Farmland Partners Inc. (FPI): Price and Financial Metrics

FPI Price/Volume Stats

| Current price | $11.23 | 52-week high | $13.27 |

| Prev. close | $10.97 | 52-week low | $9.44 |

| Day low | $10.94 | Volume | 306,600 |

| Day high | $11.34 | Avg. volume | 337,007 |

| 50-day MA | $12.01 | Dividend yield | 2.17% |

| 200-day MA | $11.45 | Market Cap | 541.13M |

FPI Stock Price Chart Interactive Chart >

FPI POWR Grades

- Quality is the dimension where FPI ranks best; there it ranks ahead of 68.62% of US stocks.

- The strongest trend for FPI is in Sentiment, which has been heading down over the past 26 weeks.

- FPI ranks lowest in Sentiment; there it ranks in the 12th percentile.

FPI Stock Summary

- Price to trailing twelve month operating cash flow for FPI is currently 41.53, higher than 91.26% of US stocks with positive operating cash flow.

- For FPI, its debt to operating expenses ratio is greater than that reported by 96.18% of US equities we're observing.

- FPI's price/sales ratio is 10.1; that's higher than the P/S ratio of 89.43% of US stocks.

- Stocks that are quantitatively similar to FPI, based on their financial statements, market capitalization, and price volatility, are NXRT, KW, SEM, SID, and JOE.

- Visit FPI's SEC page to see the company's official filings. To visit the company's web site, go to www.farmlandpartners.com.

FPI Valuation Summary

- FPI's price/sales ratio is 10.4; this is 766.67% higher than that of the median Real Estate stock.

- FPI's price/sales ratio has moved down 11.8 over the prior 118 months.

Below are key valuation metrics over time for FPI.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| FPI | 2023-12-29 | 10.4 | 1.2 | 35.3 | 24.3 |

| FPI | 2023-12-28 | 10.8 | 1.2 | 36.6 | 24.9 |

| FPI | 2023-12-27 | 10.8 | 1.2 | 36.7 | 24.9 |

| FPI | 2023-12-26 | 10.9 | 1.2 | 36.7 | 24.9 |

| FPI | 2023-12-22 | 10.7 | 1.2 | 36.1 | 24.7 |

| FPI | 2023-12-21 | 10.5 | 1.2 | 35.6 | 24.5 |

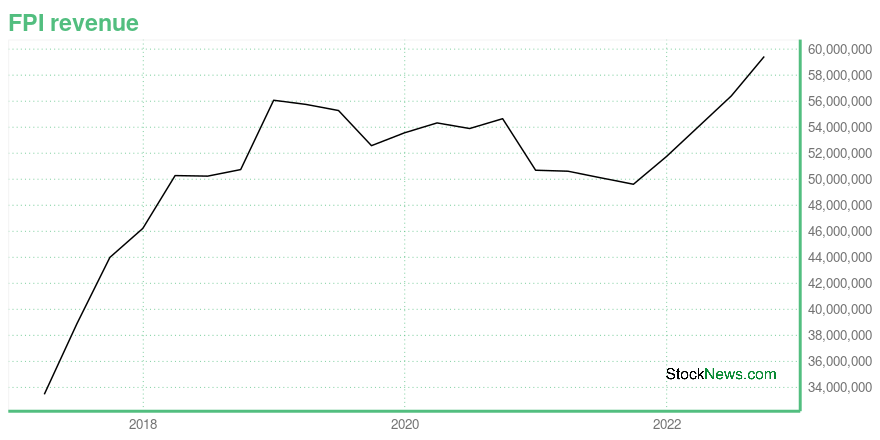

FPI Growth Metrics

- Its 4 year net cashflow from operations growth rate is now at 608.39%.

- Its 3 year revenue growth rate is now at -3.04%.

- Its 2 year net income to common stockholders growth rate is now at -383.9%.

The table below shows FPI's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 59.433 | 15.374 | 8.934 |

| 2022-06-30 | 56.398 | 8.077 | 2.961 |

| 2022-03-31 | 54.054 | 6.759 | -4.903 |

| 2021-12-31 | 51.739 | 7.856 | -5.834 |

| 2021-09-30 | 49.611 | 10.803 | -9.19 |

| 2021-06-30 | 50.11 | 17.961 | -6.12 |

FPI's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- FPI has a Quality Grade of D, ranking ahead of 23.16% of graded US stocks.

- FPI's asset turnover comes in at 0.045 -- ranking 304th of 442 Trading stocks.

- GHL, PSEC, and EQR are the stocks whose asset turnover ratios are most correlated with FPI.

The table below shows FPI's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.045 | 0.810 | 0.012 |

| 2021-06-30 | 0.046 | 0.794 | 0.015 |

| 2021-03-31 | 0.047 | 0.793 | 0.017 |

| 2020-12-31 | 0.046 | 0.788 | 0.016 |

| 2020-09-30 | 0.050 | 0.800 | 0.018 |

| 2020-06-30 | 0.049 | 0.820 | 0.017 |

FPI Price Target

For more insight on analysts targets of FPI, see our FPI price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $13.38 | Average Broker Recommendation | 1.88 (Hold) |

Farmland Partners Inc. (FPI) Company Bio

Farmland Partners owns and operates farmland located in agricultural markets throughout North America. The company was founded in 2013 and is based in Westminster, Colorado.

Latest FPI News From Around the Web

Below are the latest news stories about FARMLAND PARTNERS INC that investors may wish to consider to help them evaluate FPI as an investment opportunity.

5 REITs Paying Special Dividends With Upcoming Ex-Dividend DatesAs much as investors love regular dividend payments, it's even more "special" when one of their stocks pays a special dividend, most often at the end of the calendar year. Because real estate investment trusts (REITs) are required to pay shareholders 90% or more of taxable income each year, special dividend distributions are often required when a REIT disposes of assets with large gains, which increases the taxable income for that year. The special dividend benefits shareholders with a larger an |

Who Owns More Farmland: Bill Gates Or Farmland Partners?Bill Gates is best known for cofounding the software giant Microsoft Corp. With a net worth of somewhere in the range of $118 billion, it's safe to say that he has done well for himself. But there's something else you may not know. Gates has had great success investing outside of the tech industry. For example, he owns quite a bit of farmland in the United States. That's right. One of the top tech titans over the past 40+ years has invested heavily in farmland. How Much Farmland Does Bill Gates |

Colorado Greenhouse and Ranch Go to Market in Ag-Sector Real Estate SaleA&G Real Estate Partners and Murray Wise Associates LLC are now accepting sealed-bid offers for Spring Born's fully automated, approximately 165,000-square-foot hydroponic growing operations and 254-acre ranch near Silt and I-70 in western Colorado. |

Farmland Partners Asset Appreciation Leads to Declaration of $0.21 per Share Special DividendDENVER, December 12, 2023--Farmland Partners Inc. (NYSE: FPI) (the "Company" or "FPI") today announced that its Board of Directors has declared a one-time dividend of $0.21 per share of common stock and Class A Common OP Unit, payable in cash on January 12, 2024 to shareholders of record on December 29, 2023. |

MWA Auctions Illinois Farm for $14.9 MillionCHAMPAIGN, Ill., December 04, 2023--Murray Wise Associates (MWA) announced today that it recently helped a client secure $14.9 million for 860 acres of farmland in Moultrie, Piatt, and Douglas Counties, Illinois. |

FPI Price Returns

| 1-mo | -0.88% |

| 3-mo | 3.69% |

| 6-mo | 2.63% |

| 1-year | -8.69% |

| 3-year | 3.12% |

| 5-year | 131.79% |

| YTD | -10.02% |

| 2023 | 3.99% |

| 2022 | 6.09% |

| 2021 | 39.70% |

| 2020 | 32.09% |

| 2019 | 53.84% |

FPI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FPI

Want to do more research on Farmland Partners Inc's stock and its price? Try the links below:Farmland Partners Inc (FPI) Stock Price | Nasdaq

Farmland Partners Inc (FPI) Stock Quote, History and News - Yahoo Finance

Farmland Partners Inc (FPI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...