Exelon Corp. (EXC): Price and Financial Metrics

EXC Price/Volume Stats

| Current price | $33.75 | 52-week high | $43.71 |

| Prev. close | $34.10 | 52-week low | $33.46 |

| Day low | $33.53 | Volume | 5,935,400 |

| Day high | $33.98 | Avg. volume | 6,785,896 |

| 50-day MA | $36.27 | Dividend yield | 4.28% |

| 200-day MA | $39.33 | Market Cap | 33.60B |

EXC Stock Price Chart Interactive Chart >

EXC POWR Grades

- Growth is the dimension where EXC ranks best; there it ranks ahead of 70.89% of US stocks.

- The strongest trend for EXC is in Quality, which has been heading down over the past 26 weeks.

- EXC's current lowest rank is in the Sentiment metric (where it is better than 21.89% of US stocks).

EXC Stock Summary

- Of note is the ratio of EXELON CORP's sales and general administrative expense to its total operating expenses; only 0.17% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for EXELON CORP is higher than it is for about 94.24% of US stocks.

- The volatility of EXELON CORP's share price is greater than that of merely 4.44% US stocks with at least 200 days of trading history.

- If you're looking for stocks that are quantitatively similar to EXELON CORP, a group of peers worth examining would be FE, EVRI, PNW, USM, and MKTX.

- EXC's SEC filings can be seen here. And to visit EXELON CORP's official web site, go to www.exeloncorp.com.

EXC Valuation Summary

- In comparison to the median Utilities stock, EXC's EV/EBIT ratio is 1.8% lower, now standing at 19.1.

- EXC's price/sales ratio has moved up 0.3 over the prior 243 months.

Below are key valuation metrics over time for EXC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| EXC | 2023-12-27 | 1.7 | 1.4 | 16.4 | 19.1 |

| EXC | 2023-12-26 | 1.7 | 1.4 | 16.5 | 19.1 |

| EXC | 2023-12-22 | 1.7 | 1.4 | 16.4 | 19.1 |

| EXC | 2023-12-21 | 1.7 | 1.4 | 16.3 | 19.0 |

| EXC | 2023-12-20 | 1.6 | 1.4 | 16.2 | 18.9 |

| EXC | 2023-12-19 | 1.7 | 1.4 | 16.4 | 19.1 |

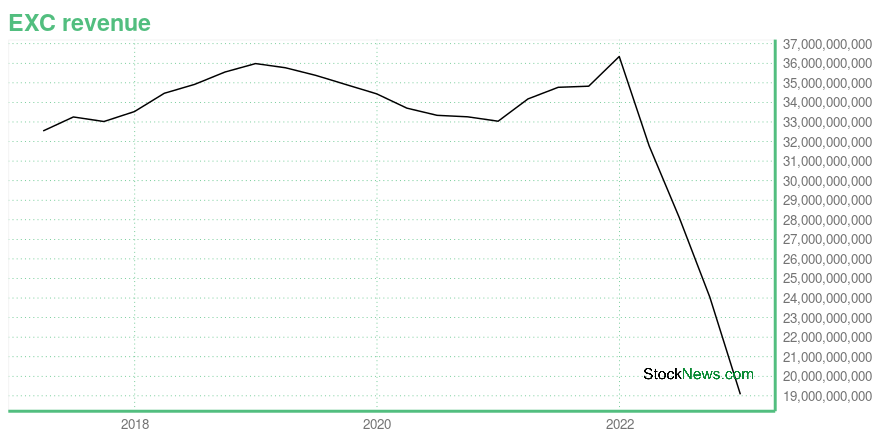

EXC Growth Metrics

- The 2 year net income to common stockholders growth rate now stands at -0.69%.

- Its 2 year net cashflow from operations growth rate is now at -9.56%.

- Its 3 year net income to common stockholders growth rate is now at 11.2%.

The table below shows EXC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 19,078 | 4,870 | 2,170 |

| 2022-09-30 | 24,043 | 3,012 | 2,129 |

| 2022-06-30 | 28,108 | 5,114 | 2,656 |

| 2022-03-31 | 31,784 | 6,055 | 2,592 |

| 2021-12-31 | 36,347 | 3,012 | 1,706 |

| 2021-09-30 | 34,829 | 4,154 | 1,674 |

EXC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- EXC has a Quality Grade of D, ranking ahead of 23.01% of graded US stocks.

- EXC's asset turnover comes in at 0.269 -- ranking 32nd of 105 Utilities stocks.

- UGI, NJR, and EPD are the stocks whose asset turnover ratios are most correlated with EXC.

The table below shows EXC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.269 | 0.217 | 0.021 |

| 2021-03-31 | 0.266 | 0.207 | 0.023 |

| 2020-12-31 | 0.260 | 0.236 | 0.027 |

| 2020-09-30 | 0.264 | 0.235 | 0.030 |

| 2020-06-30 | 0.267 | 0.246 | 0.032 |

| 2020-03-31 | 0.273 | 0.253 | 0.031 |

EXC Price Target

For more insight on analysts targets of EXC, see our EXC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $54.43 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Exelon Corp. (EXC) Company Bio

Exelon Corporation is an American Fortune 100 energy company headquartered in Chicago, Illinois and incorporated in Pennsylvania. It generates revenues of approximately $33.5 billion and employs approximately 33,400 people. Exelon is the largest electric parent company in the United States by revenue, the largest regulated electric utility in the United States with approximately 10 million customers, and was formerly the largest operator of nuclear power plants in the United States and the largest non-governmental operator of nuclear power plants in the world until the generation sources were spun off into an independent company, Constellation Energy Corp., in 2022. (Source:Wikipedia)

Latest EXC News From Around the Web

Below are the latest news stories about EXELON CORP that investors may wish to consider to help them evaluate EXC as an investment opportunity.

Exelon, ComEd, Ameren outlooks lowered by financial firms after regulator rejects grid plansWhile recent Illinois Commerce Commission decisions may hurt the utilities’ credit and financial outlook, consumer advocates said the agency’s actions protect ratepayers. |

ComEd Energy Efficiency Program Provides $8 Million in Incentives to Support 57 Affordable Housing DevelopmentsCHICAGO, December 19, 2023--To support the development of more energy-efficient, affordable-housing units across northern Illinois, while improving the comfort of the residents who reside there, ComEd has provided more than $8 million in incentives via 57 projects, or approximately 3,300 affordable-housing units since 2017. |

Joint Effort by Exelon and Transportation Electrification Advocates Shows the Electric School Bus Transition Will Provide Wide-Ranging Health, Environmental and Societal BenefitsCHICAGO, December 19, 2023--Exelon (Nasdaq, EXC), in partnership with CALSTART, EPRI, Clean Energy Works, World Resources Institute (WRI) and Edison Electric Institute (EEI), today released a white paper examining how the electric school bus transition can deliver a wide range of environmental justice, health and other benefits to customers, communities and the electric grid. In fact, replacing all diesel school buses in the United States with electric school buses would avoid approximately nine |

S&P 500 Gains and Losses Today: Amazon Reportedly Aims To Expand Reach Into SportsThe S&P 500 advanced 0.5% on Monday, Dec. 18, 2023, carrying over good feelings about the economy and talk of interest rate cuts from last week. |

12 High Growth Utility Stocks to BuyIn this article, we will take a look at the 12 high growth utility stocks to buy. To skip our analysis of the recent market trends and activity, you can go directly to see the 5 High Growth Utility Stocks to Buy. The U.S. power and utilities industry maintained its focus on increasing its decarbonization […] |

EXC Price Returns

| 1-mo | -7.38% |

| 3-mo | -13.60% |

| 6-mo | -15.15% |

| 1-year | -13.11% |

| 3-year | 19.44% |

| 5-year | 17.22% |

| YTD | -5.99% |

| 2023 | -13.96% |

| 2022 | 8.14% |

| 2021 | 41.47% |

| 2020 | -3.87% |

| 2019 | 4.28% |

EXC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EXC

Want to do more research on Exelon Corp's stock and its price? Try the links below:Exelon Corp (EXC) Stock Price | Nasdaq

Exelon Corp (EXC) Stock Quote, History and News - Yahoo Finance

Exelon Corp (EXC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...