Dollar General Corp. (DG): Price and Financial Metrics

DG Price/Volume Stats

| Current price | $135.65 | 52-week high | $233.74 |

| Prev. close | $135.29 | 52-week low | $101.09 |

| Day low | $135.08 | Volume | 1,441,000 |

| Day high | $136.95 | Avg. volume | 2,222,478 |

| 50-day MA | $132.91 | Dividend yield | 1.76% |

| 200-day MA | $148.45 | Market Cap | 29.77B |

DG Stock Price Chart Interactive Chart >

DG POWR Grades

- DG scores best on the Momentum dimension, with a Momentum rank ahead of 82.24% of US stocks.

- DG's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- DG's current lowest rank is in the Growth metric (where it is better than 3.92% of US stocks).

DG Stock Summary

- DG has a higher market value than 91.63% of US stocks; more precisely, its current market capitalization is $28,815,599,505.

- The capital turnover (annual revenue relative to shareholder's equity) for DG is 6.05 -- better than 93.1% of US stocks.

- Of note is the ratio of DOLLAR GENERAL CORP's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- Stocks with similar financial metrics, market capitalization, and price volatility to DOLLAR GENERAL CORP are DLTR, CCEP, K, BLDR, and WBA.

- DG's SEC filings can be seen here. And to visit DOLLAR GENERAL CORP's official web site, go to www.dollargeneral.com.

DG Valuation Summary

- DG's price/earnings ratio is 15.1; this is 27.75% lower than that of the median Consumer Defensive stock.

- Over the past 172 months, DG's price/sales ratio has gone down 0.

Below are key valuation metrics over time for DG.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| DG | 2023-12-22 | 0.7 | 4.5 | 15.1 | 16.7 |

| DG | 2023-12-21 | 0.7 | 4.4 | 14.9 | 16.5 |

| DG | 2023-12-20 | 0.7 | 4.4 | 14.7 | 16.4 |

| DG | 2023-12-19 | 0.7 | 4.4 | 14.9 | 16.5 |

| DG | 2023-12-18 | 0.7 | 4.3 | 14.4 | 16.2 |

| DG | 2023-12-15 | 0.7 | 4.4 | 14.9 | 16.5 |

DG Growth Metrics

- Its year over year price growth rate is now at 8.68%.

- The 2 year cash and equivalents growth rate now stands at -87.45%.

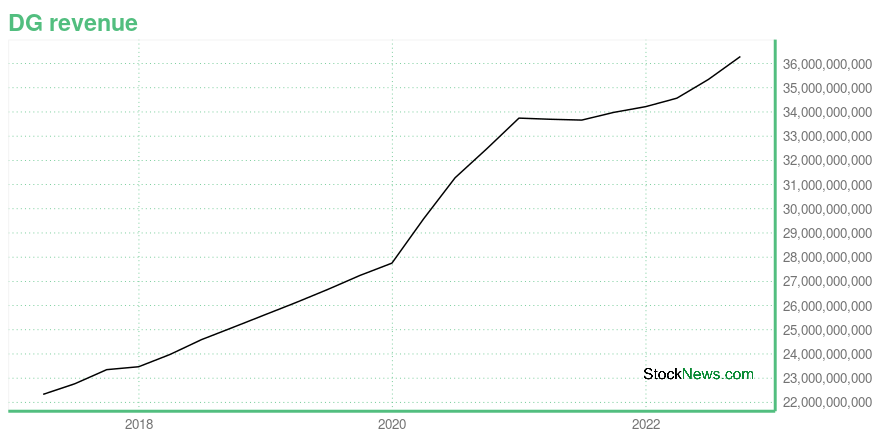

- The 2 year revenue growth rate now stands at 16.88%.

The table below shows DG's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 36,293.4 | 1,887.282 | 2,354.287 |

| 2022-06-30 | 35,346.35 | 2,496.283 | 2,315.151 |

| 2022-03-31 | 34,570.84 | 2,612.336 | 2,274.14 |

| 2021-12-31 | 34,220.45 | 2,865.811 | 2,399.232 |

| 2021-09-30 | 33,983.53 | 2,719.335 | 2,444.542 |

| 2021-06-30 | 33,665.31 | 2,286.368 | 2,531.771 |

DG's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- DG has a Quality Grade of C, ranking ahead of 65.35% of graded US stocks.

- DG's asset turnover comes in at 1.311 -- ranking 102nd of 165 Retail stocks.

- FL, GPS, and ZUMZ are the stocks whose asset turnover ratios are most correlated with DG.

The table below shows DG's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-30 | 1.311 | 0.321 | 0.126 |

| 2021-04-30 | 1.307 | 0.323 | 0.136 |

| 2021-01-29 | 1.314 | 0.318 | 0.138 |

| 2020-10-30 | 1.304 | 0.316 | 0.136 |

| 2020-07-31 | 1.304 | 0.312 | 0.128 |

| 2020-05-01 | 1.286 | 0.307 | 0.112 |

DG Price Target

For more insight on analysts targets of DG, see our DG price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $251.30 | Average Broker Recommendation | 1.45 (Moderate Buy) |

Dollar General Corp. (DG) Company Bio

Dollar General Corporation is an American chain of variety stores headquartered in Goodlettsville, Tennessee. As of October 2021, Dollar General operates 18,000 stores in the continental United States. (Source:Wikipedia)

Latest DG News From Around the Web

Below are the latest news stories about DOLLAR GENERAL CORP that investors may wish to consider to help them evaluate DG as an investment opportunity.

The Top 7 Stocks to Buy Before They Take Off Next YearThese seven blue-chip stocks to buy can form a robust core portfolio for the next leg higher in 2024 and beyond. |

The Biggest Losers in S&P 500 This Year: Dollar General, Moderna, and MoreThe five worst performers in the market benchmark so far this year could be set for brighter futures. |

The Winners and Losers: 2023 Stock Market Performance ReviewThe 2023 stock market saw steep declines followed by rapid upswings, but we're ending the year on a high note (even if some stocks aren't). |

The Smart Money: 3 Stocks the ‘Super Investors’ Are BuyingWhen the smart money is piling into a stock, it pays to sit up, take notice, and start doing your own due diligence. |

Should You Buy This Year's Worst-Performing S&P 500 Stocks for 2024?Some of this year's underperformers could have brighter futures. |

DG Price Returns

| 1-mo | -0.76% |

| 3-mo | 15.52% |

| 6-mo | -16.89% |

| 1-year | -39.44% |

| 3-year | -29.31% |

| 5-year | 22.56% |

| YTD | 0.21% |

| 2023 | -44.13% |

| 2022 | 5.57% |

| 2021 | 13.01% |

| 2020 | 35.89% |

| 2019 | 45.71% |

DG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DG

Here are a few links from around the web to help you further your research on Dollar General Corp's stock as an investment opportunity:Dollar General Corp (DG) Stock Price | Nasdaq

Dollar General Corp (DG) Stock Quote, History and News - Yahoo Finance

Dollar General Corp (DG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...