Digital Turbine, Inc. (APPS): Price and Financial Metrics

APPS Price/Volume Stats

| Current price | $3.81 | 52-week high | $14.61 |

| Prev. close | $5.04 | 52-week low | $3.70 |

| Day low | $3.70 | Volume | 10,835,300 |

| Day high | $4.30 | Avg. volume | 1,786,163 |

| 50-day MA | $5.94 | Dividend yield | N/A |

| 200-day MA | $7.82 | Market Cap | 385.98M |

APPS Stock Price Chart Interactive Chart >

APPS POWR Grades

- APPS scores best on the Value dimension, with a Value rank ahead of 88.22% of US stocks.

- The strongest trend for APPS is in Growth, which has been heading up over the past 26 weeks.

- APPS ranks lowest in Stability; there it ranks in the 7th percentile.

APPS Stock Summary

- In terms of twelve month growth in earnings before interest and taxes, DIGITAL TURBINE INC is reporting a growth rate of -284.31%; that's higher than merely 4.44% of US stocks.

- Revenue growth over the past 12 months for DIGITAL TURBINE INC comes in at -22.55%, a number that bests merely 12.29% of the US stocks we're tracking.

- The volatility of DIGITAL TURBINE INC's share price is greater than that of 86.59% US stocks with at least 200 days of trading history.

- If you're looking for stocks that are quantitatively similar to DIGITAL TURBINE INC, a group of peers worth examining would be PHUN, EHTH, SCOR, OSS, and STRM.

- Visit APPS's SEC page to see the company's official filings. To visit the company's web site, go to www.digitalturbine.com.

APPS Valuation Summary

- APPS's price/sales ratio is 1.1; this is 54.17% lower than that of the median Technology stock.

- Over the past 212 months, APPS's price/earnings ratio has gone up 22.3.

Below are key valuation metrics over time for APPS.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| APPS | 2023-12-08 | 1.1 | 1.4 | -3.5 | -6.1 |

| APPS | 2023-12-07 | 1.0 | 1.3 | -3.3 | -5.8 |

| APPS | 2023-12-06 | 1.0 | 1.4 | -3.4 | -5.9 |

| APPS | 2023-12-05 | 1.0 | 1.3 | -3.2 | -5.8 |

| APPS | 2023-12-04 | 1.0 | 1.3 | -3.3 | -5.8 |

| APPS | 2023-12-01 | 0.9 | 1.1 | -2.9 | -5.4 |

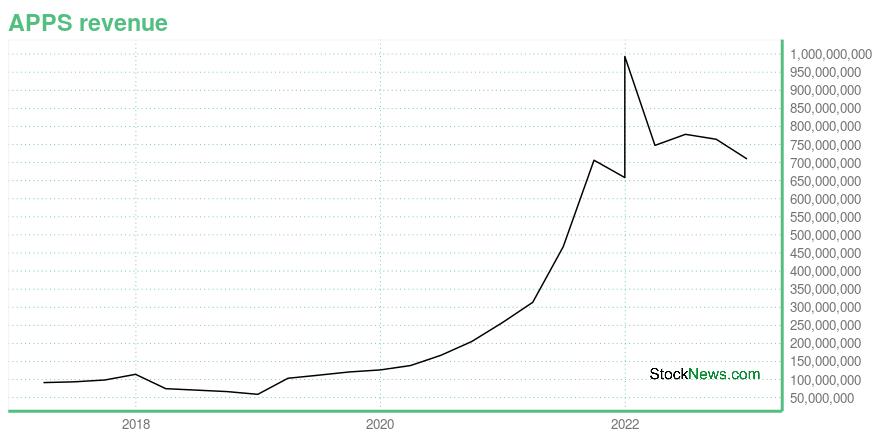

APPS Growth Metrics

- The 5 year price growth rate now stands at 600%.

- Its 5 year net income to common stockholders growth rate is now at 157.29%.

- The year over year revenue growth rate now stands at 138.41%.

The table below shows APPS's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 709.937 | 138.79 | 50.705 |

| 2022-09-30 | 764.445 | 141.293 | 53.7 |

| 2022-06-30 | 778.154 | 150.364 | 36.184 |

| 2022-03-31 | 747.596 | 84.738 | 35.546 |

| 2021-12-31 | 658.543 | 57.645 | 45.502 |

| 2021-12-31 | 993.389 | 57.645 | 45.502 |

APPS's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- APPS has a Quality Grade of D, ranking ahead of 18.45% of graded US stocks.

- APPS's asset turnover comes in at 0.849 -- ranking 23rd of 444 Trading stocks.

- PECO, TROW, and STAR are the stocks whose asset turnover ratios are most correlated with APPS.

The table below shows APPS's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.849 | 0.342 | -0.947 |

| 2021-06-30 | 0.879 | 0.381 | -2.089 |

| 2021-03-31 | 1.404 | 0.423 | -14.469 |

| 2020-12-31 | 1.263 | 0.422 | -5.020 |

| 2020-09-30 | 1.176 | 0.415 | -1.933 |

| 2020-06-30 | 1.130 | 0.406 | -1.368 |

APPS Price Target

For more insight on analysts targets of APPS, see our APPS price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $102.50 | Average Broker Recommendation | 1.42 (Moderate Buy) |

Latest APPS News From Around the Web

Below are the latest news stories about DIGITAL TURBINE INC that investors may wish to consider to help them evaluate APPS as an investment opportunity.

Digital Turbine, Inc.'s (NASDAQ:APPS) Intrinsic Value Is Potentially 93% Above Its Share PriceKey Insights Digital Turbine's estimated fair value is US$9.76 based on 2 Stage Free Cash Flow to Equity Digital... |

Digital Turbine, Inc. (NASDAQ:APPS) Q2 2024 Earnings Call TranscriptDigital Turbine, Inc. (NASDAQ:APPS) Q2 2024 Earnings Call Transcript November 8, 2023 Operator: Good afternoon and welcome to the Digital Turbine Reports Fiscal 2024 Second Quarter Results Conference Call. [Operator Instructions] Please note that this event is being recorded. I would now like to turn the conference over to Brian Bartholomew, Senior Vice President of […] |

Twilio, Yeti and 3 Other Popular Earnings ChartsThese five companies are some of the most popular stocks to report this week. All of them had out-performance during the pandemic but sold off in 2022. |

Digital Turbine Inc (APPS) Faces Fiscal Challenges Despite Solid Cash Flow in Q2 FY2024Revenue Declines as Company Navigates Market Headwinds |

Digital Turbine Reports Fiscal 2024 Second Quarter Financial ResultsDigital Turbine, Inc. (Nasdaq: APPS) announced financial results for the fiscal second quarter ended September 30, 2023. |

APPS Price Returns

| 1-mo | -36.82% |

| 3-mo | -19.79% |

| 6-mo | -58.59% |

| 1-year | -76.50% |

| 3-year | -95.81% |

| 5-year | 50.00% |

| YTD | -44.46% |

| 2023 | -54.99% |

| 2022 | -75.01% |

| 2021 | 7.83% |

| 2020 | 693.27% |

| 2019 | 289.62% |

Continue Researching APPS

Want to see what other sources are saying about Digital Turbine Inc's financials and stock price? Try the links below:Digital Turbine Inc (APPS) Stock Price | Nasdaq

Digital Turbine Inc (APPS) Stock Quote, History and News - Yahoo Finance

Digital Turbine Inc (APPS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...