Metropolitan Bank Holding Corp. (MCB): Price and Financial Metrics

MCB Price/Volume Stats

| Current price | $41.95 | 52-week high | $61.02 |

| Prev. close | $41.05 | 52-week low | $13.98 |

| Day low | $40.50 | Volume | 121,000 |

| Day high | $42.03 | Avg. volume | 118,478 |

| 50-day MA | $48.56 | Dividend yield | N/A |

| 200-day MA | $38.88 | Market Cap | 464.09M |

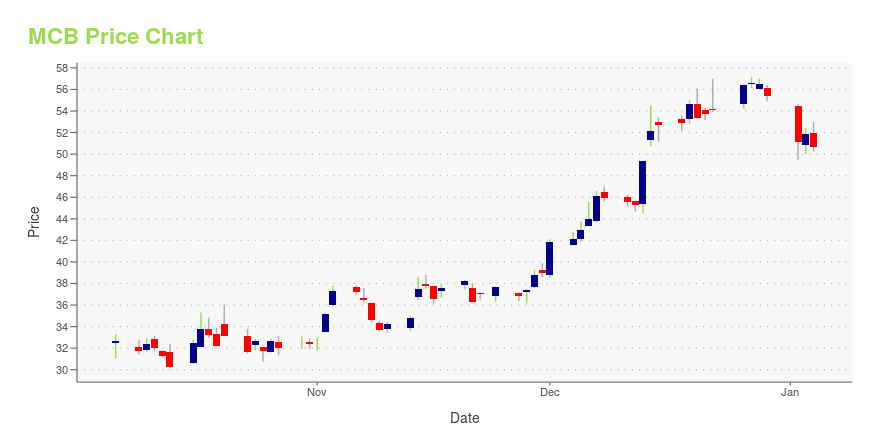

MCB Stock Price Chart Interactive Chart >

MCB POWR Grades

- Value is the dimension where MCB ranks best; there it ranks ahead of 80.83% of US stocks.

- The strongest trend for MCB is in Stability, which has been heading up over the past 26 weeks.

- MCB ranks lowest in Quality; there it ranks in the 16th percentile.

MCB Stock Summary

- MCB's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 90.99% of US stocks.

- With a year-over-year growth in debt of 706.28%, METROPOLITAN BANK HOLDING CORP's debt growth rate surpasses 98.71% of about US stocks.

- METROPOLITAN BANK HOLDING CORP's shareholder yield -- a measure of how much capital is returned to stockholders via dividends and buybacks -- is -57.92%, greater than the shareholder yield of just 7.1% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to METROPOLITAN BANK HOLDING CORP, a group of peers worth examining would be STBA, RBA, OBT, CIVI, and AMNB.

- Visit MCB's SEC page to see the company's official filings. To visit the company's web site, go to www.metropolitanbankny.com.

MCB Valuation Summary

- MCB's EV/EBIT ratio is 9.1; this is 23.85% lower than that of the median Financial Services stock.

- Over the past 74 months, MCB's EV/EBIT ratio has gone down 28.6.

Below are key valuation metrics over time for MCB.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MCB | 2023-12-22 | 2.4 | 0.9 | 10.9 | 9.1 |

| MCB | 2023-12-21 | 2.4 | 0.9 | 10.8 | 9.1 |

| MCB | 2023-12-20 | 2.4 | 0.9 | 10.7 | 9.0 |

| MCB | 2023-12-19 | 2.4 | 1.0 | 11.0 | 9.2 |

| MCB | 2023-12-18 | 2.3 | 0.9 | 10.7 | 9.0 |

| MCB | 2023-12-15 | 2.3 | 0.9 | 10.6 | 8.9 |

MCB's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MCB has a Quality Grade of D, ranking ahead of 20.59% of graded US stocks.

- MCB's asset turnover comes in at 0.03 -- ranking 374th of 428 Banking stocks.

- CIZN, WRLD, and ICMB are the stocks whose asset turnover ratios are most correlated with MCB.

The table below shows MCB's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.030 | 1 | 0.020 |

| 2021-06-30 | 0.031 | 1 | 0.019 |

| 2021-03-31 | 0.033 | 1 | 0.019 |

| 2020-12-31 | 0.033 | 1 | 0.017 |

| 2020-09-30 | 0.034 | 1 | 0.016 |

| 2020-06-30 | 0.033 | 1 | 0.015 |

MCB Price Target

For more insight on analysts targets of MCB, see our MCB price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $107.50 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Metropolitan Bank Holding Corp. (MCB) Company Bio

Metropolitan Bank Holding Corp. operates as the bank holding company for Metropolitan Commercial Bank that provides a range of business, commercial, and retail banking products and services to small businesses, middle-market enterprises, public entities, and individuals in the New York metropolitan area. The company was founded in 1999 and is based in New York, New York.

Latest MCB News From Around the Web

Below are the latest news stories about METROPOLITAN BANK HOLDING CORP that investors may wish to consider to help them evaluate MCB as an investment opportunity.

Metropolitan Bank Holding Corp. (MCB) Surges 5.7%: Is This an Indication of Further Gains?Metropolitan Bank Holding Corp. (MCB) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road. |

ConnectOne (CNOB) Surges 7.7%: Is This an Indication of Further Gains?ConnectOne (CNOB) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Strength Seen in Equity Bancshares (EQBK): Can Its 5.8% Jump Turn into More Strength?Equity Bancshares (EQBK) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Do Options Traders Know Something About Metropolitan Bank (MCB) Stock We Don't?Investors need to pay close attention to Metropolitan Bank (MCB) stock based on the movements in the options market lately. |

Metropolitan Bank Holding's (NYSE:MCB) earnings have declined over year, contributing to shareholders 46% lossMetropolitan Bank Holding Corp. ( NYSE:MCB ) shareholders should be happy to see the share price up 12% in the last... |

MCB Price Returns

| 1-mo | -16.90% |

| 3-mo | 22.66% |

| 6-mo | -9.02% |

| 1-year | -28.84% |

| 3-year | -11.31% |

| 5-year | 14.21% |

| YTD | -24.25% |

| 2023 | -5.61% |

| 2022 | -44.93% |

| 2021 | 193.71% |

| 2020 | -24.80% |

| 2019 | 56.34% |

Continue Researching MCB

Want to see what other sources are saying about Metropolitan Bank Holding Corp's financials and stock price? Try the links below:Metropolitan Bank Holding Corp (MCB) Stock Price | Nasdaq

Metropolitan Bank Holding Corp (MCB) Stock Quote, History and News - Yahoo Finance

Metropolitan Bank Holding Corp (MCB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...