Netflix Inc. (NFLX): Price and Financial Metrics

NFLX Price/Volume Stats

| Current price | $558.53 | 52-week high | $579.64 |

| Prev. close | $559.30 | 52-week low | $285.33 |

| Day low | $555.74 | Volume | 3,175,400 |

| Day high | $563.70 | Avg. volume | 6,209,604 |

| 50-day MA | $497.69 | Dividend yield | N/A |

| 200-day MA | $429.88 | Market Cap | 241.71B |

NFLX Stock Price Chart Interactive Chart >

NFLX POWR Grades

- Quality is the dimension where NFLX ranks best; there it ranks ahead of 93.69% of US stocks.

- NFLX's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- NFLX ranks lowest in Value; there it ranks in the 25th percentile.

NFLX Stock Summary

- NFLX has a market capitalization of $205,823,241,144 -- more than approximately 99.11% of US stocks.

- With a price/earnings ratio of 45.48, NETFLIX INC P/E ratio is greater than that of about 84.6% of stocks in our set with positive earnings.

- Price to trailing twelve month operating cash flow for NFLX is currently 33.99, higher than 88.62% of US stocks with positive operating cash flow.

- Stocks that are quantitatively similar to NFLX, based on their financial statements, market capitalization, and price volatility, are CSCO, PFE, INTU, AMGN, and ADBE.

- Visit NFLX's SEC page to see the company's official filings. To visit the company's web site, go to www.netflix.com.

NFLX Valuation Summary

- In comparison to the median Communication Services stock, NFLX's price/earnings ratio is 164.61% higher, now standing at 47.1.

- Over the past 243 months, NFLX's EV/EBIT ratio has gone down 69.6.

Below are key valuation metrics over time for NFLX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| NFLX | 2023-12-29 | 6.5 | 9.6 | 47.1 | 38.0 |

| NFLX | 2023-12-28 | 6.6 | 9.7 | 47.4 | 38.3 |

| NFLX | 2023-12-27 | 6.6 | 9.7 | 47.6 | 38.4 |

| NFLX | 2023-12-26 | 6.6 | 9.7 | 47.5 | 38.3 |

| NFLX | 2023-12-22 | 6.5 | 9.6 | 47.1 | 38.0 |

| NFLX | 2023-12-21 | 6.6 | 9.7 | 47.5 | 38.3 |

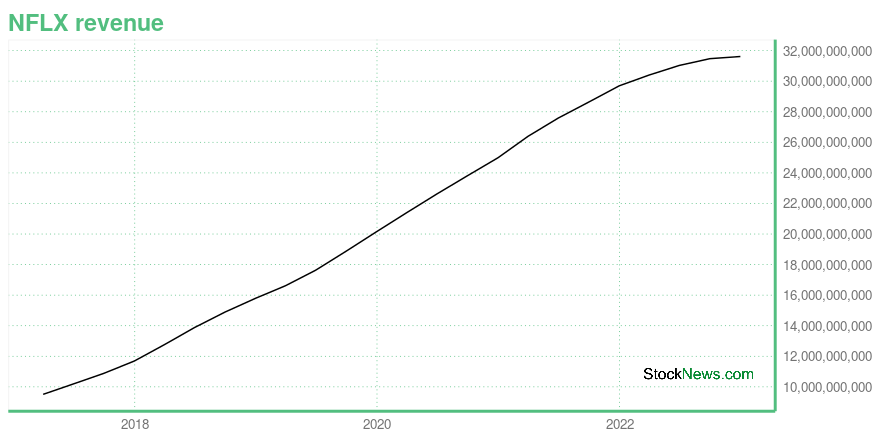

NFLX Growth Metrics

- The 2 year cash and equivalents growth rate now stands at 16.64%.

- The 2 year revenue growth rate now stands at 42.05%.

- Its year over year net income to common stockholders growth rate is now at 33.2%.

The table below shows NFLX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 31,615.55 | 2,026.257 | 4,491.924 |

| 2022-09-30 | 31,472.81 | 1,179.125 | 5,044.069 |

| 2022-06-30 | 31,030.69 | 704.694 | 5,094.898 |

| 2022-03-31 | 30,402.33 | 538.183 | 5,006.96 |

| 2021-12-31 | 29,697.84 | 392.61 | 5,116.228 |

| 2021-09-30 | 28,632.97 | 658.212 | 5,050.955 |

NFLX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- NFLX has a Quality Grade of B, ranking ahead of 79.64% of graded US stocks.

- NFLX's asset turnover comes in at 0.702 -- ranking 7th of 44 Entertainment stocks.

- AESE, WMG, and EVRI are the stocks whose asset turnover ratios are most correlated with NFLX.

The table below shows NFLX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.702 | 0.432 | 0.479 |

| 2021-06-30 | 0.694 | 0.423 | 0.424 |

| 2021-03-31 | 0.680 | 0.411 | 0.388 |

| 2020-12-31 | 0.666 | 0.389 | 0.305 |

| 2020-09-30 | 0.658 | 0.388 | 0.287 |

| 2020-06-30 | 0.660 | 0.390 | 0.327 |

NFLX Price Target

For more insight on analysts targets of NFLX, see our NFLX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $614.38 | Average Broker Recommendation | 1.57 (Moderate Buy) |

Netflix Inc. (NFLX) Company Bio

Netflix Inc. is a global streaming entertainment service provider with over 200 million paid members in over 190 countries offering TV series, documentaries, and feature films across a wide variety of genres and languages. Netflix was originally established as an online DVD rental service in 1997, offering members unlimited DVD rentals without due dates, late fees, or monthly rental limits. Netflix has since shifted to an online streaming service where subscribers can watch as much commercial-free content as they want, anytime, anywhere, on any internet-connected screen for a fixed monthly subscription fee.

Latest NFLX News From Around the Web

Below are the latest news stories about NETFLIX INC that investors may wish to consider to help them evaluate NFLX as an investment opportunity.

3 Growth Stocks Set to Outperform the Nasdaq in 2024As we transition into a new year, investors cannot ignore these three growth stocks to outperform the Nasdaq in 2024! |

Best Performing Stocks In January Over The Last Two Decades (75%+ Win Rate)January is generally one of the weakest months of the year for the stock market, but the following stocks have excelled in January over the last 15 years or more. |

Top Performers: 7 High-Efficiency Stocks With Stellar Profit Per Employee RatiosInundated with myriad ways of assessing publicly traded companies, one unique metric could intrigue investors seeking opportunities in 2024 and that would be high-efficiency stocks. |

Streaming Superstars: 3 Stocks Changing How We WatchConsumers continue to subscribe to streaming services making these streaming stocks among the best investments for 2024 |

Checkout Champs: 3 Retail Stocks Committed to Self-Service SuccessThere is a divide amongst retail stocks on whether self-checkout is good business. |

NFLX Price Returns

| 1-mo | 15.86% |

| 3-mo | 24.88% |

| 6-mo | 32.46% |

| 1-year | 52.26% |

| 3-year | 1.94% |

| 5-year | 60.70% |

| YTD | 14.72% |

| 2023 | 65.11% |

| 2022 | -51.05% |

| 2021 | 11.41% |

| 2020 | 67.11% |

| 2019 | 20.89% |

Continue Researching NFLX

Here are a few links from around the web to help you further your research on Netflix Inc's stock as an investment opportunity:Netflix Inc (NFLX) Stock Price | Nasdaq

Netflix Inc (NFLX) Stock Quote, History and News - Yahoo Finance

Netflix Inc (NFLX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...