CoreCivic, Inc. (CXW): Price and Financial Metrics

CXW Price/Volume Stats

| Current price | $15.00 | 52-week high | $15.13 |

| Prev. close | $14.15 | 52-week low | $7.84 |

| Day low | $13.58 | Volume | 1,523,000 |

| Day high | $15.13 | Avg. volume | 885,856 |

| 50-day MA | $14.25 | Dividend yield | N/A |

| 200-day MA | $11.37 | Market Cap | 1.70B |

CXW Stock Price Chart Interactive Chart >

CXW POWR Grades

- Quality is the dimension where CXW ranks best; there it ranks ahead of 71.4% of US stocks.

- The strongest trend for CXW is in Value, which has been heading down over the past 26 weeks.

- CXW ranks lowest in Momentum; there it ranks in the 42nd percentile.

CXW Stock Summary

- The ratio of debt to operating expenses for CORECIVIC INC is higher than it is for about 79.27% of US stocks.

- With a year-over-year growth in debt of -17.18%, CORECIVIC INC's debt growth rate surpasses merely 18.84% of about US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for CXW comes in at 15.61% -- higher than that of 89.3% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to CORECIVIC INC, a group of peers worth examining would be CLVT, RLJ, EGLE, SUM, and SLCA.

- Visit CXW's SEC page to see the company's official filings. To visit the company's web site, go to www.corecivic.com.

CXW Valuation Summary

- CXW's price/sales ratio is 0.9; this is 25% lower than that of the median Industrials stock.

- Over the past 243 months, CXW's price/sales ratio has gone down 0.1.

Below are key valuation metrics over time for CXW.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CXW | 2023-12-29 | 0.9 | 1.1 | 25.2 | 15.6 |

| CXW | 2023-12-28 | 0.9 | 1.1 | 25.3 | 15.7 |

| CXW | 2023-12-27 | 0.9 | 1.1 | 25.3 | 15.7 |

| CXW | 2023-12-26 | 0.9 | 1.1 | 25.5 | 15.7 |

| CXW | 2023-12-22 | 0.9 | 1.1 | 25.3 | 15.7 |

| CXW | 2023-12-21 | 0.9 | 1.1 | 25.3 | 15.7 |

CXW Growth Metrics

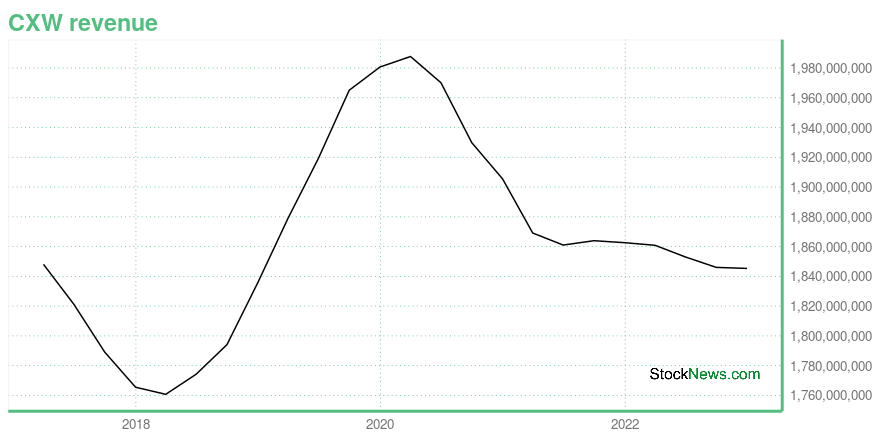

- The 2 year revenue growth rate now stands at -6.38%.

- The 4 year cash and equivalents growth rate now stands at 716.28%.

- Its year over year revenue growth rate is now at -0.44%.

The table below shows CXW's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 1,845.329 | 153.583 | 122.32 |

| 2022-09-30 | 1,846.029 | 97.279 | 125.92 |

| 2022-06-30 | 1,853.012 | 275.219 | 87.614 |

| 2022-03-31 | 1,860.886 | 261.342 | 92.675 |

| 2021-12-31 | 1,862.616 | 263.231 | -51.896 |

| 2021-09-30 | 1,863.96 | 358.158 | -106.736 |

CXW's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CXW has a Quality Grade of C, ranking ahead of 64.67% of graded US stocks.

- CXW's asset turnover comes in at 0.5 -- ranking 41st of 442 Trading stocks.

- PEB, MAIN, and DHC are the stocks whose asset turnover ratios are most correlated with CXW.

The table below shows CXW's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.500 | 0.271 | 0.019 |

| 2021-03-31 | 0.482 | 0.263 | 0.017 |

| 2020-12-31 | 0.480 | 0.262 | 0.026 |

| 2020-09-30 | 0.484 | 0.261 | 0.039 |

| 2020-06-30 | 0.503 | 0.266 | 0.045 |

| 2020-03-31 | 0.518 | 0.276 | 0.052 |

CXW Price Target

For more insight on analysts targets of CXW, see our CXW price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $13.82 | Average Broker Recommendation | 1.75 (Moderate Buy) |

CoreCivic, Inc. (CXW) Company Bio

CoreCivic owns, operates and manages prisons and other correctional facilities and provides residential, community re-entry and prisoner transportation services for governmental agencies. The company was founded in 1983 and is based in Nashville, Tennessee.

Latest CXW News From Around the Web

Below are the latest news stories about CORECIVIC INC that investors may wish to consider to help them evaluate CXW as an investment opportunity.

12 Best Prison and Law Enforcement Stocks to Buy NowIn this article, we discuss the 12 best prison and law enforcement stocks to buy now. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Prison And Law Enforcement Stocks To Buy Now. It is no secret that the United States has an inmate problem. There are more […] |

Getting In Cheap On CoreCivic, Inc. (NYSE:CXW) Might Be DifficultCoreCivic, Inc.'s ( NYSE:CXW ) price-to-earnings (or "P/E") ratio of 24.9x might make it look like a sell right now... |

Insider Sell Alert: EVP Cole Carter Unloads Shares of CoreCivic Inc (CXW)Recent filings with the SEC have revealed that Cole Carter, the Executive Vice President, General Counsel, and Secretary of CoreCivic Inc (NYSE:CXW), has sold a significant number of shares in the company. |

CoreCivic Enters Into New Contracts With the State of Wyoming and Harris County, TX, at the Tallahatchie County Correctional FacilityRecent Contract Wins Total Nearly 1,000 BedsBRENTWOOD, Tenn., Nov. 16, 2023 (GLOBE NEWSWIRE) -- CoreCivic, Inc. (NYSE: CXW) ("CoreCivic") announced today it signed a new management contract with the state of Wyoming for the housing of up to 240 male inmates at the Company's 2,672-bed Tallahatchie County Correctional Facility in Tutwiler, Mississippi. We previously housed inmates for Wyoming under a management contract that had not been utilized since 2019. The term of the new contract runs throu |

Insider Sell Alert: EVP Anthony Grande Sells 10,000 Shares of CoreCivic Inc (CXW)CoreCivic Inc (NYSE:CXW), a diversified government solutions company, has recently witnessed a significant insider sell by one of its top executives. |

CXW Price Returns

| 1-mo | 10.21% |

| 3-mo | 10.05% |

| 6-mo | 42.99% |

| 1-year | 48.81% |

| 3-year | 96.59% |

| 5-year | -15.57% |

| YTD | 3.23% |

| 2023 | 25.69% |

| 2022 | 15.95% |

| 2021 | 52.21% |

| 2020 | -59.85% |

| 2019 | 4.44% |

Continue Researching CXW

Here are a few links from around the web to help you further your research on CoreCivic Inc's stock as an investment opportunity:CoreCivic Inc (CXW) Stock Price | Nasdaq

CoreCivic Inc (CXW) Stock Quote, History and News - Yahoo Finance

CoreCivic Inc (CXW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...