Williams Cos. (WMB): Price and Financial Metrics

WMB Price/Volume Stats

| Current price | $34.04 | 52-week high | $37.45 |

| Prev. close | $34.29 | 52-week low | $27.80 |

| Day low | $33.89 | Volume | 7,093,400 |

| Day high | $34.28 | Avg. volume | 6,463,682 |

| 50-day MA | $35.04 | Dividend yield | 5.2% |

| 200-day MA | $33.54 | Market Cap | 41.41B |

WMB Stock Price Chart Interactive Chart >

WMB POWR Grades

- Momentum is the dimension where WMB ranks best; there it ranks ahead of 82.9% of US stocks.

- The strongest trend for WMB is in Growth, which has been heading down over the past 26 weeks.

- WMB ranks lowest in Value; there it ranks in the 15th percentile.

WMB Stock Summary

- With a market capitalization of $44,171,066,780, WILLIAMS COMPANIES INC has a greater market value than 94.14% of US stocks.

- WILLIAMS COMPANIES INC's stock had its IPO on January 1, 1986, making it an older stock than 92.92% of US equities in our set.

- For WMB, its debt to operating expenses ratio is greater than that reported by 91.34% of US equities we're observing.

- Stocks that are quantitatively similar to WMB, based on their financial statements, market capitalization, and price volatility, are KMI, MPLX, SPG, CCI, and DLR.

- Visit WMB's SEC page to see the company's official filings. To visit the company's web site, go to co.williams.com.

WMB Valuation Summary

- WMB's price/sales ratio is 3.8; this is 181.48% higher than that of the median Energy stock.

- WMB's price/sales ratio has moved up 3.4 over the prior 243 months.

Below are key valuation metrics over time for WMB.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| WMB | 2023-12-28 | 3.8 | 3.6 | 15.7 | 13.6 |

| WMB | 2023-12-27 | 3.9 | 3.6 | 15.7 | 13.6 |

| WMB | 2023-12-26 | 3.9 | 3.6 | 15.8 | 13.7 |

| WMB | 2023-12-22 | 3.9 | 3.6 | 15.8 | 13.7 |

| WMB | 2023-12-21 | 3.8 | 3.6 | 15.7 | 13.6 |

| WMB | 2023-12-20 | 3.8 | 3.6 | 15.6 | 13.6 |

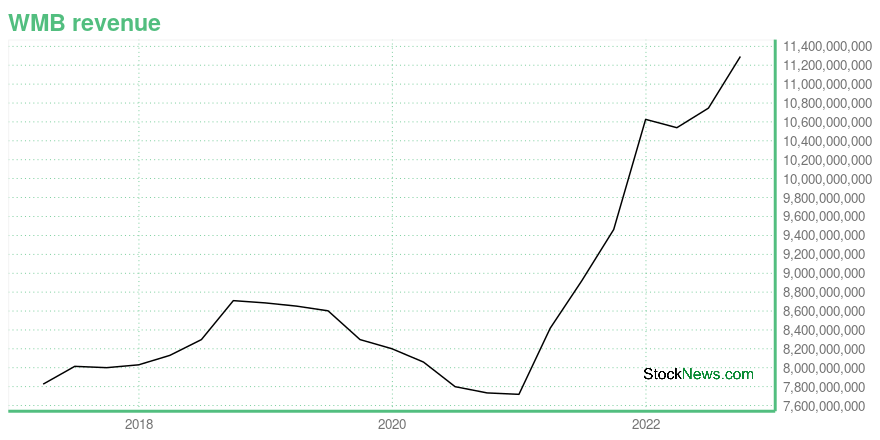

WMB Growth Metrics

- The year over year cash and equivalents growth rate now stands at -46.36%.

- The 3 year cash and equivalents growth rate now stands at 1304.65%.

- Its year over year net income to common stockholders growth rate is now at 27.54%.

The table below shows WMB's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 11,292 | 4,809 | 1,999 |

| 2022-06-30 | 10,746 | 4,153 | 1,564 |

| 2022-03-31 | 10,539 | 4,112 | 1,468 |

| 2021-12-31 | 10,627 | 3,945 | 1,514 |

| 2021-09-30 | 9,462 | 3,920 | 1,008 |

| 2021-06-30 | 8,920 | 3,538 | 1,152 |

WMB's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- WMB has a Quality Grade of C, ranking ahead of 66.92% of graded US stocks.

- WMB's asset turnover comes in at 0.209 -- ranking 58th of 105 Utilities stocks.

- KMI, YORW, and AY are the stocks whose asset turnover ratios are most correlated with WMB.

The table below shows WMB's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.209 | 0.499 | 0.046 |

| 2021-06-30 | 0.199 | 0.552 | 0.049 |

| 2021-03-31 | 0.188 | 0.584 | 0.049 |

| 2020-12-31 | 0.173 | 0.619 | 0.026 |

| 2020-09-30 | 0.172 | 0.611 | 0.027 |

| 2020-06-30 | 0.171 | 0.604 | 0.025 |

WMB Price Target

For more insight on analysts targets of WMB, see our WMB price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $29.05 | Average Broker Recommendation | 1.46 (Moderate Buy) |

Williams Cos. (WMB) Company Bio

The Williams Companies, Inc., is an American energy company based in Tulsa, Oklahoma. Its core business is natural gas processing and transportation, with additional petroleum and electricity generation assets. A Fortune 500 company, its common stock is a component of the S&P 500. (Source:Wikipedia)

Latest WMB News From Around the Web

Below are the latest news stories about WILLIAMS COMPANIES INC that investors may wish to consider to help them evaluate WMB as an investment opportunity.

Here's Why Hold Strategy is Apt for ConocoPhillips (COP) NowFavorable oil price is aiding ConocoPhillips' (COP) bottom line. However, increasing production and operating expenses are hurting it. |

3 Energy Stocks With Solid Earnings Estimate Revisions for '24A favorable business environment in the energy space has heightened the need to bet on The Williams Companies (WMB), Western Midstream (WES) and Murphy USA (MUSA). |

Eni (E) Strengthens Position as U.K.'s Leading CCS OperatorEni (E) accelerates the U.K.'s carbon capture journey through the expansion of HyNet, while also revealing the CCUS Vision and outlining plans for a second CCUS facility, the Bacton Energy Hub. |

Williams (WMB) to Buy Gas Storage Portfolio for $1.95 BillionWilliams (WMB) is set to acquire a $1.95B natural gas assets portfolio in the Gulf Coast, establishing a strong hold over the rapidly evolving energy landscape. |

This 5.1%-Yielding Dividend Stock Makes a $2 Billion Acquisition to Add More Fuel to Its Dividend Growth EngineWilliams is using its financial flexibility to enhance its growth prospects. |

WMB Price Returns

| 1-mo | -3.90% |

| 3-mo | -1.18% |

| 6-mo | -1.28% |

| 1-year | 13.06% |

| 3-year | 79.02% |

| 5-year | 72.75% |

| YTD | -2.27% |

| 2023 | 11.85% |

| 2022 | 32.83% |

| 2021 | 38.36% |

| 2020 | -8.20% |

| 2019 | 14.18% |

WMB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WMB

Want to see what other sources are saying about Williams Companies Inc's financials and stock price? Try the links below:Williams Companies Inc (WMB) Stock Price | Nasdaq

Williams Companies Inc (WMB) Stock Quote, History and News - Yahoo Finance

Williams Companies Inc (WMB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...