Apyx Medical Corporation (APYX): Price and Financial Metrics

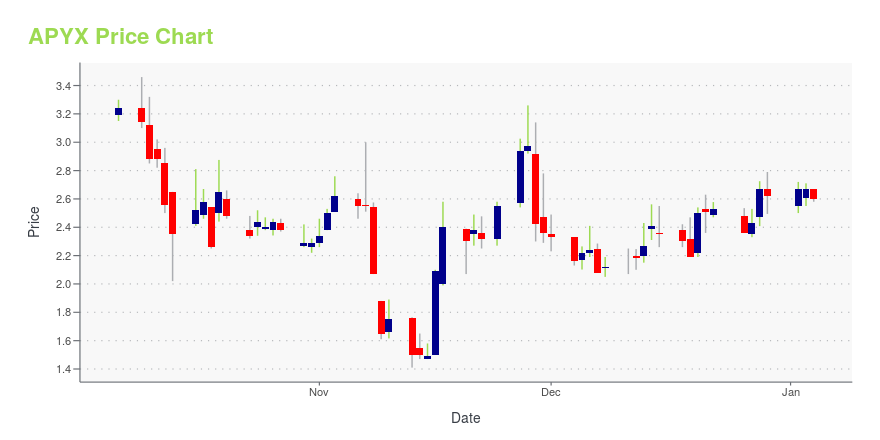

APYX Price/Volume Stats

| Current price | $2.58 | 52-week high | $7.97 |

| Prev. close | $2.40 | 52-week low | $1.41 |

| Day low | $2.40 | Volume | 35,700 |

| Day high | $2.65 | Avg. volume | 93,819 |

| 50-day MA | $2.37 | Dividend yield | N/A |

| 200-day MA | $3.89 | Market Cap | 89.38M |

APYX Stock Price Chart Interactive Chart >

APYX POWR Grades

- APYX scores best on the Growth dimension, with a Growth rank ahead of 75.49% of US stocks.

- The strongest trend for APYX is in Quality, which has been heading up over the past 26 weeks.

- APYX's current lowest rank is in the Momentum metric (where it is better than 4.37% of US stocks).

APYX Stock Summary

- With a market capitalization of $92,499,093, APYX MEDICAL CORP has a greater market value than just 19.24% of US stocks.

- With a year-over-year growth in debt of 1,667.69%, APYX MEDICAL CORP's debt growth rate surpasses 99.4% of about US stocks.

- The volatility of APYX MEDICAL CORP's share price is greater than that of 90.79% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to APYX MEDICAL CORP are TSBK, ISDR, PEGY, MBIN, and SMTI.

- Visit APYX's SEC page to see the company's official filings. To visit the company's web site, go to apyxmedical.com.

APYX Valuation Summary

- In comparison to the median Healthcare stock, APYX's price/earnings ratio is 120.58% lower, now standing at -6.

- Over the past 243 months, APYX's price/earnings ratio has gone down 73.5.

Below are key valuation metrics over time for APYX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| APYX | 2023-12-29 | 1.8 | 2.7 | -6.0 | -5.1 |

| APYX | 2023-12-28 | 1.8 | 2.8 | -6.1 | -5.2 |

| APYX | 2023-12-27 | 1.7 | 2.5 | -5.6 | -4.7 |

| APYX | 2023-12-26 | 1.6 | 2.5 | -5.4 | -4.6 |

| APYX | 2023-12-22 | 1.7 | 2.6 | -5.8 | -4.9 |

| APYX | 2023-12-21 | 1.7 | 2.6 | -5.7 | -4.9 |

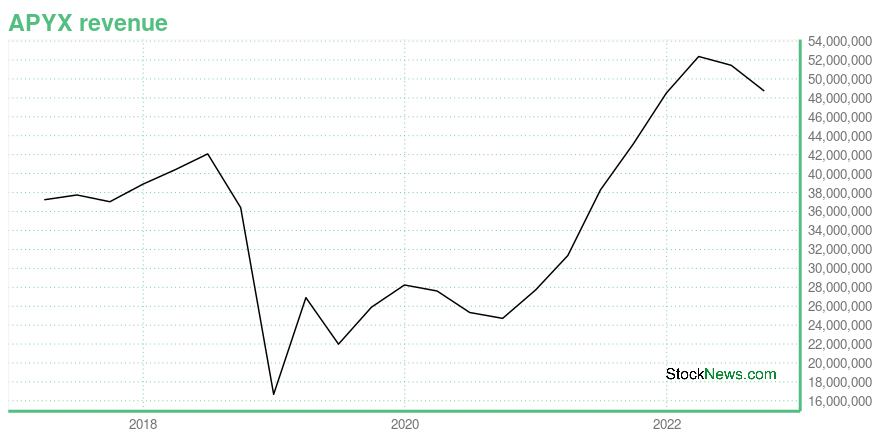

APYX Growth Metrics

- Its year over year revenue growth rate is now at 67.05%.

- Its 5 year price growth rate is now at 37.74%.

- The 3 year net cashflow from operations growth rate now stands at 47.38%.

The table below shows APYX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 48.723 | -15.536 | -19.138 |

| 2022-06-30 | 51.44 | -13.781 | -17.596 |

| 2022-03-31 | 52.372 | -12.915 | -16.216 |

| 2021-12-31 | 48.517 | -10.449 | -15.172 |

| 2021-09-30 | 43.157 | -11.68 | -14.696 |

| 2021-06-30 | 38.28 | -10.691 | -14.202 |

APYX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- APYX has a Quality Grade of F, ranking ahead of 3.65% of graded US stocks.

- APYX's asset turnover comes in at 0.528 -- ranking 87th of 186 Medical Equipment stocks.

- NDRA, SINT, and AVNS are the stocks whose asset turnover ratios are most correlated with APYX.

The table below shows APYX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.528 | 0.675 | -0.642 |

| 2021-03-31 | 0.420 | 0.650 | -0.749 |

| 2020-12-31 | 0.358 | 0.632 | -0.847 |

| 2020-09-30 | 0.309 | 0.643 | -1.141 |

| 2020-06-30 | 0.306 | 0.639 | -1.224 |

| 2020-03-31 | 0.322 | 0.672 | -1.282 |

APYX Price Target

For more insight on analysts targets of APYX, see our APYX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.00 | Average Broker Recommendation | 1.38 (Strong Buy) |

Apyx Medical Corporation (APYX) Company Bio

Apyx Medical Corporation, a energy technology company, manufactures and sells medical devices in the cosmetic and surgical markets worldwide. It operates in two segments, Advanced Energy and Original Equipment Manufacturing (OEM). The company develops J-Plasma, a patented plasma-based surgical product for cutting, coagulation, and ablation of soft tissue. It markets and sells Helium Plasma Technology under the Renuvion brand name in the cosmetic surgery market and under the J-Plasma brand name in the hospital surgical market. The company's Renuvion cosmetic technology enables plastic surgeons, fascial plastic surgeons, and cosmetic physicians to provide controlled heat to the tissue; and the J-Plasma system allows surgeons to operate in eliminating unintended tissue trauma. It also designs, develops, manufactures, and sells electrosurgical and OEM generators and related accessories for medical device manufacturers. The company was formerly known as Bovie Medical Corporation and changed its name to Apyx Medical Corporation in January 2019. Apyx Medical Corporation was incorporated in 1982 and is based in Clearwater, Florida.

Latest APYX News From Around the Web

Below are the latest news stories about APYX MEDICAL CORP that investors may wish to consider to help them evaluate APYX as an investment opportunity.

Apyx Medical Corporation Appoints Matthew Hill as Chief Financial OfficerCLEARWATER, Fla., November 28, 2023--Apyx Medical Corporation (Nasdaq:APYX) ("Apyx Medical;" the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today announced the appointment of Matthew Hill to the position of Chief Financial Officer, effective December 4, 2023. Mr. Hill succeeds Tara Semb, whose departure was announced by the Company on November 9, 2023. |

Apyx Medical Corporation (NASDAQ:APYX) Q3 2023 Earnings Call TranscriptApyx Medical Corporation (NASDAQ:APYX) Q3 2023 Earnings Call Transcript November 9, 2023 Apyx Medical Corporation misses on earnings expectations. Reported EPS is $-0.13 EPS, expectations were $-0.1. Operator: Please stand by. Hello, and welcome, ladies and gentlemen, to the Third Quarter of Fiscal Year 2023 Earnings Conference Call for Apyx Medical Corporation. At this time, […] |

Apyx Medical Corp (APYX) Reports 31% Revenue Growth in Q3; Updates Full Year OutlookAdvanced Energy Sales Surge as Company Adjusts Annual Guidance |

Apyx Medical Corporation Announces New Debt Facility with Perceptive AdvisorsCLEARWATER, Fla., November 09, 2023--Apyx Medical Corporation (NASDAQ:APYX) (the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today announced that the Company and its subsidiaries have entered into a new, five-year credit agreement with Perceptive Credit Holdings IV, LP ("Perceptive"), an affiliate of Perceptive Advisors. The Perceptive Credit Agreement provides for a facility of up to $45 million in senior secured term |

Apyx Medical Corporation Reports Third Quarter 2023 Financial Results and Updates Full Year 2023 Financial OutlookCLEARWATER, Fla., November 09, 2023--Apyx Medical Corporation (NASDAQ:APYX) (the "Company"), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today reported financial results for its third quarter ended September 30, 2023, and updated its financial expectations for the full year ending December 31, 2023. |

APYX Price Returns

| 1-mo | 5.74% |

| 3-mo | 47.01% |

| 6-mo | -48.91% |

| 1-year | -21.58% |

| 3-year | -75.57% |

| 5-year | -68.42% |

| YTD | -1.53% |

| 2023 | 11.97% |

| 2022 | -81.75% |

| 2021 | 78.06% |

| 2020 | -14.89% |

| 2019 | 30.56% |

Continue Researching APYX

Want to do more research on Apyx Medical Corp's stock and its price? Try the links below:Apyx Medical Corp (APYX) Stock Price | Nasdaq

Apyx Medical Corp (APYX) Stock Quote, History and News - Yahoo Finance

Apyx Medical Corp (APYX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...