Houston American Energy Corporation (HUSA): Price and Financial Metrics

HUSA Price/Volume Stats

| Current price | $1.44 | 52-week high | $3.82 |

| Prev. close | $1.43 | 52-week low | $1.38 |

| Day low | $1.42 | Volume | 61,400 |

| Day high | $1.46 | Avg. volume | 108,759 |

| 50-day MA | $1.68 | Dividend yield | N/A |

| 200-day MA | $2.00 | Market Cap | 15.70M |

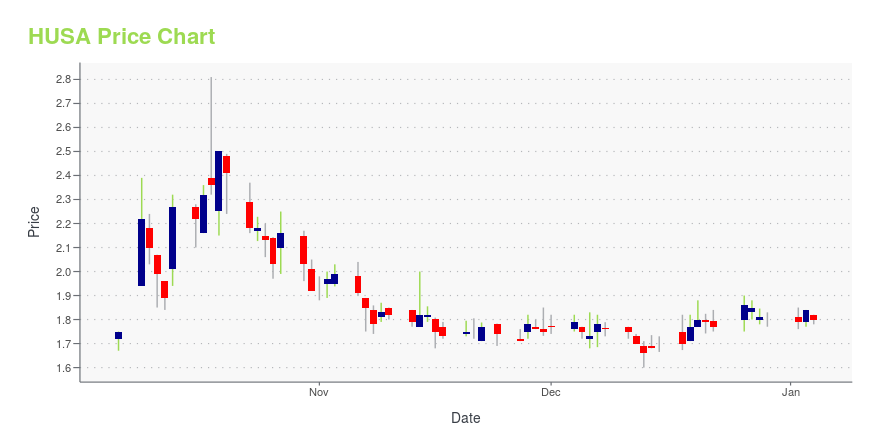

HUSA Stock Price Chart Interactive Chart >

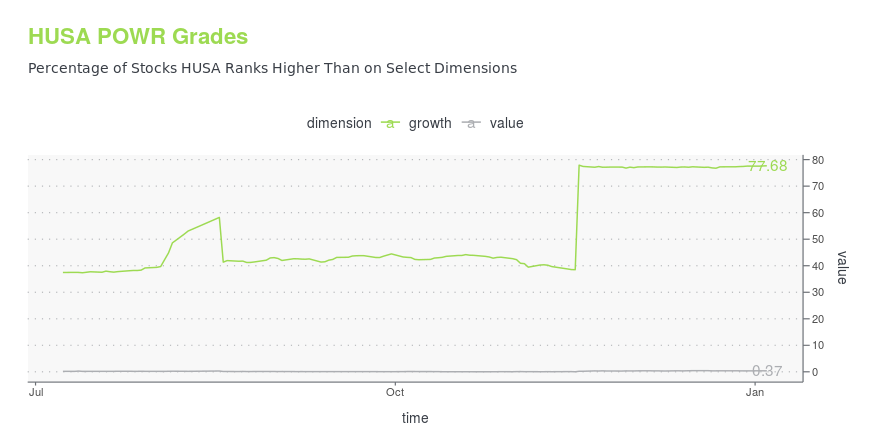

HUSA POWR Grades

- Growth is the dimension where HUSA ranks best; there it ranks ahead of 77.68% of US stocks.

- The strongest trend for HUSA is in Growth, which has been heading up over the past 26 weeks.

- HUSA ranks lowest in Value; there it ranks in the 0th percentile.

HUSA Stock Summary

- Price to trailing twelve month operating cash flow for HUSA is currently 108.24, higher than 97.43% of US stocks with positive operating cash flow.

- With a price/sales ratio of 23.01, HOUSTON AMERICAN ENERGY CORP has a higher such ratio than 94.77% of stocks in our set.

- As for revenue growth, note that HUSA's revenue has grown -49.33% over the past 12 months; that beats the revenue growth of merely 4.72% of US companies in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to HOUSTON AMERICAN ENERGY CORP are MMI, CVGW, TBI, JRSH, and AGTI.

- HUSA's SEC filings can be seen here. And to visit HOUSTON AMERICAN ENERGY CORP's official web site, go to www.houstonamerican.com.

HUSA Valuation Summary

- HUSA's EV/EBIT ratio is -93.3; this is 1224.1% lower than that of the median Energy stock.

- Over the past 243 months, HUSA's price/sales ratio has gone down 52.4.

Below are key valuation metrics over time for HUSA.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| HUSA | 2023-12-28 | 22.6 | 1.5 | -119.4 | -93.3 |

| HUSA | 2023-12-27 | 23.2 | 1.5 | -122.4 | -96.4 |

| HUSA | 2023-12-26 | 23.3 | 1.5 | -123.0 | -97.0 |

| HUSA | 2023-12-22 | 22.1 | 1.5 | -117.0 | -90.9 |

| HUSA | 2023-12-21 | 22.4 | 1.5 | -118.2 | -92.1 |

| HUSA | 2023-12-20 | 22.5 | 1.5 | -118.8 | -92.7 |

HUSA Growth Metrics

- Its year over year net cashflow from operations growth rate is now at 51.58%.

- The 5 year price growth rate now stands at -63.24%.

- Its 3 year net cashflow from operations growth rate is now at -253.22%.

The table below shows HUSA's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 1.721401 | -0.234775 | -0.90931 |

| 2022-06-30 | 1.58452 | -0.182293 | -0.868905 |

| 2022-03-31 | 1.42553 | -0.412307 | -0.918614 |

| 2021-12-31 | 1.330198 | -0.680691 | -1.058731 |

| 2021-09-30 | 1.123718 | -0.677543 | -3.350813 |

| 2021-06-30 | 0.959768 | -0.825107 | -3.329303 |

HUSA's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- HUSA has a Quality Grade of D, ranking ahead of 16.63% of graded US stocks.

- HUSA's asset turnover comes in at 0.1 -- ranking 128th of 137 Petroleum and Natural Gas stocks.

- TUSK, VTNR, and VNOM are the stocks whose asset turnover ratios are most correlated with HUSA.

The table below shows HUSA's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.100 | 0.497 | -0.500 |

| 2021-03-31 | 0.080 | 0.334 | -0.531 |

| 2020-12-31 | 0.062 | 0.269 | -0.590 |

| 2020-09-30 | 0.070 | 0.136 | -0.385 |

| 2020-06-30 | 0.088 | 0.180 | -0.386 |

| 2020-03-31 | 0.110 | 0.193 | -0.400 |

Houston American Energy Corporation (HUSA) Company Bio

Houston American Energy Corp., an independent energy company, acquires, explores for, develops, and produces natural gas, crude oil, and condensate. Its oil and gas properties are located primarily in the Texas Permian Basin, the onshore Texas and Louisiana Gulf Coast region, and in the South American country of Colombia. As of December 31, 2019, the company owned interests in 4 gross wells. Houston American Energy Corp. was incorporated in 2001 and is based in Houston, Texas.

Latest HUSA News From Around the Web

Below are the latest news stories about HOUSTON AMERICAN ENERGY CORP that investors may wish to consider to help them evaluate HUSA as an investment opportunity.

Houston American Energy Increases Interest in Colombian CPO-11 ProjectHouston, TX, Dec. 09, 2022 (GLOBE NEWSWIRE) -- Houston American Energy Corp. (NYSE American: HUSA) today announced the acquisition of an additional interest in Hupecol Meta, LLC. Hupecol Meta owns the 639,405 gross acre CPO-11 block in the Llanos Basin in Colombia, comprised of the 69,128 acre Venus Exploration area, operated by Hupecol, and 570,277 acres which was 50% farmed out to Parex Resources by Hupecol. In total, the CPO-11 block covers almost 1000 square miles with multiple identified le |

HUSA Price Returns

| 1-mo | -14.79% |

| 3-mo | -20.88% |

| 6-mo | -36.73% |

| 1-year | -60.76% |

| 3-year | -43.75% |

| 5-year | -42.40% |

| YTD | -19.55% |

| 2023 | -47.97% |

| 2022 | 140.56% |

| 2021 | -18.29% |

| 2020 | -4.11% |

| 2019 | -23.16% |

Continue Researching HUSA

Want to see what other sources are saying about Houston American Energy Corp's financials and stock price? Try the links below:Houston American Energy Corp (HUSA) Stock Price | Nasdaq

Houston American Energy Corp (HUSA) Stock Quote, History and News - Yahoo Finance

Houston American Energy Corp (HUSA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...