Sprouts Farmers Market, Inc. (SFM): Price and Financial Metrics

SFM Price/Volume Stats

| Current price | $50.76 | 52-week high | $52.02 |

| Prev. close | $49.95 | 52-week low | $30.20 |

| Day low | $50.12 | Volume | 1,226,800 |

| Day high | $50.90 | Avg. volume | 1,098,822 |

| 50-day MA | $48.57 | Dividend yield | N/A |

| 200-day MA | $41.19 | Market Cap | 5.16B |

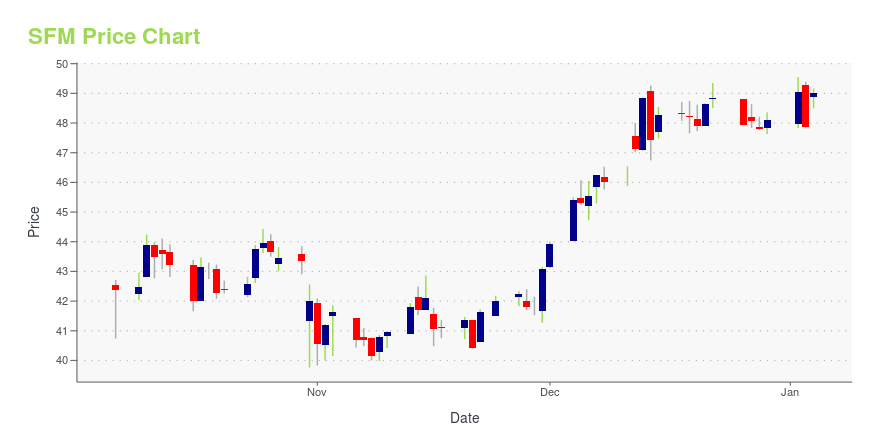

SFM Stock Price Chart Interactive Chart >

SFM POWR Grades

- Quality is the dimension where SFM ranks best; there it ranks ahead of 95.13% of US stocks.

- SFM's strongest trending metric is Quality; it's been moving down over the last 26 weeks.

- SFM ranks lowest in Sentiment; there it ranks in the 21st percentile.

SFM Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for SFM is 6.02 -- better than 93.02% of US stocks.

- SFM's price/sales ratio is 0.72; that's higher than the P/S ratio of merely 23.6% of US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for SFM comes in at 6.51% -- higher than that of 75.94% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to SPROUTS FARMERS MARKET INC are RL, HELE, BWA, DOOR, and ARC.

- SFM's SEC filings can be seen here. And to visit SPROUTS FARMERS MARKET INC's official web site, go to www.sprouts.com.

SFM Valuation Summary

- SFM's EV/EBIT ratio is 18.6; this is 6.59% higher than that of the median Consumer Defensive stock.

- SFM's price/sales ratio has moved down 2.5 over the prior 126 months.

Below are key valuation metrics over time for SFM.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| SFM | 2023-12-22 | 0.7 | 4.4 | 19.5 | 18.6 |

| SFM | 2023-12-21 | 0.7 | 4.4 | 19.5 | 18.5 |

| SFM | 2023-12-20 | 0.7 | 4.4 | 19.2 | 18.3 |

| SFM | 2023-12-19 | 0.7 | 4.4 | 19.3 | 18.4 |

| SFM | 2023-12-18 | 0.7 | 4.4 | 19.3 | 18.4 |

| SFM | 2023-12-15 | 0.7 | 4.4 | 19.3 | 18.4 |

SFM Growth Metrics

- Its 2 year cash and equivalents growth rate is now at 31.24%.

- Its 3 year net income to common stockholders growth rate is now at 68.18%.

- The 4 year price growth rate now stands at -2.11%.

The table below shows SFM's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 6,320.465 | 374.93 | 252.272 |

| 2022-06-30 | 6,239.072 | 396.457 | 250.399 |

| 2022-03-31 | 6,165.583 | 412.39 | 249.416 |

| 2021-12-31 | 6,099.869 | 364.799 | 244.157 |

| 2021-09-30 | 6,208.907 | 380.43 | 276.326 |

| 2021-06-30 | 6,276.872 | 277.992 | 272.7 |

SFM's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- SFM has a Quality Grade of A, ranking ahead of 98.55% of graded US stocks.

- SFM's asset turnover comes in at 2.158 -- ranking 39th of 165 Retail stocks.

- TSCO, KR, and BGFV are the stocks whose asset turnover ratios are most correlated with SFM.

The table below shows SFM's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-10-03 | 2.158 | 0.365 | 0.122 |

| 2021-07-04 | 2.209 | 0.368 | 0.120 |

| 2021-04-04 | 2.235 | 0.371 | 0.122 |

| 2021-01-03 | 2.268 | 0.368 | 0.126 |

| 2020-09-27 | 2.201 | 0.363 | 0.108 |

| 2020-06-28 | 2.156 | 0.353 | 0.094 |

SFM Price Target

For more insight on analysts targets of SFM, see our SFM price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $24.94 | Average Broker Recommendation | 1.95 (Hold) |

Sprouts Farmers Market, Inc. (SFM) Company Bio

Sprouts Farmers Market operates as a specialty retailer of fresh, natural, and organic food in the United States. The company was founded in 2002 and is based in Phoenix, Arizona.

Latest SFM News From Around the Web

Below are the latest news stories about SPROUTS FARMERS MARKET INC that investors may wish to consider to help them evaluate SFM as an investment opportunity.

3 Stocks With Incredible Growth Potential to Buy for 2024These stocks should serve investors well over the long run. |

Here's Why Sprouts Farmers (SFM) is Staying Ahead of IndustrySprouts Farmers (SFM) is benefiting from strategic initiatives, including omni-channel solutions, expanding customer base and focus on private-label products. |

Does This Valuation Of Sprouts Farmers Market, Inc. (NASDAQ:SFM) Imply Investors Are Overpaying?Key Insights Using the 2 Stage Free Cash Flow to Equity, Sprouts Farmers Market fair value estimate is US$38.84 Sprouts... |

3 Short-Squeeze Stocks Ready for a Year-End RallyThese are a few companies that have seen considerable gains this year that still have a large percentage of short interest. |

Sprouts Broadens On-Demand Delivery by Partnering with UberPHOENIX, December 11, 2023--Sprouts Farmers Market, is now available on Uber Eats for on-demand grocery delivery. Customers can order fresh, natural and organic items on the app. |

SFM Price Returns

| 1-mo | 3.13% |

| 3-mo | 23.96% |

| 6-mo | 31.91% |

| 1-year | 57.64% |

| 3-year | 125.30% |

| 5-year | 115.82% |

| YTD | 5.51% |

| 2023 | 48.63% |

| 2022 | 9.06% |

| 2021 | 47.66% |

| 2020 | 3.88% |

| 2019 | -17.69% |

Continue Researching SFM

Want to see what other sources are saying about Sprouts Farmers Market Inc's financials and stock price? Try the links below:Sprouts Farmers Market Inc (SFM) Stock Price | Nasdaq

Sprouts Farmers Market Inc (SFM) Stock Quote, History and News - Yahoo Finance

Sprouts Farmers Market Inc (SFM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...