PNM Resources, Inc. (Holding Co.) (PNM): Price and Financial Metrics

PNM Price/Volume Stats

| Current price | $37.08 | 52-week high | $49.47 |

| Prev. close | $36.96 | 52-week low | $34.63 |

| Day low | $36.53 | Volume | 1,729,800 |

| Day high | $37.34 | Avg. volume | 2,450,041 |

| 50-day MA | $39.47 | Dividend yield | 4.46% |

| 200-day MA | $43.50 | Market Cap | 3.18B |

PNM Stock Price Chart Interactive Chart >

PNM POWR Grades

- Stability is the dimension where PNM ranks best; there it ranks ahead of 57.54% of US stocks.

- PNM's strongest trending metric is Quality; it's been moving down over the last 26 weeks.

- PNM ranks lowest in Growth; there it ranks in the 3rd percentile.

PNM Stock Summary

- PNM's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- The ratio of debt to operating expenses for PNM RESOURCES INC is higher than it is for about 90.81% of US stocks.

- The volatility of PNM RESOURCES INC's share price is greater than that of merely 4.29% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to PNM RESOURCES INC are AROC, SKT, SJW, AWR, and YORW.

- PNM's SEC filings can be seen here. And to visit PNM RESOURCES INC's official web site, go to www.pnmresources.com.

PNM Valuation Summary

- In comparison to the median Utilities stock, PNM's price/sales ratio is 22.73% lower, now standing at 1.7.

- Over the past 243 months, PNM's price/sales ratio has gone up 0.9.

Below are key valuation metrics over time for PNM.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PNM | 2023-12-27 | 1.7 | 1.6 | 23.3 | 24.4 |

| PNM | 2023-12-26 | 1.7 | 1.6 | 23.5 | 24.5 |

| PNM | 2023-12-22 | 1.7 | 1.6 | 23.6 | 24.5 |

| PNM | 2023-12-21 | 1.7 | 1.6 | 23.9 | 24.7 |

| PNM | 2023-12-20 | 1.7 | 1.6 | 23.7 | 24.6 |

| PNM | 2023-12-19 | 1.8 | 1.7 | 24.1 | 24.8 |

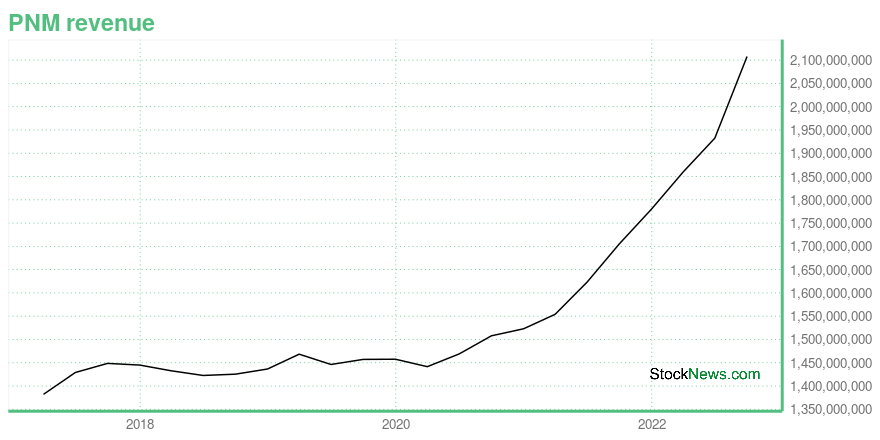

PNM Growth Metrics

- The 4 year net cashflow from operations growth rate now stands at 7.85%.

- Its 2 year price growth rate is now at 22.25%.

- Its 5 year revenue growth rate is now at 4.3%.

The table below shows PNM's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 2,107.811 | 566.857 | 164.477 |

| 2022-06-30 | 1,932.474 | 591.174 | 155.365 |

| 2022-03-31 | 1,859.284 | 578.006 | 193.713 |

| 2021-12-31 | 1,779.873 | 547.873 | 195.301 |

| 2021-09-30 | 1,705.074 | 526.255 | 192.991 |

| 2021-06-30 | 1,622.988 | 494.481 | 201.438 |

PNM's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PNM has a Quality Grade of C, ranking ahead of 62.05% of graded US stocks.

- PNM's asset turnover comes in at 0.213 -- ranking 54th of 105 Utilities stocks.

- CEQP, XEL, and PCYO are the stocks whose asset turnover ratios are most correlated with PNM.

The table below shows PNM's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.213 | 0.509 | 0.030 |

| 2021-06-30 | 0.204 | 0.538 | 0.033 |

| 2021-03-31 | 0.199 | 0.557 | 0.035 |

| 2020-12-31 | 0.199 | 0.562 | 0.032 |

| 2020-09-30 | 0.201 | 0.577 | 0.035 |

| 2020-06-30 | 0.200 | 0.583 | 0.034 |

PNM Price Target

For more insight on analysts targets of PNM, see our PNM price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $50.06 | Average Broker Recommendation | 2.14 (Hold) |

PNM Resources, Inc. (Holding Co.) (PNM) Company Bio

PNM Resources operates in energy and energy-related businesses in the United States, serving customers in New Mexico and Texas. The company was founded in 1917 and is based in Albuquerque, New Mexico.

Latest PNM News From Around the Web

Below are the latest news stories about PNM RESOURCES INC that investors may wish to consider to help them evaluate PNM as an investment opportunity.

American Electric Power (AEP) to Sell Stake in New Mexico AssetAmerican Electric Power (AEP) continues to streamline its operation by divesting non-core assets and adding more renewable assets to its generation portfolio. |

PNM Resources (PNM) to Sell Renewable Joint Venture for $230MPNM Resources (PNM) and American Electric Power inked a deal to divest around 50% stake each in New Mexico Renewable Development, LLC for $230 million. |

Electric Company AEP and PNM Unload 50% Solar Stake for $230M in Strategic ShiftAmerican Electric Power Co Inc (NASDAQ: AEP), along with PNM Resources Inc (NYSE: PNM), inked a deal to divest around 50% stake each in New Mexico Renewable Development, LLC (NMRD) to Exus North America Holdings, LLC for about $230 million. In particular, AEP and PNM Resources intend to sell the portfolio of 15 solar projects totaling 625 megawatts (MW). AEP's share of the sale is around $115 million, and it expects to garner about $104 million in cash after tax, transaction fees, and other cust |

Utilities AEP, PNM Sell New Mexico Solar Assets for $230 Million(Bloomberg) -- American Electric Power and PNM Resources Inc. have entered into an agreement to sell their joint venture New Mexico Renewable Development, which consists of 15 solar projects, to Exus North America Holdings LLC for about $230 million.Most Read from BloombergChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerTesla Plans Revamp of Smash Hit Model Y From China PlantApple’s iPhone Design Chief Enlisted by Jony Ive, Sam Altman to Work on AI DevicesGhost Ships at Reawaken |

PNM Resources Announces Sale of Renewable Joint VenturePNM Resources (NYSE: PNM) has entered into an agreement to sell its 50% ownership interest in its renewable joint venture, New Mexico Renewable Development, LLC (NMRD) to Exus North America Holdings, LLC. PNM Resources and American Electric Power (AEP), which also owns 50% of NMRD, have agreed to sell the NMRD portfolio for approximately $230 million subject to true-up adjustments at close. |

PNM Price Returns

| 1-mo | -3.60% |

| 3-mo | -11.10% |

| 6-mo | -14.26% |

| 1-year | -21.87% |

| 3-year | -16.91% |

| 5-year | -0.28% |

| YTD | -9.90% |

| 2023 | -11.99% |

| 2022 | 10.19% |

| 2021 | -3.48% |

| 2020 | -1.74% |

| 2019 | 26.50% |

PNM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PNM

Here are a few links from around the web to help you further your research on Pnm Resources Inc's stock as an investment opportunity:Pnm Resources Inc (PNM) Stock Price | Nasdaq

Pnm Resources Inc (PNM) Stock Quote, History and News - Yahoo Finance

Pnm Resources Inc (PNM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...