Comfort Systems USA, Inc. (FIX): Price and Financial Metrics

FIX Price/Volume Stats

| Current price | $237.17 | 52-week high | $238.34 |

| Prev. close | $231.95 | 52-week low | $117.71 |

| Day low | $232.21 | Volume | 274,700 |

| Day high | $238.34 | Avg. volume | 271,200 |

| 50-day MA | $205.06 | Dividend yield | 0.45% |

| 200-day MA | $177.89 | Market Cap | 8.47B |

FIX Stock Price Chart Interactive Chart >

FIX POWR Grades

- FIX scores best on the Quality dimension, with a Quality rank ahead of 95.59% of US stocks.

- The strongest trend for FIX is in Quality, which has been heading up over the past 26 weeks.

- FIX's current lowest rank is in the Stability metric (where it is better than 41.94% of US stocks).

FIX Stock Summary

- COMFORT SYSTEMS USA INC's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than 87.84% of US listed stocks.

- Of note is the ratio of COMFORT SYSTEMS USA INC's sales and general administrative expense to its total operating expenses; 97.34% of US stocks have a lower such ratio.

- With a year-over-year growth in debt of -51.79%, COMFORT SYSTEMS USA INC's debt growth rate surpasses merely 4.84% of about US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to COMFORT SYSTEMS USA INC are EME, JBSS, XPEL, CNXN, and MYRG.

- Visit FIX's SEC page to see the company's official filings. To visit the company's web site, go to www.comfortsystemsusa.com.

FIX Valuation Summary

- In comparison to the median Industrials stock, FIX's EV/EBIT ratio is 18.39% higher, now standing at 20.6.

- Over the past 243 months, FIX's price/earnings ratio has gone up 115.8.

Below are key valuation metrics over time for FIX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| FIX | 2023-12-29 | 1.5 | 6.1 | 25.6 | 20.6 |

| FIX | 2023-12-28 | 1.5 | 6.1 | 25.7 | 20.7 |

| FIX | 2023-12-27 | 1.5 | 6.1 | 25.8 | 20.8 |

| FIX | 2023-12-26 | 1.5 | 6.2 | 26.0 | 21.0 |

| FIX | 2023-12-22 | 1.5 | 6.1 | 25.8 | 20.8 |

| FIX | 2023-12-21 | 1.5 | 6.1 | 25.7 | 20.7 |

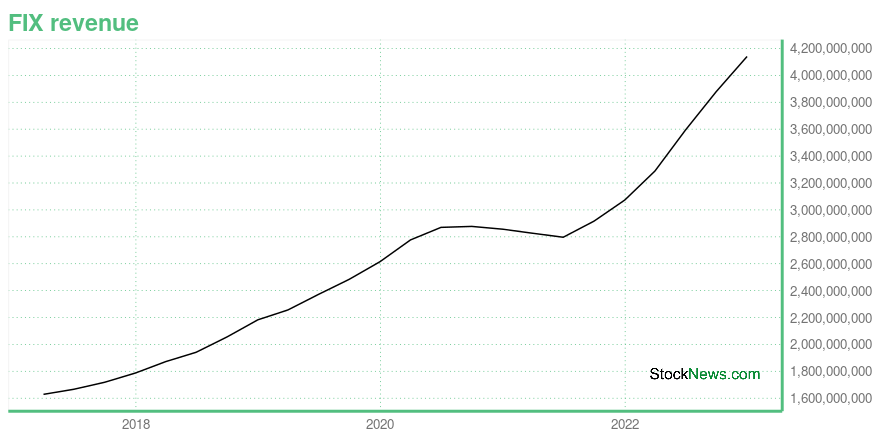

FIX Growth Metrics

- Its 2 year net income to common stockholders growth rate is now at 81.52%.

- Its 4 year revenue growth rate is now at 70.47%.

- Its 3 year net cashflow from operations growth rate is now at 10.33%.

The table below shows FIX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 4,140.364 | 301.531 | 245.947 |

| 2022-09-30 | 3,879.26 | 197.021 | 228.118 |

| 2022-06-30 | 3,593.144 | 178.374 | 212.9 |

| 2022-03-31 | 3,289.091 | 159.233 | 203.619 |

| 2021-12-31 | 3,073.636 | 180.151 | 143.348 |

| 2021-09-30 | 2,916.513 | 222.764 | 148.593 |

FIX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- FIX has a Quality Grade of B, ranking ahead of 92.66% of graded US stocks.

- FIX's asset turnover comes in at 1.625 -- ranking 8th of 51 Construction stocks.

- NVR, MHO, and GRBK are the stocks whose asset turnover ratios are most correlated with FIX.

The table below shows FIX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 1.625 | 0.187 | 0.334 |

| 2021-06-30 | 1.620 | 0.191 | 0.340 |

| 2021-03-31 | 1.656 | 0.196 | 0.348 |

| 2020-12-31 | 1.698 | 0.191 | 0.300 |

| 2020-09-30 | 1.777 | 0.189 | 0.286 |

| 2020-06-30 | 1.832 | 0.187 | 0.270 |

FIX Price Target

For more insight on analysts targets of FIX, see our FIX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $82.33 | Average Broker Recommendation | 1.75 (Moderate Buy) |

Comfort Systems USA, Inc. (FIX) Company Bio

Comfort Systems provides installation, maintenance, repair, and replacement services for heating, ventilation, and air conditioning (HVAC) systems in the mechanical services industry. The company was founded in 1917 and is based in Houston, Texas.

Latest FIX News From Around the Web

Below are the latest news stories about COMFORT SYSTEMS USA INC that investors may wish to consider to help them evaluate FIX as an investment opportunity.

Why You Should Care About Comfort Systems USA's (NYSE:FIX) Strong Returns On CapitalIf we want to find a stock that could multiply over the long term, what are the underlying trends we should look for... |

Insider Sell: Director Constance Skidmore Sells 3,000 Shares of Comfort Systems USA Inc (FIX)Comfort Systems USA Inc (NYSE:FIX), a leader in the provision of commercial, industrial, and institutional heating, ventilation, air conditioning, and electrical contracting services, has recently witnessed a notable insider sell by Director Constance Skidmore. |

Insider Buying: Director Rhoman Hardy Acquires Shares of Comfort Systems USA IncInsider buying can often provide valuable insights into a company's potential future performance. When insiders purchase shares, it suggests they are confident about the company's prospects and believe that the current share price represents an attractive entry point. |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

Uber Technologies, Jabil and Builders FirstSource Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 18, to coincide with the quarterly rebalance. The changes ensure each index is more representative of its market capitalization range. All companies being added to the S&P 500 are more representative of the large-cap market space, all companies being added to the S&P MidCap 400 are more representative of the mid- |

FIX Price Returns

| 1-mo | 19.22% |

| 3-mo | 26.53% |

| 6-mo | 33.55% |

| 1-year | 98.14% |

| 3-year | 272.22% |

| 5-year | 410.76% |

| YTD | 15.32% |

| 2023 | 79.62% |

| 2022 | 16.98% |

| 2021 | 88.98% |

| 2020 | 6.73% |

| 2019 | 15.07% |

FIX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FIX

Want to do more research on Comfort Systems Usa Inc's stock and its price? Try the links below:Comfort Systems Usa Inc (FIX) Stock Price | Nasdaq

Comfort Systems Usa Inc (FIX) Stock Quote, History and News - Yahoo Finance

Comfort Systems Usa Inc (FIX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...