Axcelis Technologies, Inc. (ACLS): Price and Financial Metrics

ACLS Price/Volume Stats

| Current price | $122.25 | 52-week high | $201.00 |

| Prev. close | $131.49 | 52-week low | $105.28 |

| Day low | $110.00 | Volume | 2,533,800 |

| Day high | $124.91 | Avg. volume | 807,993 |

| 50-day MA | $127.97 | Dividend yield | N/A |

| 200-day MA | $151.02 | Market Cap | 4.00B |

ACLS Stock Price Chart Interactive Chart >

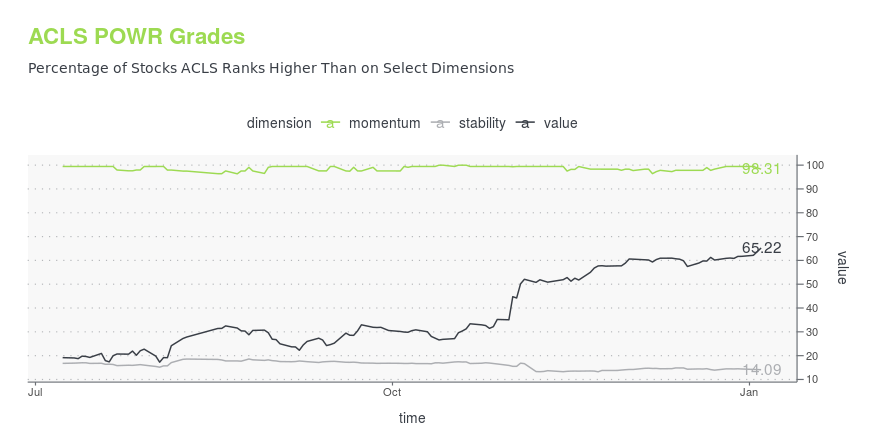

ACLS POWR Grades

- Momentum is the dimension where ACLS ranks best; there it ranks ahead of 98.31% of US stocks.

- ACLS's strongest trending metric is Value; it's been moving up over the last 26 weeks.

- ACLS's current lowest rank is in the Stability metric (where it is better than 14.09% of US stocks).

ACLS Stock Summary

- For ACLS, its debt to operating expenses ratio is greater than that reported by just 20.93% of US equities we're observing.

- Over the past twelve months, ACLS has reported earnings growth of 38.36%, putting it ahead of 78.67% of US stocks in our set.

- Revenue growth over the past 12 months for AXCELIS TECHNOLOGIES INC comes in at 26.38%, a number that bests 82.5% of the US stocks we're tracking.

- Stocks with similar financial metrics, market capitalization, and price volatility to AXCELIS TECHNOLOGIES INC are VICR, JNPR, DAIO, SCKT, and HYPR.

- Visit ACLS's SEC page to see the company's official filings. To visit the company's web site, go to www.axcelis.com.

ACLS Valuation Summary

- ACLS's price/sales ratio is 3.7; this is 37.04% higher than that of the median Technology stock.

- Over the past 243 months, ACLS's EV/EBIT ratio has gone up 31.4.

Below are key valuation metrics over time for ACLS.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| ACLS | 2023-12-08 | 3.7 | 5.0 | 17.3 | 14.9 |

| ACLS | 2023-12-07 | 3.7 | 5.0 | 17.3 | 14.9 |

| ACLS | 2023-12-06 | 3.7 | 5.0 | 17.2 | 14.9 |

| ACLS | 2023-12-05 | 3.8 | 5.1 | 17.6 | 15.2 |

| ACLS | 2023-12-04 | 3.8 | 5.1 | 17.6 | 15.2 |

| ACLS | 2023-12-01 | 3.8 | 5.1 | 17.8 | 15.3 |

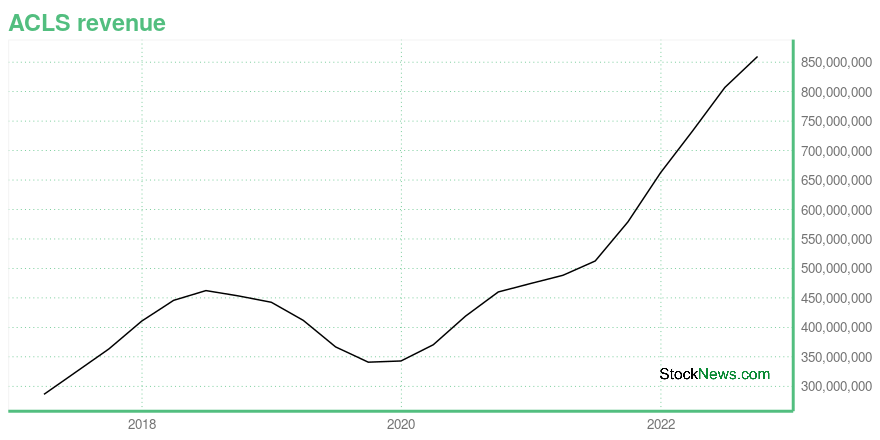

ACLS Growth Metrics

- Its year over year revenue growth rate is now at 50.15%.

- The 5 year cash and equivalents growth rate now stands at 151.69%.

- Its 5 year revenue growth rate is now at 29.38%.

The table below shows ACLS's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 859.631 | 131.332 | 161.835 |

| 2022-06-30 | 807.15 | 133.491 | 149.067 |

| 2022-03-31 | 733.247 | 160.862 | 123.784 |

| 2021-12-31 | 662.428 | 150.19 | 98.65 |

| 2021-09-30 | 578.943 | 106.117 | 77.575 |

| 2021-06-30 | 512.654 | 59.049 | 60.845 |

ACLS's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- ACLS has a Quality Grade of B, ranking ahead of 75.39% of graded US stocks.

- ACLS's asset turnover comes in at 0.819 -- ranking 36th of 104 Machinery stocks.

- DRQ, CFX, and LNN are the stocks whose asset turnover ratios are most correlated with ACLS.

The table below shows ACLS's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.819 | 0.432 | 0.196 |

| 2021-03-31 | 0.803 | 0.429 | 0.179 |

| 2020-12-31 | 0.802 | 0.418 | 0.167 |

| 2020-09-30 | 0.804 | 0.413 | 0.162 |

| 2020-06-30 | 0.752 | 0.411 | 0.125 |

| 2020-03-31 | 0.687 | 0.411 | 0.086 |

ACLS Price Target

For more insight on analysts targets of ACLS, see our ACLS price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $57.17 | Average Broker Recommendation | 1.42 (Moderate Buy) |

Axcelis Technologies, Inc. (ACLS) Company Bio

Axcelis Technologies, Inc. designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips worldwide. The company was founded in 1995 and is based in Beverly, Massachusetts.

Latest ACLS News From Around the Web

Below are the latest news stories about AXCELIS TECHNOLOGIES INC that investors may wish to consider to help them evaluate ACLS as an investment opportunity.

Is It Worth Investing in Axcelis (ACLS) Based on Wall Street's Bullish Views?The average brokerage recommendation (ABR) for Axcelis (ACLS) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock? |

Here is What to Know Beyond Why Axcelis Technologies, Inc. (ACLS) is a Trending StockAxcelis (ACLS) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock. |

13 Cash-Rich Small Cap Stocks To Invest InIn this piece, we will take a look at the 13 cash rich small cap stocks to invest in. If you want to skip our introduction to small cap investing and the latest stock market news, then you can take a look at the 5 Cash-Rich Small Cap Stocks To Invest In. Small cap stocks […] |

New AI Millionaires Club: 3 High-Potential Stocks to WatchAre you looking to become a millionaire with AI stocks? |

Axcelis Technologies (ACLS) Stock Sinks As Market Gains: What You Should KnowAxcelis Technologies (ACLS) reachead $133.43 at the closing of the latest trading day, reflecting a -1.02% change compared to its last close. |

ACLS Price Returns

| 1-mo | 1.75% |

| 3-mo | -6.90% |

| 6-mo | -26.84% |

| 1-year | 3.98% |

| 3-year | 215.08% |

| 5-year | 459.50% |

| YTD | -5.74% |

| 2023 | 63.42% |

| 2022 | 6.44% |

| 2021 | 156.04% |

| 2020 | 20.85% |

| 2019 | 35.37% |

Continue Researching ACLS

Want to do more research on Axcelis Technologies Inc's stock and its price? Try the links below:Axcelis Technologies Inc (ACLS) Stock Price | Nasdaq

Axcelis Technologies Inc (ACLS) Stock Quote, History and News - Yahoo Finance

Axcelis Technologies Inc (ACLS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...