Marathon Oil Corporation (MRO): Price and Financial Metrics

MRO Price/Volume Stats

| Current price | $22.70 | 52-week high | $29.56 |

| Prev. close | $22.69 | 52-week low | $20.57 |

| Day low | $22.35 | Volume | 13,237,700 |

| Day high | $22.89 | Avg. volume | 9,302,974 |

| 50-day MA | $23.72 | Dividend yield | 1.97% |

| 200-day MA | $24.77 | Market Cap | 13.29B |

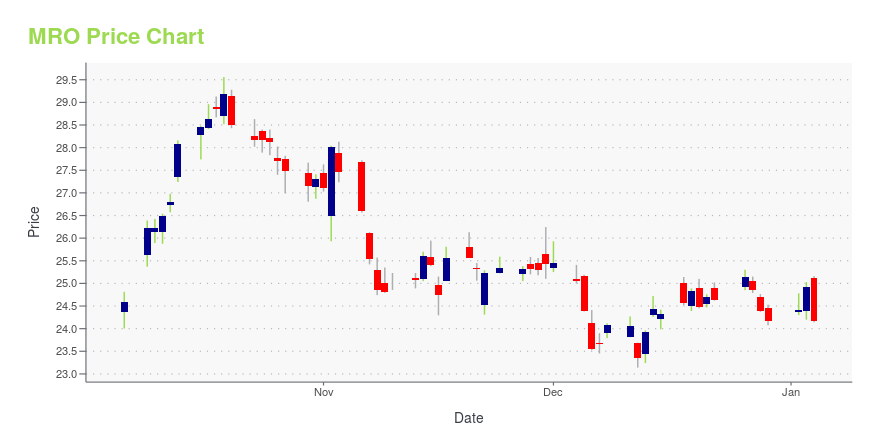

MRO Stock Price Chart Interactive Chart >

MRO POWR Grades

- Quality is the dimension where MRO ranks best; there it ranks ahead of 88.74% of US stocks.

- MRO's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- MRO's current lowest rank is in the Stability metric (where it is better than 16.38% of US stocks).

MRO Stock Summary

- MRO's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- Price to trailing twelve month operating cash flow for MRO is currently 3.53, higher than only 12.23% of US stocks with positive operating cash flow.

- Of note is the ratio of MARATHON OIL CORP's sales and general administrative expense to its total operating expenses; only 3.77% of US stocks have a lower such ratio.

- If you're looking for stocks that are quantitatively similar to MARATHON OIL CORP, a group of peers worth examining would be CTRA, MTDR, SNDR, CPE, and MGY.

- Visit MRO's SEC page to see the company's official filings. To visit the company's web site, go to www.marathonoil.com.

MRO Valuation Summary

- In comparison to the median Energy stock, MRO's EV/EBIT ratio is 3.61% lower, now standing at 8.

- MRO's price/sales ratio has moved up 1.8 over the prior 243 months.

Below are key valuation metrics over time for MRO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MRO | 2023-12-28 | 2.1 | 1.3 | 8.5 | 8.0 |

| MRO | 2023-12-27 | 2.2 | 1.3 | 8.6 | 8.1 |

| MRO | 2023-12-26 | 2.2 | 1.3 | 8.8 | 8.1 |

| MRO | 2023-12-22 | 2.1 | 1.3 | 8.6 | 8.0 |

| MRO | 2023-12-21 | 2.1 | 1.3 | 8.6 | 8.0 |

| MRO | 2023-12-20 | 2.1 | 1.3 | 8.5 | 8.0 |

MRO Growth Metrics

- The 3 year revenue growth rate now stands at 1.7%.

- Its 2 year revenue growth rate is now at 17.73%.

- Its 3 year net cashflow from operations growth rate is now at 18.84%.

The table below shows MRO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 8,036 | 5,428 | 3,612 |

| 2022-09-30 | 8,103 | 5,447 | 3,736 |

| 2022-06-30 | 7,309 | 4,707 | 3,103 |

| 2022-03-31 | 6,149 | 3,684 | 2,153 |

| 2021-12-31 | 5,467 | 3,239 | 946 |

| 2021-09-30 | 4,497 | 2,511 | -41 |

MRO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MRO has a Quality Grade of B, ranking ahead of 82.94% of graded US stocks.

- MRO's asset turnover comes in at 0.209 -- ranking 105th of 136 Petroleum and Natural Gas stocks.

- CVX, XOM, and BDCO are the stocks whose asset turnover ratios are most correlated with MRO.

The table below shows MRO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.209 | 0.690 | -0.015 |

| 2021-03-31 | 0.159 | 0.617 | -0.051 |

| 2020-12-31 | 0.165 | 0.627 | -0.055 |

| 2020-09-30 | 0.180 | 0.665 | -0.038 |

| 2020-06-30 | 0.206 | 0.717 | -0.017 |

| 2020-03-31 | 0.256 | 0.755 | 0.025 |

MRO Price Target

For more insight on analysts targets of MRO, see our MRO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $15.96 | Average Broker Recommendation | 1.62 (Moderate Buy) |

Marathon Oil Corporation (MRO) Company Bio

Marathon Oil Corp is an exploration and production company. It focuses on producing crude oil and condensate, natural gas liquids and natural gas as well as bitumen from oil sands deposits. In 2011, Marathon Oil spun off from Marathon Petroleum Corporation becoming an independent exploration and production company. The company has operations in four of the oil rich basins in the United States – the Eagle Ford Basin, the Bakken Basin, the STACK/SCOOP basin, and the Permian Basin. Marathon Oil employs just under 1,700 individuals and is headquartered in Houston, Texas. Lee Tillman serves as President and Chief Executive Officer.

Latest MRO News From Around the Web

Below are the latest news stories about MARATHON OIL CORP that investors may wish to consider to help them evaluate MRO as an investment opportunity.

In 2024 The US Will Sell CITGO Petroleum And Pay Out Two Canadian JuniorsVenezuela owns Citgo Petroleum. This is a big company – the 7th largest refiner in North America. By July, a US court may make Venezuela liquidate to pay its debts, and some miners may get unexpected windfalls. |

Marathon Oil (NYSE:MRO) Shareholders Will Want The ROCE Trajectory To ContinueTo find a multi-bagger stock, what are the underlying trends we should look for in a business? One common approach is... |

12 Best Energy Dividend Stocks To Buy NowIn this article, we discuss 12 best energy dividend stocks to buy now. You can skip our detailed analysis of the energy sector and the performance of dividend stocks over the years, and go directly to read 5 Best Energy Dividend Stocks To Buy Now. As 2023 draws to a close, experts are evaluating how […] |

Marathon Oil (MRO) Down 9.2% Since Last Earnings Report: Can It Rebound?Marathon Oil (MRO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Do Options Traders Know Something About Marathon Oil (MRO) Stock We Don't?Investors need to pay close attention to Marathon Oil (MRO) stock based on the movements in the options market lately. |

MRO Price Returns

| 1-mo | -2.20% |

| 3-mo | -9.13% |

| 6-mo | -14.73% |

| 1-year | -13.26% |

| 3-year | 163.93% |

| 5-year | 60.55% |

| YTD | -6.04% |

| 2023 | -9.29% |

| 2022 | 66.91% |

| 2021 | 149.77% |

| 2020 | -50.38% |

| 2019 | -3.93% |

MRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRO

Want to do more research on Marathon Oil Corp's stock and its price? Try the links below:Marathon Oil Corp (MRO) Stock Price | Nasdaq

Marathon Oil Corp (MRO) Stock Quote, History and News - Yahoo Finance

Marathon Oil Corp (MRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...