Luther Burbank Corporation (LBC): Price and Financial Metrics

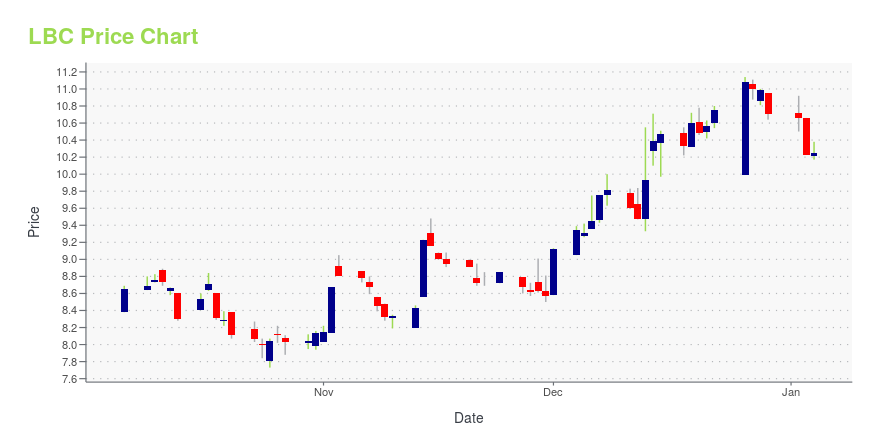

LBC Price/Volume Stats

| Current price | $9.29 | 52-week high | $12.27 |

| Prev. close | $9.20 | 52-week low | $7.73 |

| Day low | $9.16 | Volume | 16,500 |

| Day high | $9.29 | Avg. volume | 27,907 |

| 50-day MA | $9.89 | Dividend yield | N/A |

| 200-day MA | $9.20 | Market Cap | 473.95M |

LBC Stock Price Chart Interactive Chart >

LBC POWR Grades

- Sentiment is the dimension where LBC ranks best; there it ranks ahead of 93.73% of US stocks.

- LBC's strongest trending metric is Growth; it's been moving down over the last 170 days.

- LBC ranks lowest in Growth; there it ranks in the 1st percentile.

LBC Stock Summary

- The ratio of debt to operating expenses for LUTHER BURBANK CORP is higher than it is for about 97.14% of US stocks.

- Equity multiplier, or assets relative to shareholders' equity, comes in at 11.82 for LUTHER BURBANK CORP; that's greater than it is for 93.05% of US stocks.

- As for revenue growth, note that LBC's revenue has grown -36.02% over the past 12 months; that beats the revenue growth of merely 7.4% of US companies in our set.

- Stocks that are quantitatively similar to LBC, based on their financial statements, market capitalization, and price volatility, are WTBA, HBNC, KRNY, INBK, and WAFD.

- LBC's SEC filings can be seen here. And to visit LUTHER BURBANK CORP's official web site, go to www.lutherburbanksavings.com.

LBC Valuation Summary

- In comparison to the median Financial Services stock, LBC's price/earnings ratio is 39.09% higher, now standing at 15.3.

- LBC's price/sales ratio has moved down 0.8 over the prior 74 months.

Below are key valuation metrics over time for LBC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LBC | 2023-12-22 | 4.6 | 0.8 | 15.3 | 30.2 |

| LBC | 2023-12-21 | 4.5 | 0.8 | 15.0 | 30.1 |

| LBC | 2023-12-20 | 4.5 | 0.8 | 14.9 | 30.0 |

| LBC | 2023-12-19 | 4.5 | 0.8 | 15.0 | 30.1 |

| LBC | 2023-12-18 | 4.4 | 0.8 | 14.7 | 29.8 |

| LBC | 2023-12-15 | 4.5 | 0.8 | 14.9 | 30.0 |

LBC Growth Metrics

- The 2 year revenue growth rate now stands at 49.84%.

- The year over year cash and equivalents growth rate now stands at 81.24%.

- Its 5 year net income to common stockholders growth rate is now at -35.97%.

The table below shows LBC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 177.764 | 84.924 | 80.198 |

| 2022-09-30 | 186.33 | 102.369 | 89.892 |

| 2022-06-30 | 190.634 | 110.616 | 93.633 |

| 2022-03-31 | 189.209 | 116.14 | 92.282 |

| 2021-12-31 | 183.145 | 106.721 | 87.753 |

| 2021-09-30 | 172.696 | 97.578 | 73.071 |

LBC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LBC has a Quality Grade of C, ranking ahead of 27.7% of graded US stocks.

- LBC's asset turnover comes in at 0.023 -- ranking 415th of 431 Banking stocks.

- 500 - Internal server error

The table below shows LBC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.023 | 1 | 0.011 |

| 2021-03-31 | 0.020 | 1 | 0.009 |

| 2020-12-31 | 0.019 | 1 | 0.007 |

| 2020-09-30 | 0.018 | 1 | 0.008 |

| 2020-06-30 | 0.017 | 1 | 0.007 |

| 2020-03-31 | 0.018 | 1 | 0.008 |

LBC Price Target

For more insight on analysts targets of LBC, see our LBC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $15.25 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Luther Burbank Corporation (LBC) Company Bio

Luther Burbank Corporation operates as the bank holding company for Luther Burbank Savings that provides various banking products and services for individuals, entrepreneurs, professionals, and businesses in California, Washington, and Oregon. The company was founded in 1983 and is based in Santa Rosa, California.

Latest LBC News From Around the Web

Below are the latest news stories about LUTHER BURBANK CORP that investors may wish to consider to help them evaluate LBC as an investment opportunity.

WaFd, Luther Burbank extend merger deadline to FebruaryBoth banks say they're "fully committed" to the deal, but it's the second delay for the transaction, originally expected to close by June 2023. It also faces opposition from a coalition of 54 nonprofits. |

Investors in Luther Burbank (NASDAQ:LBC) have unfortunately lost 27% over the last yearPassive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you... |

Luther Burbank Corporation Reports Earnings for the Quarter and Nine Months Ended September 30, 2023Third Quarter 2023 Highlights Net income of $1.9 million and $22.3 million, or $0.04 and $0.44 per diluted share, for the quarter and nine months ended September 30, 2023, respectivelyNet interest margin of 0.97%Return on average assets and equity of 0.09% and 1.09%, respectivelyNoninterest expense to average assets of 0.73%Estimated uninsured deposits remained stable at $1.0 billion, or 17.6% of total depositsDependence on wholesale funds declined to 27.6% (1)Liquidity ratio of 13.8% (1)On-bala |

LIBERO CLOSES PRIVATE PLACEMENTLibero Copper & Gold Corporation (TSXV: LBC) (OTCQB: LBCMF) (DE: 29H) announces it has closed the first tranche of a non-brokered private placement (the "Offering") for the sale of 9,130,000 units (the "Units") at a price of C$0.05 per Unit for gross proceeds of C$456,500. Each Unit is comprised of one common share (each, a "Unit Share") and one common share purchase warrant (each, a "Warrant"). Each Warrant entitles the holder thereof to purchase one common share (each, a "Warrant Share") at a |

Luther Burbank Corporation Reports Earnings for the Quarter and Six Months Ended June 30, 2023Second Quarter 2023 Highlights Net income of $6.9 million, or $0.14 per diluted shareNet interest margin of 1.27%Return on average assets and equity of 0.33% and 3.94%, respectivelyNoninterest expense to average assets of 0.76%Deposits increased 3% to $5.8 billionEstimated uninsured deposits of $997.8 million, or 17.1% of total depositsOn-balance sheet liquidity plus borrowing capacity of more than 3 times uninsured depositsNonperforming assets to total assets of 0.06%Book value per share of $13 |

LBC Price Returns

| 1-mo | -8.74% |

| 3-mo | 11.52% |

| 6-mo | -7.29% |

| 1-year | -22.00% |

| 3-year | -3.32% |

| 5-year | 6.19% |

| YTD | -13.26% |

| 2023 | -3.60% |

| 2022 | -17.87% |

| 2021 | 47.37% |

| 2020 | -12.97% |

| 2019 | 30.69% |

Continue Researching LBC

Here are a few links from around the web to help you further your research on Luther Burbank Corp's stock as an investment opportunity:Luther Burbank Corp (LBC) Stock Price | Nasdaq

Luther Burbank Corp (LBC) Stock Quote, History and News - Yahoo Finance

Luther Burbank Corp (LBC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...