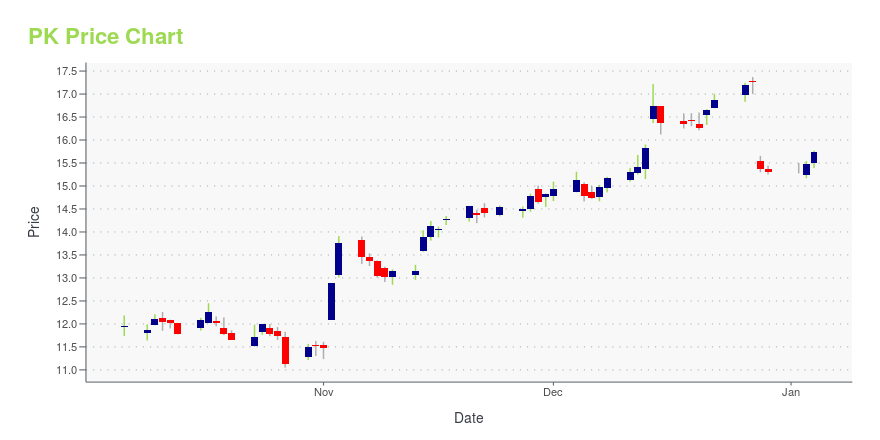

PK Price/Volume Stats

| Current price | $15.26 | 52-week high | $17.37 |

| Prev. close | $15.07 | 52-week low | $10.70 |

| Day low | $15.04 | Volume | 2,035,500 |

| Day high | $15.41 | Avg. volume | 3,252,111 |

| 50-day MA | $15.70 | Dividend yield | 24.73% |

| 200-day MA | $13.59 | Market Cap | 3.20B |

PK Stock Price Chart Interactive Chart >

PK POWR Grades

- PK scores best on the Momentum dimension, with a Momentum rank ahead of 62.22% of US stocks.

- PK's strongest trending metric is Value; it's been moving down over the last 26 weeks.

- PK's current lowest rank is in the Stability metric (where it is better than 17.37% of US stocks).

PK Stock Summary

- Of note is the ratio of PARK HOTELS & RESORTS INC's sales and general administrative expense to its total operating expenses; only 2.56% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for PARK HOTELS & RESORTS INC is higher than it is for about 82.15% of US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for PK comes in at 15.64% -- higher than that of 89.32% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to PARK HOTELS & RESORTS INC, a group of peers worth examining would be SBRA, HR, INN, OPI, and SWX.

- Visit PK's SEC page to see the company's official filings. To visit the company's web site, go to www.pkhotelsandresorts.com.

PK Valuation Summary

- In comparison to the median Real Estate stock, PK's EV/EBIT ratio is 21.28% higher, now standing at 35.9.

- PK's EV/EBIT ratio has moved up 19.4 over the prior 85 months.

Below are key valuation metrics over time for PK.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PK | 2023-12-29 | 1.2 | 0.8 | -57.4 | 35.9 |

| PK | 2023-12-28 | 1.2 | 0.8 | -57.6 | 36.0 |

| PK | 2023-12-27 | 1.3 | 0.9 | -64.8 | 38.0 |

| PK | 2023-12-26 | 1.3 | 0.9 | -64.5 | 37.9 |

| PK | 2023-12-22 | 1.3 | 0.9 | -63.2 | 37.5 |

| PK | 2023-12-21 | 1.3 | 0.9 | -62.4 | 37.3 |

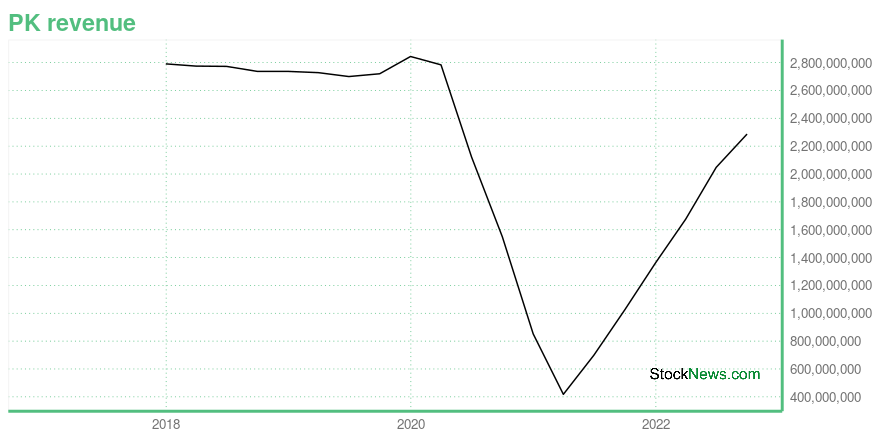

PK Growth Metrics

- Its 2 year revenue growth rate is now at -39.8%.

- The 3 year net cashflow from operations growth rate now stands at -104.65%.

- Its year over year revenue growth rate is now at 300.96%.

The table below shows PK's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 2,287 | 297 | 61 |

| 2022-06-30 | 2,048 | 215 | -60 |

| 2022-03-31 | 1,676 | -22 | -326 |

| 2021-12-31 | 1,362 | -137 | -459 |

| 2021-09-30 | 1,024 | -259 | -609 |

| 2021-06-30 | 699 | -441 | -799 |

PK's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PK has a Quality Grade of D, ranking ahead of 5.51% of graded US stocks.

- PK's asset turnover comes in at 0.066 -- ranking 75th of 79 Restaraunts Hotels Motels stocks.

- SHO, H, and ARMK are the stocks whose asset turnover ratios are most correlated with PK.

The table below shows PK's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.066 | 0.199 | -0.038 |

| 2021-03-31 | 0.039 | -0.081 | -0.048 |

| 2020-12-31 | 0.078 | 0.149 | -0.082 |

| 2020-09-30 | 0.139 | 0.304 | -0.059 |

| 2020-06-30 | 0.188 | 0.364 | -0.042 |

| 2020-03-31 | 0.255 | 0.407 | -0.021 |

PK Price Target

For more insight on analysts targets of PK, see our PK price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $22.93 | Average Broker Recommendation | 1.7 (Moderate Buy) |

Park Hotels & Resorts Inc. (PK) Company Bio

Park Hotels & Resorts Inc. was established as an independent company on January 3, 2017, following its spin-off from Hilton Worldwide Holdings, Inc. The company is a lodging real estate company with its portfolio consists of approximately 67 premium-branded hotels and resorts with over 35,000 rooms located in prime United States and internationally. Over 85% of Park’s portfolio is in the luxury or upper upscale segment and 100% is in the U.S., including locations in 14 of the top 25 markets. Nearly 80% of the company’s portfolio is in the central business districts of major cities or resort or conference destinations. Thomas J. Baltimore, Jr. serves as Park’s President and Chief Executive Officer and the company has approximately 500 employees.

Latest PK News From Around the Web

Below are the latest news stories about PARK HOTELS & RESORTS INC that investors may wish to consider to help them evaluate PK as an investment opportunity.

Hotel REITs 2024: Golden Opportunity Or Fool's Gold?As 2023 nears completion, investors in real estate investment trusts (REITs) are feeling more optimistic. After a prolonged slump throughout 2022 and the first 10 months of 2023, REITs have rallied over the past two months. Pauses in interest rate hikes, along with the likelihood of three interest rate cuts in 2024, have generated strong appreciation of REITs across multiple subsectors. As investors look toward 2024, they will be forced to differentiate between REITs that will likely continue ma |

5 REITs Paying Special Dividends With Upcoming Ex-Dividend DatesAs much as investors love regular dividend payments, it's even more "special" when one of their stocks pays a special dividend, most often at the end of the calendar year. Because real estate investment trusts (REITs) are required to pay shareholders 90% or more of taxable income each year, special dividend distributions are often required when a REIT disposes of assets with large gains, which increases the taxable income for that year. The special dividend benefits shareholders with a larger an |

Park Hotels' (PK) Portfolio Sees Robust Q4 Operating TrendsPark Hotels' (PK) fourth-quarter operating trend remains robust, aided by a strong performance in the urban portfolio. |

Zacks.com featured highlights Park Hotels & Resorts, Centene, Solo Brands and AZZPark Hotels & Resorts, Centene, Solo Brands and AZZ have been highlighted in this Screen of The Week article. |

4 Low Price-to-Cash Flow Stocks to Navigate the Market in 2024Value investing is essentially about selecting stocks that are usually cheap but fundamentally sound. Park Hotels & Resorts (PK), Centene (CNC), Solo Brands (DTC) and AZZ Inc. (AZZ) boast low P/CF ratios. |

PK Price Returns

| 1-mo | -5.28% |

| 3-mo | 28.62% |

| 6-mo | 31.74% |

| 1-year | 23.24% |

| 3-year | -3.73% |

| 5-year | -30.93% |

| YTD | -0.26% |

| 2023 | 49.45% |

| 2022 | -36.03% |

| 2021 | 10.09% |

| 2020 | -30.13% |

| 2019 | 6.86% |

PK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PK

Want to do more research on Park Hotels & Resorts Inc's stock and its price? Try the links below:Park Hotels & Resorts Inc (PK) Stock Price | Nasdaq

Park Hotels & Resorts Inc (PK) Stock Quote, History and News - Yahoo Finance

Park Hotels & Resorts Inc (PK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...