UNITIL Corporation (UTL): Price and Financial Metrics

UTL Price/Volume Stats

| Current price | $48.06 | 52-week high | $60.59 |

| Prev. close | $48.23 | 52-week low | $41.43 |

| Day low | $47.45 | Volume | 51,600 |

| Day high | $48.45 | Avg. volume | 47,159 |

| 50-day MA | $50.27 | Dividend yield | 3.37% |

| 200-day MA | $50.17 | Market Cap | 773.67M |

UTL Stock Price Chart Interactive Chart >

UTL POWR Grades

- Sentiment is the dimension where UTL ranks best; there it ranks ahead of 90.76% of US stocks.

- The strongest trend for UTL is in Quality, which has been heading down over the past 26 weeks.

- UTL ranks lowest in Quality; there it ranks in the 26th percentile.

UTL Stock Summary

- With a one year PEG ratio of 240.87, UNITIL CORP is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than 86.94% of US stocks.

- Of note is the ratio of UNITIL CORP's sales and general administrative expense to its total operating expenses; only 0.17% of US stocks have a lower such ratio.

- For UTL, its debt to operating expenses ratio is greater than that reported by 87.31% of US equities we're observing.

- If you're looking for stocks that are quantitatively similar to UNITIL CORP, a group of peers worth examining would be MGEE, ALE, MDU, CPK, and IDA.

- Visit UTL's SEC page to see the company's official filings. To visit the company's web site, go to unitil.com.

UTL Valuation Summary

- In comparison to the median Utilities stock, UTL's price/sales ratio is 36.36% lower, now standing at 1.4.

- Over the past 243 months, UTL's price/sales ratio has gone up 0.7.

Below are key valuation metrics over time for UTL.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| UTL | 2023-12-27 | 1.4 | 1.8 | 19.3 | 17.7 |

| UTL | 2023-12-26 | 1.4 | 1.8 | 19.2 | 17.6 |

| UTL | 2023-12-22 | 1.4 | 1.7 | 18.9 | 17.5 |

| UTL | 2023-12-21 | 1.4 | 1.7 | 18.7 | 17.4 |

| UTL | 2023-12-20 | 1.4 | 1.7 | 18.6 | 17.3 |

| UTL | 2023-12-19 | 1.4 | 1.7 | 18.8 | 17.4 |

UTL Growth Metrics

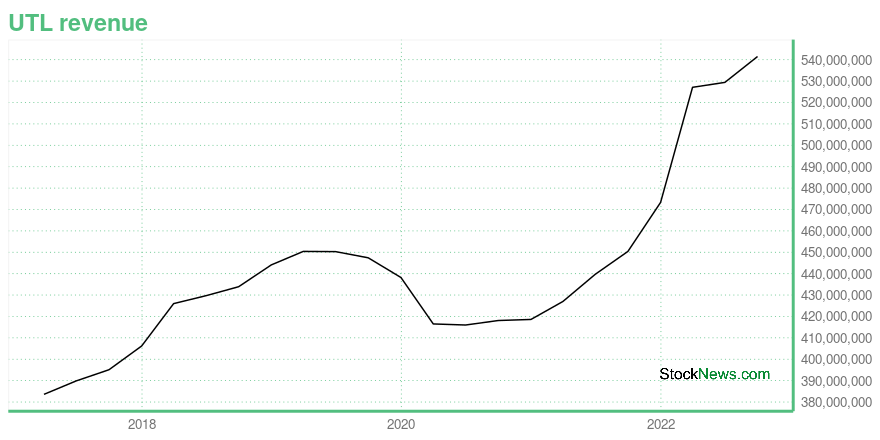

- Its 2 year revenue growth rate is now at 26.55%.

- Its year over year price growth rate is now at -9.43%.

- The year over year net cashflow from operations growth rate now stands at -6.6%.

The table below shows UTL's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 541.5 | 94.6 | 41.4 |

| 2022-06-30 | 529.4 | 94.4 | 40.9 |

| 2022-03-31 | 527.1 | 89.2 | 38.7 |

| 2021-12-31 | 473.3 | 107.8 | 36.1 |

| 2021-09-30 | 450.4 | 96.7 | 35.2 |

| 2021-06-30 | 439.7 | 101.8 | 35.5 |

UTL's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- UTL has a Quality Grade of C, ranking ahead of 25.73% of graded US stocks.

- UTL's asset turnover comes in at 0.303 -- ranking 24th of 105 Utilities stocks.

- ALE, CPK, and BKH are the stocks whose asset turnover ratios are most correlated with UTL.

The table below shows UTL's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.303 | 0.354 | 0.038 |

| 2021-06-30 | 0.300 | 0.359 | 0.038 |

| 2021-03-31 | 0.296 | 0.367 | 0.039 |

| 2020-12-31 | 0.296 | 0.358 | 0.036 |

| 2020-09-30 | 0.301 | 0.348 | 0.036 |

| 2020-06-30 | 0.306 | 0.354 | 0.038 |

UTL Price Target

For more insight on analysts targets of UTL, see our UTL price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $53.67 | Average Broker Recommendation | 1.83 (Hold) |

UNITIL Corporation (UTL) Company Bio

Unitil Corporation distributes electricity in New Hampshire and Massachusetts and natural gas in New Hampshire, Maine, and Massachusetts. The company was founded in 1984 and is based in Hampton, New Hampshire.

Latest UTL News From Around the Web

Below are the latest news stories about UNITIL CORP that investors may wish to consider to help them evaluate UTL as an investment opportunity.

4 Reasons to Add Unitil (UTL) to Your Portfolio Right NowUnitil (UTL), with its regular dividend payment and rising earnings estimates, makes a strong case for investment in the utility space. |

UTL or DTE: Which Is the Better Value Stock Right Now?UTL vs. DTE: Which Stock Is the Better Value Option? |

Calculating The Intrinsic Value Of Unitil Corporation (NYSE:UTL)Key Insights Using the Dividend Discount Model, Unitil fair value estimate is US$45.30 With US$52.93 share price... |

Unitil Announces Director ResignationHAMPTON, N.H., Dec. 01, 2023 (GLOBE NEWSWIRE) -- Unitil Corporation (NYSE: UTL) (unitil.com) today announced that Eben S. Moulton will resign as a member of the Board of Directors (the “Board”) of Unitil Corporation, effective as of today, December 1, 2023. Mr. Moulton has served on the Board since 2000, including as chair of the Compensation Committee from 2002 to 2017. Mr. Moulton elected to resign from the Board prior to the expiration of his current term in April 2025 in order to pursue addi |

Unitil Corporation (NYSE:UTL) Q3 2023 Earnings Call TranscriptUnitil Corporation (NYSE:UTL) Q3 2023 Earnings Call Transcript November 11, 2023 Todd Diggins: Good morning, and thank you for joining us to discuss Unitil Corporation’s Third Quarter 2023 Financial Results. Speaking on the call today will be Tom Meissner, Chairman and Chief Executive Officer; and Dan Hurstak, Senior Vice President, Chief Financial Officer and Treasurer. […] |

UTL Price Returns

| 1-mo | -7.09% |

| 3-mo | 0.49% |

| 6-mo | -2.74% |

| 1-year | -3.96% |

| 3-year | 24.92% |

| 5-year | 6.30% |

| YTD | -8.58% |

| 2023 | 5.63% |

| 2022 | 15.90% |

| 2021 | 7.31% |

| 2020 | -25.94% |

| 2019 | 25.30% |

UTL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UTL

Here are a few links from around the web to help you further your research on Unitil Corp's stock as an investment opportunity:Unitil Corp (UTL) Stock Price | Nasdaq

Unitil Corp (UTL) Stock Quote, History and News - Yahoo Finance

Unitil Corp (UTL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...