Big Lots, Inc. (BIG): Price and Financial Metrics

BIG Price/Volume Stats

| Current price | $5.57 | 52-week high | $17.45 |

| Prev. close | $5.41 | 52-week low | $3.47 |

| Day low | $5.31 | Volume | 576,100 |

| Day high | $5.65 | Avg. volume | 887,311 |

| 50-day MA | $6.52 | Dividend yield | N/A |

| 200-day MA | $6.73 | Market Cap | 162.74M |

BIG Stock Price Chart Interactive Chart >

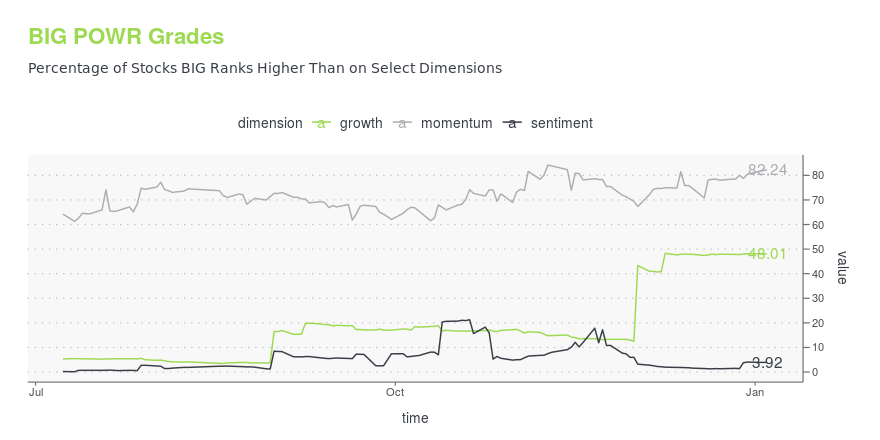

BIG POWR Grades

- Momentum is the dimension where BIG ranks best; there it ranks ahead of 82.24% of US stocks.

- BIG's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- BIG's current lowest rank is in the Sentiment metric (where it is better than 3.92% of US stocks).

BIG Stock Summary

- The capital turnover (annual revenue relative to shareholder's equity) for BIG is 15.43 -- better than 97.82% of US stocks.

- With a price/sales ratio of 0.04, BIG LOTS INC has a higher such ratio than merely 0.75% of stocks in our set.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for BIG comes in at 28.25% -- higher than that of 93.89% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to BIG LOTS INC, a group of peers worth examining would be PLCE, DXYN, AN, KD, and OMI.

- Visit BIG's SEC page to see the company's official filings. To visit the company's web site, go to www.biglots.com.

BIG Valuation Summary

- In comparison to the median Consumer Defensive stock, BIG's EV/EBIT ratio is 140.11% lower, now standing at -7.

- Over the past 243 months, BIG's price/sales ratio has gone down 0.4.

Below are key valuation metrics over time for BIG.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BIG | 2023-12-22 | 0 | 0.6 | -0.4 | -7 |

| BIG | 2023-12-21 | 0 | 0.6 | -0.4 | -7 |

| BIG | 2023-12-20 | 0 | 0.7 | -0.4 | -7 |

| BIG | 2023-12-19 | 0 | 0.7 | -0.5 | -7 |

| BIG | 2023-12-18 | 0 | 0.7 | -0.4 | -7 |

| BIG | 2023-12-15 | 0 | 0.7 | -0.4 | -7 |

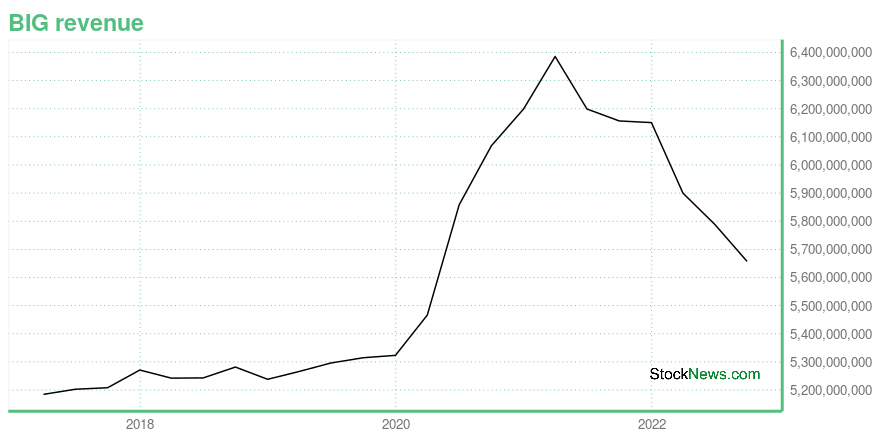

BIG Growth Metrics

- Its year over year net income to common stockholders growth rate is now at -89.3%.

- Its 2 year cash and equivalents growth rate is now at -80.21%.

- Its 5 year cash and equivalents growth rate is now at 374.47%.

The table below shows BIG's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 5,657.237 | -160.983 | -148.407 |

| 2022-06-30 | 5,788.612 | -83.805 | -49.724 |

| 2022-03-31 | 5,899.765 | -206.764 | 72.133 |

| 2021-12-31 | 6,150.603 | 193.762 | 177.778 |

| 2021-09-30 | 6,156.497 | 207.645 | 225.926 |

| 2021-06-30 | 6,198.766 | 73.123 | 260.166 |

BIG's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BIG has a Quality Grade of B, ranking ahead of 85.3% of graded US stocks.

- BIG's asset turnover comes in at 1.54 -- ranking 73rd of 165 Retail stocks.

- KR, FAST, and DLTH are the stocks whose asset turnover ratios are most correlated with BIG.

The table below shows BIG's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-31 | 1.540 | 0.399 | 0.084 |

| 2021-05-01 | 1.553 | 0.404 | 0.221 |

| 2021-01-30 | 1.576 | 0.403 | 0.210 |

| 2020-10-31 | 1.631 | 0.403 | 0.214 |

| 2020-08-01 | 1.662 | 0.401 | 0.248 |

| 2020-05-02 | 1.666 | 0.396 | 0.096 |

BIG Price Target

For more insight on analysts targets of BIG, see our BIG price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $53.89 | Average Broker Recommendation | 2 (Hold) |

Big Lots, Inc. (BIG) Company Bio

Big Lots is a discount retailer with product assortments in the merchandise categories of Food, Consumables, Furniture, Seasonal, Soft Home, Hard Home, and Electronics & Accessories. The company was founded in 1967 and is based in Columbus, Ohio.

Latest BIG News From Around the Web

Below are the latest news stories about BIG LOTS INC that investors may wish to consider to help them evaluate BIG as an investment opportunity.

Big Lots, Inc. (NYSE:BIG) is favoured by institutional owners who hold 73% of the companyKey Insights Significantly high institutional ownership implies Big Lots' stock price is sensitive to their trading... |

American Software's (AMSWA) Logility Bolsters AI EffortsAmerican Software (AMSWA) expands as Logility upgrades its SaaS platform with improved AI and ML capabilities. |

Do Options Traders Know Something About Big Lots (BIG) Stock We Don't?Investors need to pay close attention to Big Lots (BIG) stock based on the movements in the options market lately. |

Big Lots (BIG) Q3 Earnings: Taking a Look at Key Metrics Versus EstimatesAlthough the revenue and EPS for Big Lots (BIG) give a sense of how its business performed in the quarter ended October 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

3 Stocks to Avoid This WeekWall Street keeps inching higher. I thought my three stocks to avoid for last week -- Warner Bros. Discovery, Ambarella, and Big Lots -- were going to lose to the market. They rose 4%, 5%, and a whopping 54%, respectively, for an average gain of 21% for the week. |

BIG Price Returns

| 1-mo | -22.32% |

| 3-mo | 49.33% |

| 6-mo | -34.47% |

| 1-year | -66.55% |

| 3-year | -89.78% |

| 5-year | -78.24% |

| YTD | -28.50% |

| 2023 | -45.78% |

| 2022 | -65.65% |

| 2021 | 7.28% |

| 2020 | 56.99% |

| 2019 | 3.60% |

Continue Researching BIG

Here are a few links from around the web to help you further your research on Big Lots Inc's stock as an investment opportunity:Big Lots Inc (BIG) Stock Price | Nasdaq

Big Lots Inc (BIG) Stock Quote, History and News - Yahoo Finance

Big Lots Inc (BIG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...