Amplify Energy Corp. (AMPY): Price and Financial Metrics

AMPY Price/Volume Stats

| Current price | $6.11 | 52-week high | $10.23 |

| Prev. close | $5.90 | 52-week low | $5.47 |

| Day low | $5.85 | Volume | 286,300 |

| Day high | $6.11 | Avg. volume | 439,715 |

| 50-day MA | $5.98 | Dividend yield | N/A |

| 200-day MA | $6.64 | Market Cap | 238.88M |

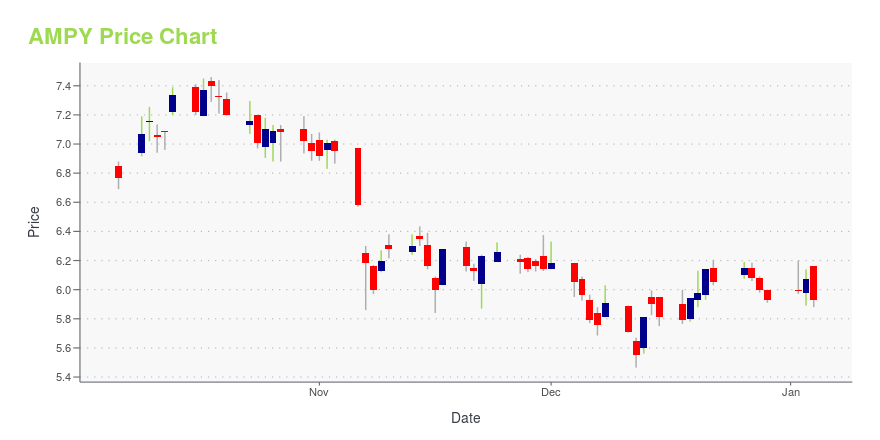

AMPY Stock Price Chart Interactive Chart >

AMPY POWR Grades

- Value is the dimension where AMPY ranks best; there it ranks ahead of 99.3% of US stocks.

- AMPY's strongest trending metric is Sentiment; it's been moving down over the last 26 weeks.

- AMPY ranks lowest in Growth; there it ranks in the 1st percentile.

AMPY Stock Summary

- With a price/earnings ratio of 0.66, AMPLIFY ENERGY CORP P/E ratio is greater than that of about only 0.34% of stocks in our set with positive earnings.

- Price to trailing twelve month operating cash flow for AMPY is currently 1.85, higher than only 5.25% of US stocks with positive operating cash flow.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for AMPY comes in at 35.82% -- higher than that of 94.94% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to AMPLIFY ENERGY CORP are CEIX, ML, DAC, MIGI, and ERF.

- AMPY's SEC filings can be seen here. And to visit AMPLIFY ENERGY CORP's official web site, go to www.amplifyenergy.com.

AMPY Valuation Summary

- In comparison to the median Energy stock, AMPY's EV/EBIT ratio is 67.47% lower, now standing at 2.7.

- AMPY's EV/EBIT ratio has moved NA NA over the prior 87 months.

Below are key valuation metrics over time for AMPY.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AMPY | 2023-12-28 | 0.7 | 0.7 | 0.6 | 2.7 |

| AMPY | 2023-12-27 | 0.7 | 0.7 | 0.7 | 2.7 |

| AMPY | 2023-12-26 | 0.7 | 0.7 | 0.7 | 2.7 |

| AMPY | 2023-12-22 | 0.7 | 0.7 | 0.7 | 2.7 |

| AMPY | 2023-12-21 | 0.7 | 0.7 | 0.7 | 2.7 |

| AMPY | 2023-12-20 | 0.7 | 0.7 | 0.6 | 2.7 |

AMPY's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AMPY has a Quality Grade of B, ranking ahead of 82.89% of graded US stocks.

- AMPY's asset turnover comes in at 0.284 -- ranking 92nd of 137 Petroleum and Natural Gas stocks.

- 500 - Internal server error

The table below shows AMPY's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2019-06-30 | 0.284 | 0.749 | -0.006 |

| 2019-03-31 | 0.304 | 0.733 | 0.055 |

| 2018-12-31 | 0.339 | 0.739 | 0.092 |

| 2018-09-30 | 0.302 | 0.675 | -0.164 |

| 2018-06-30 | 0.283 | 0.640 | -0.160 |

| 2018-03-31 | 0.289 | 0.656 | -0.127 |

Amplify Energy Corp. (AMPY) Company Bio

Amplify Energy Corp. engages in the acquisition, development, exploitation, and production of oil and natural gas properties in the United States. The company's properties consist of operated and non-operated working interests in producing and undeveloped leasehold acreage, as well as working interests in identified producing wells located in Oklahoma, the Rockies, federal waters offshore Southern California, East Texas/North Louisiana, and South Texas. As of December 31, 2019, it had total estimated proved reserves of approximately 163.0 million barrels of oil equivalent; and 2,643 gross wells. Amplify Energy Corp. was founded in 2011 and is based in Houston, Texas.

Latest AMPY News From Around the Web

Below are the latest news stories about AMPLIFY ENERGY CORP that investors may wish to consider to help them evaluate AMPY as an investment opportunity.

Amplify Energy Corp.'s (NYSE:AMPY) largest shareholders are individual investors with 58% ownership, institutions own 41%Key Insights Significant control over Amplify Energy by individual investors implies that the general public has more... |

Should Value Investors Buy Amplify Energy (AMPY) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

US officials want ships to anchor farther from California undersea pipelines, citing 2021 oil spillFederal officials on Tuesday recommended increasing the distance from undersea pipelines that vessels are allowed to anchor in Southern California, citing a 2021 oil spill they said was caused by ships whose anchors were dragged across a pipeline after a storm. The leak occurred in a ruptured pipeline owned by Houston-based Amplify Energy. National Transportation Safety Board officials concluded damage to the pipeline had been caused months earlier when a cold front brought high winds and seas to the Southern California coast, causing two container vessels that were anchored offshore to drag their anchors across the area where the pipeline was located. |

Top Stocks for December 2023The top stocks have the performance of well-run companies, a steady performance, and the potential for future growth. In addition, top stocks turn over more shares and thus have plenty of liquidity to reduce your transaction costs. Investors often compare top stocks against the Russell 3000 Index, a broad measure of the U.S. stock market comprising 3,000 large publicly traded companies or 96% of the investable U.S. equity market. |

Amplify Energy Insiders Added US$616.8k Of Stock To Their HoldingsGenerally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

AMPY Price Returns

| 1-mo | 3.21% |

| 3-mo | -2.71% |

| 6-mo | -15.02% |

| 1-year | -25.67% |

| 3-year | 115.14% |

| 5-year | -24.16% |

| YTD | 3.04% |

| 2023 | -32.54% |

| 2022 | 182.64% |

| 2021 | 137.40% |

| 2020 | -77.85% |

| 2019 | -5.47% |

Continue Researching AMPY

Want to see what other sources are saying about Amplify Energy Corp's financials and stock price? Try the links below:Amplify Energy Corp (AMPY) Stock Price | Nasdaq

Amplify Energy Corp (AMPY) Stock Quote, History and News - Yahoo Finance

Amplify Energy Corp (AMPY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...