American Tower REIT (AMT): Price and Financial Metrics

AMT Price/Volume Stats

| Current price | $193.64 | 52-week high | $220.49 |

| Prev. close | $193.62 | 52-week low | $154.58 |

| Day low | $191.63 | Volume | 2,001,100 |

| Day high | $194.25 | Avg. volume | 2,212,937 |

| 50-day MA | $206.78 | Dividend yield | 3.59% |

| 200-day MA | $189.61 | Market Cap | 90.27B |

AMT Stock Price Chart Interactive Chart >

AMT POWR Grades

- Growth is the dimension where AMT ranks best; there it ranks ahead of 87.04% of US stocks.

- AMT's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- AMT ranks lowest in Value; there it ranks in the 6th percentile.

AMT Stock Summary

- With a market capitalization of $100,080,989,183, AMERICAN TOWER CORP has a greater market value than 97.49% of US stocks.

- With a price/earnings ratio of 140.05, AMERICAN TOWER CORP P/E ratio is greater than that of about 95.57% of stocks in our set with positive earnings.

- AMT's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 94.54% of US stocks.

- Stocks that are quantitatively similar to AMT, based on their financial statements, market capitalization, and price volatility, are PLD, DUK, IBN, CB, and SO.

- Visit AMT's SEC page to see the company's official filings. To visit the company's web site, go to www.americantower.com.

AMT Valuation Summary

- In comparison to the median Real Estate stock, AMT's EV/EBIT ratio is 127.7% higher, now standing at 67.4.

- AMT's price/sales ratio has moved up 4.5 over the prior 243 months.

Below are key valuation metrics over time for AMT.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AMT | 2023-12-29 | 9.1 | 22.2 | 140.8 | 67.4 |

| AMT | 2023-12-28 | 9.2 | 22.3 | 141.7 | 67.6 |

| AMT | 2023-12-27 | 9.1 | 22.3 | 141.4 | 67.5 |

| AMT | 2023-12-26 | 9.1 | 22.2 | 141.1 | 67.4 |

| AMT | 2023-12-22 | 9.1 | 22.1 | 140.4 | 67.2 |

| AMT | 2023-12-21 | 9.0 | 22.0 | 139.8 | 67.0 |

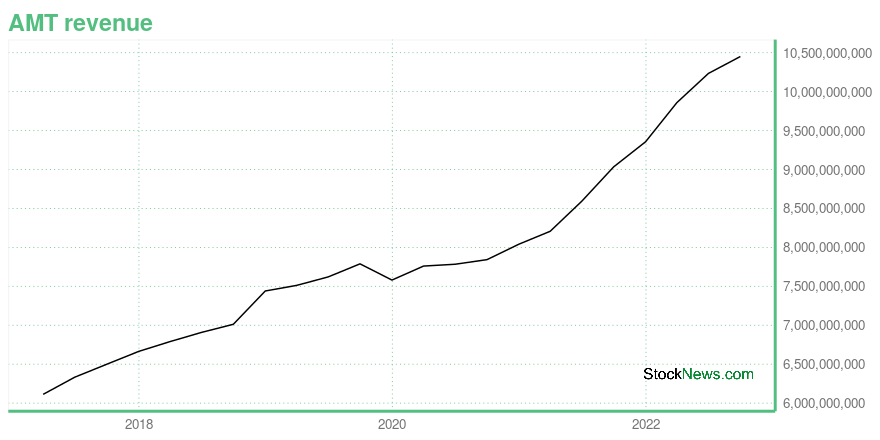

AMT Growth Metrics

- Its year over year price growth rate is now at 0.97%.

- The 4 year cash and equivalents growth rate now stands at 63.16%.

- The 4 year net income to common stockholders growth rate now stands at 114.04%.

The table below shows AMT's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 10,451.3 | 3,190.1 | 2,903 |

| 2022-06-30 | 10,234.1 | 4,354.2 | 2,786.3 |

| 2022-03-31 | 9,858.7 | 4,390.8 | 2,634.4 |

| 2021-12-31 | 9,356.9 | 4,819.9 | 2,567.7 |

| 2021-09-30 | 9,034.2 | 5,273.3 | 2,479.4 |

| 2021-06-30 | 8,592.8 | 4,137.2 | 2,220.8 |

AMT's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AMT has a Quality Grade of C, ranking ahead of 71.02% of graded US stocks.

- AMT's asset turnover comes in at 0.169 -- ranking 107th of 444 Trading stocks.

- CTT, GBL, and RGLD are the stocks whose asset turnover ratios are most correlated with AMT.

The table below shows AMT's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.169 | 0.721 | 0.058 |

| 2021-06-30 | 0.177 | 0.726 | 0.056 |

| 2021-03-31 | 0.185 | 0.726 | 0.054 |

| 2020-12-31 | 0.188 | 0.723 | 0.051 |

| 2020-09-30 | 0.188 | 0.719 | 0.055 |

| 2020-06-30 | 0.189 | 0.717 | 0.057 |

AMT Price Target

For more insight on analysts targets of AMT, see our AMT price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $305.00 | Average Broker Recommendation | 1.59 (Moderate Buy) |

American Tower REIT (AMT) Company Bio

American Tower Corporation (also referred to as American Tower or ATC) is an American real estate investment trust and an owner and operator of wireless and broadcast communications infrastructure in several countries worldwide and is headquartered in Boston, Massachusetts. (Source:Wikipedia)

Latest AMT News From Around the Web

Below are the latest news stories about AMERICAN TOWER CORP that investors may wish to consider to help them evaluate AMT as an investment opportunity.

Resilient Real Estate Stocks: 3 Picks Standing Strong Despite Market TurbulenceTraversing 2023's ebbs and flows, these real estate stocks rise as key selections for investors focused on stability and growth in 2024. |

Here's How Much You'd Have If You Invested $1000 in American Tower a Decade AgoHolding on to popular or trending stocks for the long-term can make your portfolio a winner. |

30 US Cities With the Most Foreclosures in 2023In this article, we will take a look at the 30 US cities with the most foreclosures in 2023. If you want to skip our discussion on the trends in the real estate market, you can go directly to the 5 US Cities With the Most Foreclosures in 2023. Following the expiration of the pandemic-related federal […] |

Why Should You Retain American Tower (AMT) in Your Kitty Now?Solid demand for American Tower's (AMT) wireless communication assets by network carriers and expansion efforts bode well. However, customer concentration and high interest rates are major woes. |

American Tower Corp's Dividend AnalysisAmerican Tower Corp (NYSE:AMT) recently announced a dividend of $1.7 per share, payable on 2024-02-01, with the ex-dividend date set for 2023-12-27. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into American Tower Corp's dividend performance and assess its sustainability. |

AMT Price Returns

| 1-mo | -8.60% |

| 3-mo | 6.19% |

| 6-mo | 5.36% |

| 1-year | -8.34% |

| 3-year | -9.98% |

| 5-year | 26.04% |

| YTD | -10.30% |

| 2023 | 5.37% |

| 2022 | -25.67% |

| 2021 | 32.89% |

| 2020 | -0.48% |

| 2019 | 47.87% |

AMT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AMT

Here are a few links from around the web to help you further your research on American Tower Corp's stock as an investment opportunity:American Tower Corp (AMT) Stock Price | Nasdaq

American Tower Corp (AMT) Stock Quote, History and News - Yahoo Finance

American Tower Corp (AMT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...