Dollar Tree Inc. (DLTR): Price and Financial Metrics

DLTR Price/Volume Stats

| Current price | $140.90 | 52-week high | $161.10 |

| Prev. close | $139.83 | 52-week low | $102.77 |

| Day low | $139.47 | Volume | 1,820,000 |

| Day high | $142.82 | Avg. volume | 2,196,493 |

| 50-day MA | $133.08 | Dividend yield | N/A |

| 200-day MA | $132.14 | Market Cap | 30.70B |

DLTR Stock Price Chart Interactive Chart >

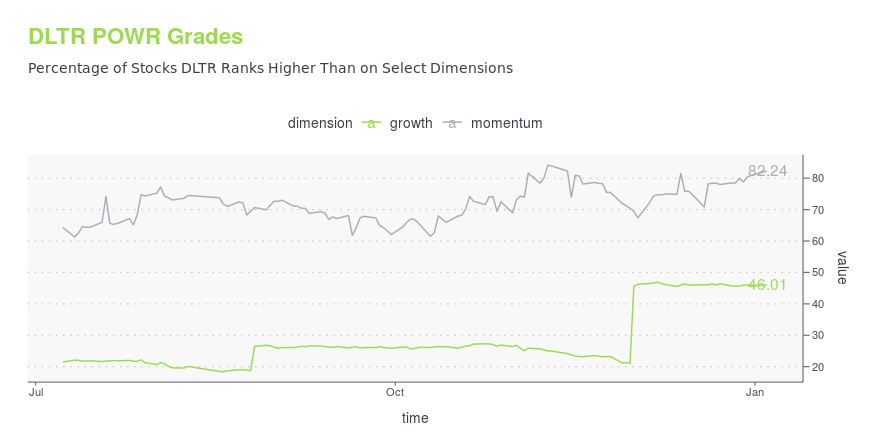

DLTR POWR Grades

- DLTR scores best on the Momentum dimension, with a Momentum rank ahead of 82.24% of US stocks.

- The strongest trend for DLTR is in Growth, which has been heading up over the past 26 weeks.

- DLTR ranks lowest in Growth; there it ranks in the 46th percentile.

DLTR Stock Summary

- DLTR has a higher market value than 91.78% of US stocks; more precisely, its current market capitalization is $29,787,451,227.

- The capital turnover (annual revenue relative to shareholder's equity) for DLTR is 3.3 -- better than 83.79% of US stocks.

- Of note is the ratio of DOLLAR TREE INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- Stocks with similar financial metrics, market capitalization, and price volatility to DOLLAR TREE INC are CCEP, DG, BF.B, DOV, and BLDR.

- Visit DLTR's SEC page to see the company's official filings. To visit the company's web site, go to www.dollartree.com.

DLTR Valuation Summary

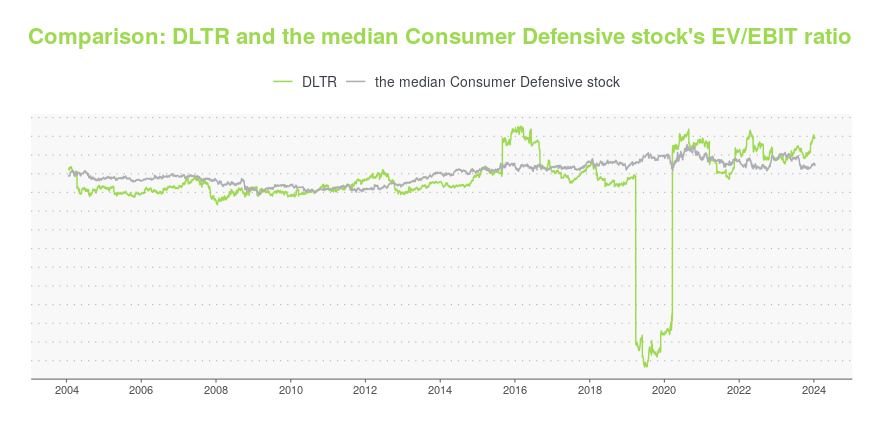

- DLTR's EV/EBIT ratio is 24.5; this is 40.4% higher than that of the median Consumer Defensive stock.

- DLTR's price/earnings ratio has moved up 1.4 over the prior 243 months.

Below are key valuation metrics over time for DLTR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| DLTR | 2023-12-22 | 1 | 3.3 | 25.6 | 24.5 |

| DLTR | 2023-12-21 | 1 | 3.3 | 25.2 | 24.2 |

| DLTR | 2023-12-20 | 1 | 3.3 | 25.2 | 24.3 |

| DLTR | 2023-12-19 | 1 | 3.2 | 25.0 | 24.1 |

| DLTR | 2023-12-18 | 1 | 3.2 | 24.4 | 23.7 |

| DLTR | 2023-12-15 | 1 | 3.2 | 24.5 | 23.8 |

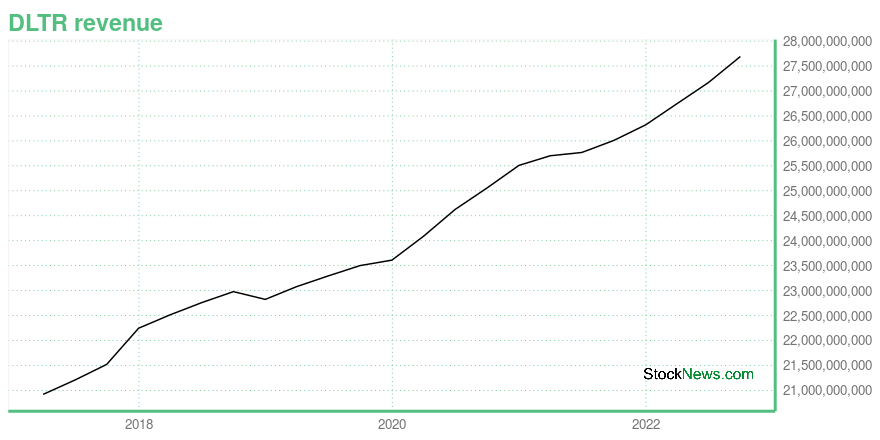

DLTR Growth Metrics

- The 3 year net cashflow from operations growth rate now stands at -29.04%.

- Its 3 year revenue growth rate is now at 15.88%.

- Its 4 year net income to common stockholders growth rate is now at -6.64%.

The table below shows DLTR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 27,691.6 | 1,146.9 | 1,617.4 |

| 2022-06-30 | 27,169.4 | 1,216 | 1,567.3 |

| 2022-03-31 | 26,744.1 | 1,413.8 | 1,489.8 |

| 2021-12-31 | 26,321.2 | 1,431.5 | 1,327.9 |

| 2021-09-30 | 26,008.5 | 2,001.3 | 1,376.5 |

| 2021-06-30 | 25,767.8 | 2,015.4 | 1,489.7 |

DLTR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- DLTR has a Quality Grade of C, ranking ahead of 71.76% of graded US stocks.

- DLTR's asset turnover comes in at 1.244 -- ranking 109th of 165 Retail stocks.

- FL, FND, and PLCE are the stocks whose asset turnover ratios are most correlated with DLTR.

The table below shows DLTR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-31 | 1.244 | 0.307 | 0.102 |

| 2021-05-01 | 1.238 | 0.310 | 0.102 |

| 2021-01-30 | 1.237 | 0.305 | 0.095 |

| 2020-10-31 | 1.232 | 0.303 | 0.073 |

| 2020-08-01 | 1.224 | 0.300 | 0.068 |

| 2020-05-02 | 1.215 | 0.295 | 0.063 |

DLTR Price Target

For more insight on analysts targets of DLTR, see our DLTR price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $108.05 | Average Broker Recommendation | 1.81 (Hold) |

Dollar Tree Inc. (DLTR) Company Bio

Dollar Tree, formerly known as Only $1.00, is an American multi-price-point chain of discount variety stores. Headquartered in Chesapeake, Virginia, it is a Fortune 500 company and operates 15,115 stores throughout the 48 contiguous U.S. states and Canada. Its stores are supported by a nationwide logistics network of 24 distribution centers. Additionally, the company operates stores under the name of Dollar Bills, as well as a multi-price-point variety chain under the Family Dollar banner. (Source:Wikipedia)

Latest DLTR News From Around the Web

Below are the latest news stories about DOLLAR TREE INC that investors may wish to consider to help them evaluate DLTR as an investment opportunity.

7 Items at Dollar Tree That Cost Way More at WalmartMaybe you avoid Dollar Tree because you think the quality of the items are low, or that the store won't have what you're looking for. The truth is you can find quite a few of your everyday essentials... |

Here’s Why Dollar Tree (DLTR) Fell in Q3Chartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Mid Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Equities rose early in the quarter on the back of a broader appetite for risk, however, they eventually fell when interest rates crossed 4%. […] |

10 Items You Should Always Buy at Dollar TreeIn tough times like these, when a recession could be on the horizon, consumers flock to retailers that promise the best prices. Naturally, stores like Dollar Tree -- whose name practically... |

Always Buy These 11 Grocery Items at Dollar TreeDollar Tree might not be the first place you think of when it comes to purchasing your groceries, but you might want to add it to your rotation, or you'll miss out on great grocery deals. Dollar Tree... |

Dollar Tree Plus: 10 High-Quality Items To Buy NowMany of us run into our local Dollar Tree to grab a greeting card or a bottle of body wash at a deep discount without going up and down the aisles. But if you took the time to venture outside of your... |

DLTR Price Returns

| 1-mo | 2.07% |

| 3-mo | 23.51% |

| 6-mo | -4.33% |

| 1-year | -6.40% |

| 3-year | 31.60% |

| 5-year | 44.29% |

| YTD | -0.81% |

| 2023 | 0.43% |

| 2022 | 0.65% |

| 2021 | 30.06% |

| 2020 | 14.88% |

| 2019 | 4.13% |

Continue Researching DLTR

Want to see what other sources are saying about Dollar Tree Inc's financials and stock price? Try the links below:Dollar Tree Inc (DLTR) Stock Price | Nasdaq

Dollar Tree Inc (DLTR) Stock Quote, History and News - Yahoo Finance

Dollar Tree Inc (DLTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...