O-I Glass Inc. (OI): Price and Financial Metrics

OI Price/Volume Stats

| Current price | $16.11 | 52-week high | $23.57 |

| Prev. close | $16.39 | 52-week low | $13.56 |

| Day low | $15.49 | Volume | 6,272,000 |

| Day high | $16.37 | Avg. volume | 1,926,407 |

| 50-day MA | $15.51 | Dividend yield | N/A |

| 200-day MA | $18.27 | Market Cap | 2.49B |

OI Stock Price Chart Interactive Chart >

OI POWR Grades

- OI scores best on the Value dimension, with a Value rank ahead of 98.04% of US stocks.

- OI's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- OI ranks lowest in Sentiment; there it ranks in the 33rd percentile.

OI Stock Summary

- OI's current price/earnings ratio is 6.19, which is higher than only 7.59% of US stocks with positive earnings.

- The price/operating cash flow metric for O-I GLASS INC is higher than only 8.91% of stocks in our set with a positive cash flow.

- OI's price/sales ratio is 0.33; that's higher than the P/S ratio of merely 10.54% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to O-I GLASS INC are CBT, OEC, SKYT, PNR, and VTRS.

- Visit OI's SEC page to see the company's official filings. To visit the company's web site, go to www.o-i.com.

OI Valuation Summary

- OI's price/sales ratio is 0.4; this is 80% lower than that of the median Consumer Cyclical stock.

- Over the past 243 months, OI's EV/EBIT ratio has gone down 2.8.

Below are key valuation metrics over time for OI.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| OI | 2023-12-29 | 0.4 | 1.2 | 6.7 | 7.8 |

| OI | 2023-12-28 | 0.4 | 1.2 | 6.8 | 7.9 |

| OI | 2023-12-27 | 0.4 | 1.2 | 6.9 | 7.9 |

| OI | 2023-12-26 | 0.4 | 1.3 | 7.0 | 8.0 |

| OI | 2023-12-22 | 0.4 | 1.2 | 6.8 | 7.9 |

| OI | 2023-12-21 | 0.4 | 1.2 | 6.7 | 7.9 |

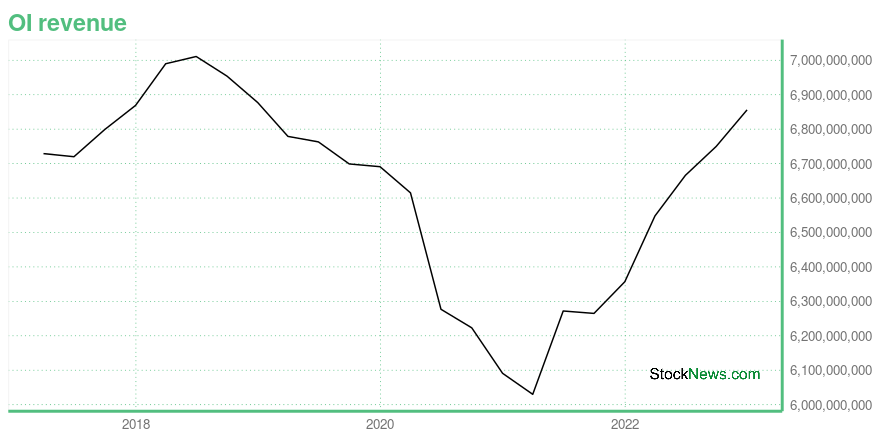

OI Growth Metrics

- Its year over year net income to common stockholders growth rate is now at 230.69%.

- Its 3 year net cashflow from operations growth rate is now at 18.37%.

- The year over year price growth rate now stands at -23.29%.

The table below shows OI's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 6,856 | 154 | 584 |

| 2022-09-30 | 6,750 | 7 | 614 |

| 2022-06-30 | 6,666 | 664 | 468 |

| 2022-03-31 | 6,548 | 670 | 334 |

| 2021-12-31 | 6,357 | 687 | 149 |

| 2021-09-30 | 6,265 | 785 | 77 |

OI's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- OI has a Quality Grade of C, ranking ahead of 69.2% of graded US stocks.

- OI's asset turnover comes in at 0.709 -- ranking 8th of 11 Shipping Containers stocks.

- DYSL, WRK, and GPK are the stocks whose asset turnover ratios are most correlated with OI.

The table below shows OI's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.709 | 0.178 | 0.050 |

| 2021-06-30 | 0.713 | 0.174 | 0.076 |

| 2021-03-31 | 0.672 | 0.157 | 0.046 |

| 2020-12-31 | 0.666 | 0.160 | 0.059 |

| 2020-09-30 | 0.667 | 0.158 | 0.066 |

| 2020-06-30 | 0.657 | 0.160 | -0.018 |

OI Price Target

For more insight on analysts targets of OI, see our OI price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $17.67 | Average Broker Recommendation | 1.81 (Hold) |

O-I Glass Inc. (OI) Company Bio

Owens-Illinois manufactures and sells glass container products to food and beverage manufacturers primarily in Europe, North America, South America, and the Asia Pacific. The company was founded in 1903 and is based in Perrysburg, Ohio.

Latest OI News From Around the Web

Below are the latest news stories about O-I GLASS INC that investors may wish to consider to help them evaluate OI as an investment opportunity.

O-I Glass (NYSE:OI) Might Have The Makings Of A Multi-BaggerIf you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'd want to identify a... |

O-I Glass is "Driving" Sustainability by Leveraging BiofuelsNORTHAMPTON, MA / ACCESSWIRE / December 7, 2023 / O-I Glass, Inc.O-I's Reims, France, plant is delivering champagne bottles to nearby customers with trucks powered by grapeseed and fryer oil.The grapeseed oil is harvested in the Marne and Aubre regions ... |

O-I Announces New Partnerships To Increase Post Consumer Glass Recycling in BrazilBy Allen MirelesNORTHAMPTON, MA / ACCESSWIRE / November 30, 2023 / O-I's team in Brazil recently announced two exciting new partnerships that increase post-consumer glass recycling, reduce consumer waste, and conserve resources in Brazil.The partnerships ... |

O-I Glass to Present at Citi’s 2023 Basic Materials ConferencePERRYSBURG, Ohio, Nov. 15, 2023 (GLOBE NEWSWIRE) -- O-I Glass, Inc. (NYSE: OI) today announced the Company will participate in Citi’s 2023 Basic Materials Conference on Wednesday, November 29, 2023. O-I Glass Chief Executive Officer Andres Lopez and Chief Financial Officer John Haudrich will present at 10:15 a.m. ET. A live webcast of the presentation will be available at: https://kvgo.com/citi/o-i-glass-inc-november-2023 The replay will be available through the above link within 24 hours of the |

O-I Glass Presents Its 'Cento per Cento Sicilia' Bottles: Circular Economy Applied to Glass Production in SicilyThe project provides a sustainable solution to enhance the value of glass, the perfect material to support a low-waste circular economy in an area with a historic wine production that is profitable for the region's GDP itself - as one billion of Sicily's ... |

OI Price Returns

| 1-mo | 3.73% |

| 3-mo | 10.34% |

| 6-mo | -19.25% |

| 1-year | -27.47% |

| 3-year | 16.91% |

| 5-year | -12.43% |

| YTD | -1.65% |

| 2023 | -1.15% |

| 2022 | 37.74% |

| 2021 | 1.09% |

| 2020 | 0.16% |

| 2019 | -29.69% |

Continue Researching OI

Here are a few links from around the web to help you further your research on O-I Glass Inc's stock as an investment opportunity:O-I Glass Inc (OI) Stock Price | Nasdaq

O-I Glass Inc (OI) Stock Quote, History and News - Yahoo Finance

O-I Glass Inc (OI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...