DuPont de Nemours Inc. (DD): Price and Financial Metrics

DD Price/Volume Stats

| Current price | $67.10 | 52-week high | $78.74 |

| Prev. close | $66.48 | 52-week low | $61.14 |

| Day low | $65.93 | Volume | 2,983,900 |

| Day high | $67.15 | Avg. volume | 4,267,326 |

| 50-day MA | $71.56 | Dividend yield | 2.35% |

| 200-day MA | $71.83 | Market Cap | 28.86B |

DD Stock Price Chart Interactive Chart >

DD POWR Grades

- DD scores best on the Sentiment dimension, with a Sentiment rank ahead of 90.3% of US stocks.

- DD's strongest trending metric is Quality; it's been moving down over the last 26 weeks.

- DD ranks lowest in Momentum; there it ranks in the 19th percentile.

DD Stock Summary

- DD's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- In terms of volatility of its share price, DD is more volatile than merely 5.39% of stocks we're observing.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for DD comes in at 28.63% -- higher than that of 94.02% of stocks in our set.

- Stocks that are quantitatively similar to DD, based on their financial statements, market capitalization, and price volatility, are PCAR, TEL, AGCO, PHG, and CARS.

- DD's SEC filings can be seen here. And to visit DUPONT DE NEMOURS INC's official web site, go to www.dupont.com.

DD Valuation Summary

- In comparison to the median Basic Materials stock, DD's EV/EBIT ratio is 46.27% lower, now standing at 7.2.

- Over the past 243 months, DD's EV/EBIT ratio has gone down 62.6.

Below are key valuation metrics over time for DD.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| DD | 2023-12-29 | 2.7 | 1.4 | 7.1 | 7.2 |

| DD | 2023-12-28 | 2.7 | 1.4 | 7.1 | 7.2 |

| DD | 2023-12-27 | 2.7 | 1.4 | 7.1 | 7.2 |

| DD | 2023-12-26 | 2.7 | 1.4 | 7.0 | 7.2 |

| DD | 2023-12-22 | 2.6 | 1.3 | 7.0 | 7.1 |

| DD | 2023-12-21 | 2.6 | 1.3 | 6.8 | 7.0 |

DD Growth Metrics

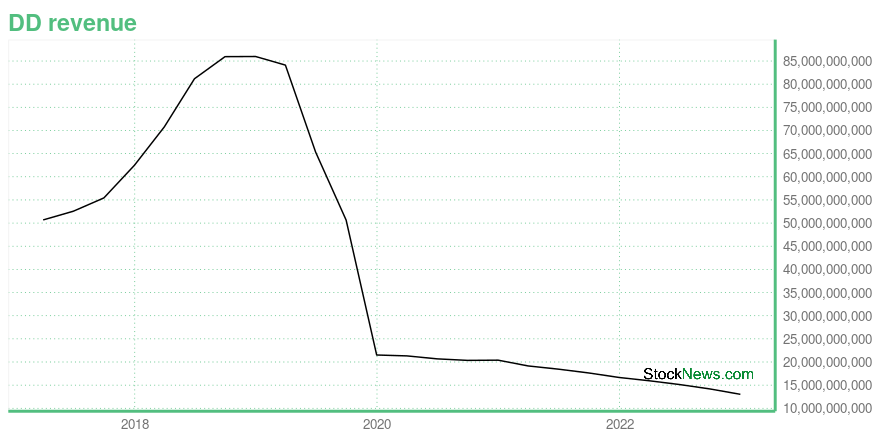

- The 5 year revenue growth rate now stands at -57.94%.

- Its year over year net income to common stockholders growth rate is now at -48.97%.

- Its 4 year net cashflow from operations growth rate is now at -64.4%.

The table below shows DD's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 13,017 | 588 | 5,868 |

| 2022-09-30 | 14,184 | 1,335 | 1,846 |

| 2022-06-30 | 15,138 | 1,758 | 1,870 |

| 2022-03-31 | 15,951 | 2,112 | 1,561 |

| 2021-12-31 | 16,653 | 2,281 | 6,467 |

| 2021-09-30 | 17,634 | 2,961 | 6,485 |

DD's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- DD has a Quality Grade of C, ranking ahead of 60.44% of graded US stocks.

- DD's asset turnover comes in at 0.335 -- ranking 73rd of 89 Chemicals stocks.

- CC, AVNT, and ASIX are the stocks whose asset turnover ratios are most correlated with DD.

The table below shows DD's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.335 | 0.350 | 0.272 |

| 2021-06-30 | 0.312 | 0.346 | 0.224 |

| 2021-03-31 | 0.297 | 0.336 | 0.114 |

| 2020-12-31 | 0.294 | 0.337 | -0.064 |

| 2020-09-30 | 0.295 | 0.341 | -0.066 |

| 2020-06-30 | 0.302 | 0.345 | -0.056 |

DD Price Target

For more insight on analysts targets of DD, see our DD price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $91.78 | Average Broker Recommendation | 1.57 (Moderate Buy) |

DuPont de Nemours Inc. (DD) Company Bio

DuPont de Nemours, Inc., commonly known as DuPont, is an American company formed by the merger of Dow Chemical and E. I. du Pont de Nemours and Company on August 31, 2017, and the subsequent spinoffs of Dow Inc. and Corteva. Prior to the spinoffs it was the world's largest chemical company in terms of sales. The merger has been reported to be worth an estimated $130 billion. With 2018 total revenue of $86 billion, DowDuPont ranked No. 35 on the 2019 Fortune 500 list of the largest United States public corporations. DuPont is headquartered in Wilmington, Delaware, in the state where it is incorporated, since the founding of the old DuPont in 1802. (Source:Wikipedia)

Latest DD News From Around the Web

Below are the latest news stories about DUPONT DE NEMOURS INC that investors may wish to consider to help them evaluate DD as an investment opportunity.

Chemours (CC), DuPont & Corteva Back U.S. Water System DealChemours (CC), DuPont & Corteva do not intend to exercise the opt-out option and extend support to PFAS Deal with the U.S. Water System. |

Who Pays to Get Forever Chemicals Out of Drinking Water? It Could Be YouOfficials say settlements with 3M and DuPont won’t cover all of the costs of building new filtration systems. |

Chemours, DuPont, and Corteva Provide Update and Affirm Support for PFAS Settlement with U.S. Water SystemsWILMINGTON, Del., December 22, 2023--Chemours, DuPont, and Corteva Provide Update and Affirm Support for PFAS Settlement with U.S. Water Systems |

DuPont Recognized as Best ESG Partner by Samsung ElectronicsDuPont (NYSE: DD) today announced it has been named the Best Partner in the Environmental, Social and Governance (ESG) category by Samsung Electronics. The prestigious award, presented at Samsung's Material-day (M-day) event, recognizes DuPont's significant contributions in establishing a sustainable supply chain by collaborating to develop more sustainable semiconductor materials. |

Investors Still Waiting For A Pull Back In DuPont de Nemours, Inc. (NYSE:DD)When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may... |

DD Price Returns

| 1-mo | -12.07% |

| 3-mo | -1.89% |

| 6-mo | -11.63% |

| 1-year | -10.98% |

| 3-year | -6.38% |

| 5-year | 1.77% |

| YTD | -12.78% |

| 2023 | 14.36% |

| 2022 | -13.36% |

| 2021 | 15.41% |

| 2020 | 13.28% |

| 2019 | -12.91% |

DD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...