Vistra Energy Corp. (VST): Price and Financial Metrics

VST Price/Volume Stats

| Current price | $42.90 | 52-week high | $44.96 |

| Prev. close | $43.76 | 52-week low | $21.18 |

| Day low | $42.61 | Volume | 3,702,000 |

| Day high | $43.83 | Avg. volume | 3,167,070 |

| 50-day MA | $38.97 | Dividend yield | 1.97% |

| 200-day MA | $31.64 | Market Cap | 15.34B |

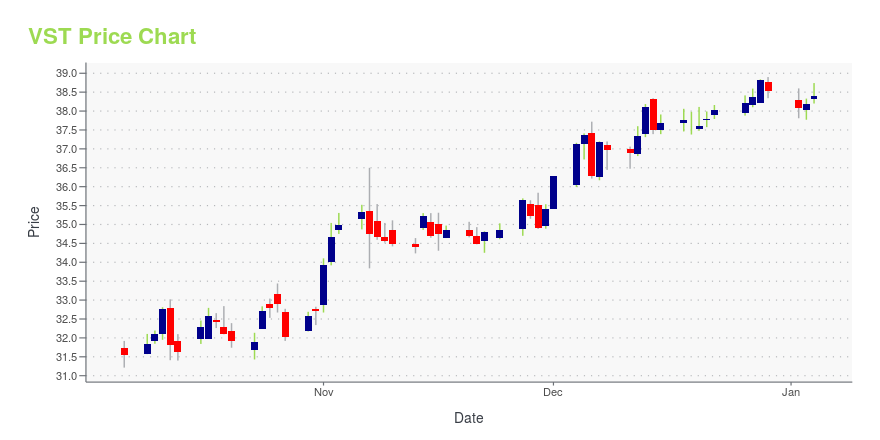

VST Stock Price Chart Interactive Chart >

VST POWR Grades

- Value is the dimension where VST ranks best; there it ranks ahead of 91.69% of US stocks.

- The strongest trend for VST is in Stability, which has been heading down over the past 26 weeks.

- VST ranks lowest in Sentiment; there it ranks in the 19th percentile.

VST Stock Summary

- The price/operating cash flow metric for VISTRA CORP is higher than only 8.32% of stocks in our set with a positive cash flow.

- Of note is the ratio of VISTRA CORP's sales and general administrative expense to its total operating expenses; only 11.64% of US stocks have a lower such ratio.

- Over the past twelve months, VST has reported earnings growth of -2,071.77%, putting it ahead of merely 0.77% of US stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to VISTRA CORP are HNRG, AG, DRVN, TNP, and FIS.

- Visit VST's SEC page to see the company's official filings. To visit the company's web site, go to www.vistraenergy.com.

VST Valuation Summary

- VST's price/earnings ratio is 10.7; this is 44.99% lower than that of the median Utilities stock.

- Over the past 88 months, VST's price/sales ratio has gone NA NA.

Below are key valuation metrics over time for VST.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| VST | 2023-12-27 | 0.9 | 2.5 | 10.7 | 10.1 |

| VST | 2023-12-26 | 0.9 | 2.5 | 10.7 | 10.1 |

| VST | 2023-12-22 | 0.9 | 2.5 | 10.6 | 10.0 |

| VST | 2023-12-21 | 0.9 | 2.5 | 10.5 | 10.0 |

| VST | 2023-12-20 | 0.9 | 2.4 | 10.5 | 10.0 |

| VST | 2023-12-19 | 0.9 | 2.4 | 10.5 | 10.0 |

VST's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- VST has a Quality Grade of D, ranking ahead of 16.39% of graded US stocks.

- VST's asset turnover comes in at 0.457 -- ranking 14th of 105 Utilities stocks.

- NEP, EIX, and SWX are the stocks whose asset turnover ratios are most correlated with VST.

The table below shows VST's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.457 | 0.251 | -0.061 |

| 2021-03-31 | 0.458 | 0.272 | -0.050 |

| 2020-12-31 | 0.441 | 0.548 | 0.057 |

| 2020-09-30 | 0.448 | 0.551 | 0.067 |

| 2020-06-30 | 0.431 | 0.518 | 0.053 |

| 2020-03-31 | 0.442 | 0.522 | 0.066 |

VST Price Target

For more insight on analysts targets of VST, see our VST price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $24.20 | Average Broker Recommendation | 1.35 (Strong Buy) |

Vistra Energy Corp. (VST) Company Bio

Vistra Energy Corp., an energy company, operates as an integrated power business in Texas. The company operates through two segments, Wholesale Generation and Retail Electricity. The company was formerly known as TCEH Corp. and changed its name to Vistra Energy Corp. in November 2016. The company is based in Dallas.

Latest VST News From Around the Web

Below are the latest news stories about VISTRA CORP that investors may wish to consider to help them evaluate VST as an investment opportunity.

Vistra Announces Pricing Terms of Cash Tender Offer for Senior Secured NotesVistra Corp. (NYSE: VST) ("Vistra") announced today the pricing terms of its previously announced cash tender offers (the "Tender Offers") to purchase a portion of Vistra's outstanding 3.550% Senior Secured Notes due 2024 ("3.550% 2024 Notes"), 4.875% Senior Secured Notes due 2024 ("4.875% 2024 Notes") and 5.125% Senior Secured Notes due 2025 ("5.125% 2025 Notes" and, together with the 3.550% 2024 Notes and 4.875% 2024 Notes, the "Notes") up to an aggregate principal amount that will not result |

Vistra Announces Early Results of Cash Tender Offer for Senior Secured NotesVistra Corp. (NYSE: VST) ("Vistra") announced today the results to date of its previously announced cash tender offers (the "Tender Offers") to purchase a portion of Vistra's outstanding 3.550% Senior Secured Notes due 2024 ("3.550% 2024 Notes"), 4.875% Senior Secured Notes due 2024 ("4.875% 2024 Notes") and 5.125% Senior Secured Notes due 2025 ("5.125% 2025 Notes" and, together with the 3.550% 2024 Notes and 4.875% 2024 Notes, the "Notes") up to an aggregate principal amount that will not resul |

Should You Hold Vistra Corp. (VST) for the Long-Term?Meridian Funds, managed by ArrowMark Partners, released its “Meridian Hedged Equity Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the quarter, the fund declined -1.36% (net), outperforming its benchmark, the S&P 500 Index, which declined -3.27%. The firm focuses on high-quality companies for long-term growth. In addition, […] |

Vistra's (NYSE:VST) investors will be pleased with their strong 122% return over the last three yearsThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

Reasons to Add Vistra (VST) to Your Portfolio Right NowVistra (VST) is making investments to strengthen its existing operations, increase shareholder value through buybacks and dividends, and continue to serve its customers efficiently. |

VST Price Returns

| 1-mo | 8.36% |

| 3-mo | 25.13% |

| 6-mo | 44.03% |

| 1-year | 92.98% |

| 3-year | 123.24% |

| 5-year | 90.44% |

| YTD | 11.37% |

| 2023 | 70.74% |

| 2022 | 5.08% |

| 2021 | 19.57% |

| 2020 | -11.87% |

| 2019 | 2.46% |

VST Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VST

Want to see what other sources are saying about Vistra Energy Corp's financials and stock price? Try the links below:Vistra Energy Corp (VST) Stock Price | Nasdaq

Vistra Energy Corp (VST) Stock Quote, History and News - Yahoo Finance

Vistra Energy Corp (VST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...