Macerich Co. (MAC): Price and Financial Metrics

MAC Price/Volume Stats

| Current price | $17.13 | 52-week high | $17.35 |

| Prev. close | $16.96 | 52-week low | $8.77 |

| Day low | $16.62 | Volume | 3,072,800 |

| Day high | $17.15 | Avg. volume | 1,901,852 |

| 50-day MA | $15.07 | Dividend yield | 4.32% |

| 200-day MA | $12.06 | Market Cap | 3.69B |

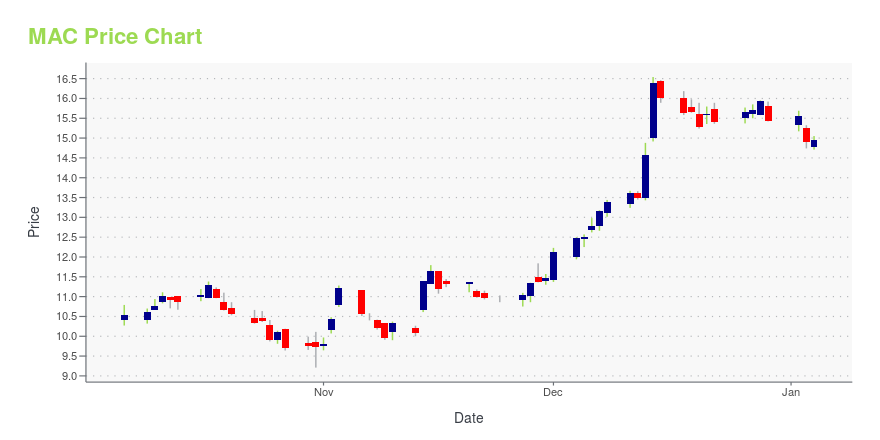

MAC Stock Price Chart Interactive Chart >

MAC POWR Grades

- Growth is the dimension where MAC ranks best; there it ranks ahead of 89.37% of US stocks.

- The strongest trend for MAC is in Growth, which has been heading up over the past 26 weeks.

- MAC's current lowest rank is in the Sentiment metric (where it is better than 0.97% of US stocks).

MAC Stock Summary

- Of note is the ratio of MACERICH CO's sales and general administrative expense to its total operating expenses; only 2.43% of US stocks have a lower such ratio.

- For MAC, its debt to operating expenses ratio is greater than that reported by 91.78% of US equities we're observing.

- Over the past twelve months, MAC has reported earnings growth of -211.43%, putting it ahead of merely 6.13% of US stocks in our set.

- If you're looking for stocks that are quantitatively similar to MACERICH CO, a group of peers worth examining would be DHC, HR, OPI, AIRC, and BHR.

- Visit MAC's SEC page to see the company's official filings. To visit the company's web site, go to www.macerich.com.

MAC Valuation Summary

- MAC's price/sales ratio is 3.8; this is 216.67% higher than that of the median Real Estate stock.

- Over the past 243 months, MAC's price/sales ratio has gone down 1.6.

Below are key valuation metrics over time for MAC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MAC | 2023-12-29 | 3.8 | 1.4 | -9.9 | -59.6 |

| MAC | 2023-12-28 | 3.9 | 1.4 | -10.3 | -60.4 |

| MAC | 2023-12-27 | 3.9 | 1.4 | -10.1 | -60.0 |

| MAC | 2023-12-26 | 3.9 | 1.4 | -10.1 | -60.0 |

| MAC | 2023-12-22 | 3.8 | 1.4 | -9.9 | -59.5 |

| MAC | 2023-12-21 | 3.9 | 1.4 | -10.1 | -59.9 |

MAC Growth Metrics

- The 2 year cash and equivalents growth rate now stands at -72.23%.

- Its year over year price growth rate is now at -8.32%.

- The 4 year revenue growth rate now stands at -10.12%.

The table below shows MAC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 859.164 | 337.51 | -66.068 |

| 2022-09-30 | 860.342 | 359.723 | -84.829 |

| 2022-06-30 | 861.775 | 288.763 | 37.066 |

| 2022-03-31 | 873.157 | 299.593 | 40.685 |

| 2021-12-31 | 847.437 | 286.368 | 14.263 |

| 2021-09-30 | 812.677 | 271.343 | -159.085 |

MAC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MAC has a Quality Grade of D, ranking ahead of 12.74% of graded US stocks.

- MAC's asset turnover comes in at 0.086 -- ranking 245th of 444 Trading stocks.

- CLDT, AHT, and DRH are the stocks whose asset turnover ratios are most correlated with MAC.

The table below shows MAC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.086 | 0.544 | -0.016 |

| 2021-03-31 | 0.080 | 0.533 | -0.016 |

| 2020-12-31 | 0.085 | 0.557 | -0.010 |

| 2020-09-30 | 0.091 | 0.580 | 0.007 |

| 2020-06-30 | 0.097 | 0.591 | 0.010 |

| 2020-03-31 | 0.103 | 0.605 | 0.014 |

MAC Price Target

For more insight on analysts targets of MAC, see our MAC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $18.50 | Average Broker Recommendation | 2.09 (Hold) |

Macerich Co. (MAC) Company Bio

The Macerich Company engages in the acquisition, ownership, development, redevelopment, management and leasing of regional and community shopping centers located throughout the United States. The company was founded in 1964 and is based in Santa Monica, California.

Latest MAC News From Around the Web

Below are the latest news stories about MACERICH CO that investors may wish to consider to help them evaluate MAC as an investment opportunity.

The Zacks Analyst Blog Highlights Prologis, Alexandria Real Estate Equities, The Macerich and Innovative Industrial PropertiesPrologis, Alexandria Real Estate Equities, The Macerich and Innovative Industrial Properties are part of the Zacks top Analyst Blog. |

Macerich (MAC) Soars 8.0%: Is Further Upside Left in the Stock?Macerich (MAC) witnessed a jump in share price last session on above-average trading volume. The latest trend in FFO estimate revisions for the stock doesn't suggest further strength down the road. |

Macerich's (MAC) JV Refinances Tysons Corner, Ups FlexibilityMacerich's (MAC) joint venture, which owns Tysons Corner Center, carries out the refinancing of the property for $710 million. The move boosts its financial flexibility and poises it well for growth. |

Macerich Completes $710 Million Refinancing of Tysons Corner CenterTysons Corner Center Exterior Tysons Corner Center in Virginia Tysons Corner Center, A Macerich Property Tysons Corner Center, A Macerich Property SANTA MONICA, Calif., Dec. 05, 2023 (GLOBE NEWSWIRE) -- Macerich (NYSE: MAC), one of the nation’s leading owners, operators and developers of major retail and mixed-use properties in top markets, today announced that Macerich’s joint venture that owns Tysons Corner Center has just closed a $710 million refinance on this high-quality property in Northe |

Macerich (MAC) Up 15.8% Since Last Earnings Report: Can It Continue?Macerich (MAC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

MAC Price Returns

| 1-mo | 11.02% |

| 3-mo | 65.83% |

| 6-mo | 39.84% |

| 1-year | 36.32% |

| 3-year | 49.83% |

| 5-year | -41.88% |

| YTD | 11.02% |

| 2023 | 45.69% |

| 2022 | -31.57% |

| 2021 | 68.49% |

| 2020 | -54.09% |

| 2019 | -32.18% |

MAC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MAC

Want to see what other sources are saying about Macerich Co's financials and stock price? Try the links below:Macerich Co (MAC) Stock Price | Nasdaq

Macerich Co (MAC) Stock Quote, History and News - Yahoo Finance

Macerich Co (MAC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...