CNX Resources Corporation (CNX): Price and Financial Metrics

CNX Price/Volume Stats

| Current price | $20.20 | 52-week high | $23.68 |

| Prev. close | $20.15 | 52-week low | $14.36 |

| Day low | $20.10 | Volume | 1,753,000 |

| Day high | $20.35 | Avg. volume | 2,942,563 |

| 50-day MA | $20.19 | Dividend yield | N/A |

| 200-day MA | $19.75 | Market Cap | 3.21B |

CNX Stock Price Chart Interactive Chart >

CNX POWR Grades

- Quality is the dimension where CNX ranks best; there it ranks ahead of 68.68% of US stocks.

- CNX's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- CNX ranks lowest in Growth; there it ranks in the 0th percentile.

CNX Stock Summary

- CNX's current price/earnings ratio is 1.38, which is higher than only 0.68% of US stocks with positive earnings.

- Over the past twelve months, CNX has reported earnings growth of -790.38%, putting it ahead of merely 1.79% of US stocks in our set.

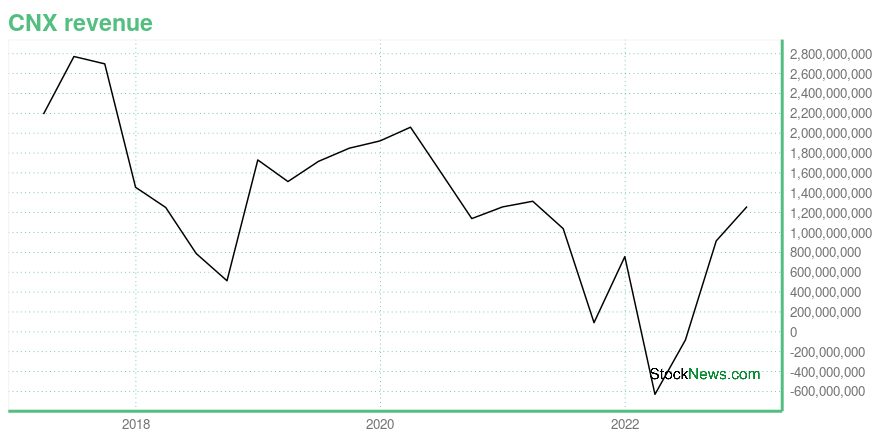

- As for revenue growth, note that CNX's revenue has grown 348.14% over the past 12 months; that beats the revenue growth of 98.36% of US companies in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to CNX RESOURCES CORP are ASRT, TNP, AHCO, BBGI, and GLNG.

- Visit CNX's SEC page to see the company's official filings. To visit the company's web site, go to www.cnx.com.

CNX Valuation Summary

- In comparison to the median Energy stock, CNX's price/sales ratio is 50% lower, now standing at 0.8.

- CNX's price/sales ratio has moved down 0.3 over the prior 243 months.

Below are key valuation metrics over time for CNX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CNX | 2023-12-28 | 0.8 | 0.8 | 1.4 | 2.2 |

| CNX | 2023-12-27 | 0.8 | 0.8 | 1.4 | 2.2 |

| CNX | 2023-12-26 | 0.8 | 0.8 | 1.4 | 2.2 |

| CNX | 2023-12-22 | 0.8 | 0.8 | 1.4 | 2.2 |

| CNX | 2023-12-21 | 0.8 | 0.8 | 1.4 | 2.2 |

| CNX | 2023-12-20 | 0.8 | 0.8 | 1.3 | 2.2 |

CNX Growth Metrics

- Its year over year revenue growth rate is now at -147.87%.

- The 3 year price growth rate now stands at 136.05%.

- Its 4 year net cashflow from operations growth rate is now at 72.04%.

The table below shows CNX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 1,261.211 | 1,235.014 | -142.077 |

| 2022-09-30 | 915.572 | 1,045.816 | -686.343 |

| 2022-06-30 | -81.75 | 995.844 | -1,132.192 |

| 2022-03-31 | -629.378 | 1,043.104 | -1,519.608 |

| 2021-12-31 | 756.792 | 926.357 | -498.643 |

| 2021-09-30 | 92.305 | 834.009 | -933.197 |

CNX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CNX has a Quality Grade of C, ranking ahead of 61.1% of graded US stocks.

- CNX's asset turnover comes in at 0.011 -- ranking 135th of 137 Petroleum and Natural Gas stocks.

- EQT, SNMP, and LPI are the stocks whose asset turnover ratios are most correlated with CNX.

The table below shows CNX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.011 | -4.210 | -0.113 |

| 2021-06-30 | 0.129 | 0.545 | -0.016 |

| 2021-03-31 | 0.162 | 0.657 | 0.012 |

| 2020-12-31 | 0.152 | 0.641 | -0.048 |

| 2020-09-30 | 0.134 | 0.587 | -0.103 |

| 2020-06-30 | 0.182 | 0.699 | -0.061 |

CNX Price Target

For more insight on analysts targets of CNX, see our CNX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $17.08 | Average Broker Recommendation | 1.73 (Moderate Buy) |

CNX Resources Corporation (CNX) Company Bio

CNX Resources Corp. is an independent natural gas exploration, development and production companies, with operations centered in the major shale formations of the Appalachian basin. The company deploys an organic growth strategy focused on responsibly developing its resource base. The firm operates through the Marcellus Shale, and Coalbed Methane segments. CNX Resources was founded in 1864 and is headquartered in Canonsburg, PA.

Latest CNX News From Around the Web

Below are the latest news stories about CNX RESOURCES CORP that investors may wish to consider to help them evaluate CNX as an investment opportunity.

11 Stocks Insiders and Billionaires Are Crazy AboutIn this article, we will take a detailed look at the 11 Stocks Insiders and Billionaires Are Crazy About. For a quick overview of such stocks, read our article 5 Stocks Insiders and Billionaires Are Crazy About. In his famous book titled One Up on Wall Street, Peter Lynch talks about how average investors miss out on opportunities by […] |

CNX Resources pulls out of Adams Fork ammonia projectCNX Resources said on Friday it had pulled out of the Adams Fork ammonia project and is evaluating several alternative sites in southern West Virginia for clean hydrogen projects. The natural gas producer cited delays and increasing uncertainty over implementation tax credit provisions of the Inflation Reduction Act (IRA) and an inability to reach final commercial terms with project developers, for ending its participation in the project. Adams Fork was an anchor project in the Appalachian Regional Clean Hydrogen Hub (ARCH2) and its construction was expected to begin in 2024. |

CNX Provides Update on Hydrogen Project Location and 45V Hydrogen Production Tax Credit RulesCiting delays and increasing uncertainty over implementation rules guiding the use of the 45V hydrogen production tax credit provisions of the Inflation Reduction Act (IRA) and an inability to reach final commercial terms with project developers, CNX Resources Corporation (NYSE: CNX) today announced it has ended coordination with the Adams Fork project and is evaluating several viable alternative sites in southern West Virginia for clean hydrogen projects. |

Do Options Traders Know Something About CNX Resources (CNX) Stock We Don't?Investors need to pay close attention to CNX Resources (CNX) stock based on the movements in the options market lately. |

CNX Announces Executive Leadership AdditionCNX Resources Corporation (NYSE: CNX) ("CNX" or "the company") today announced that Timothy S. Bedard will join the company this month as Executive Vice President, General Counsel, and Corporate Secretary. |

CNX Price Returns

| 1-mo | -0.64% |

| 3-mo | -3.40% |

| 6-mo | -6.39% |

| 1-year | 26.96% |

| 3-year | 55.15% |

| 5-year | 106.54% |

| YTD | 1.00% |

| 2023 | 18.76% |

| 2022 | 22.47% |

| 2021 | 27.31% |

| 2020 | 22.03% |

| 2019 | -22.50% |

Continue Researching CNX

Here are a few links from around the web to help you further your research on CNX Resources Corp's stock as an investment opportunity:CNX Resources Corp (CNX) Stock Price | Nasdaq

CNX Resources Corp (CNX) Stock Quote, History and News - Yahoo Finance

CNX Resources Corp (CNX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...