Pioneer Natural Resources Co. (PXD): Price and Financial Metrics

PXD Price/Volume Stats

| Current price | $231.76 | 52-week high | $257.76 |

| Prev. close | $227.76 | 52-week low | $177.26 |

| Day low | $227.65 | Volume | 1,511,300 |

| Day high | $232.45 | Avg. volume | 2,056,904 |

| 50-day MA | $226.27 | Dividend yield | 2.21% |

| 200-day MA | $224.59 | Market Cap | 54.07B |

PXD Stock Price Chart Interactive Chart >

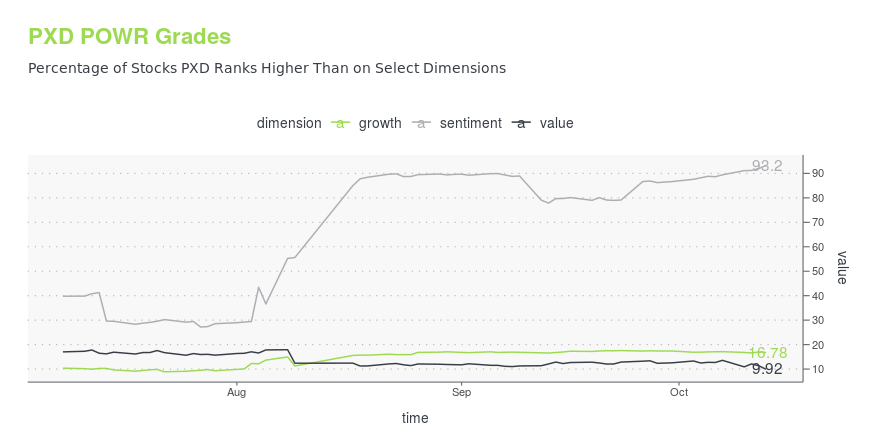

PXD POWR Grades

- PXD scores best on the Sentiment dimension, with a Sentiment rank ahead of 93.2% of US stocks.

- PXD's strongest trending metric is Growth; it's been moving up over the last 97 days.

- PXD ranks lowest in Value; there it ranks in the 9th percentile.

PXD Stock Summary

- PIONEER NATURAL RESOURCES CO's market capitalization of $54,213,985,375 is ahead of 95.31% of US-listed equities.

- PXD's went public 36.06 years ago, making it older than 90.79% of listed US stocks we're tracking.

- Of note is the ratio of PIONEER NATURAL RESOURCES CO's sales and general administrative expense to its total operating expenses; only 3.57% of US stocks have a lower such ratio.

- Stocks with similar financial metrics, market capitalization, and price volatility to PIONEER NATURAL RESOURCES CO are EOG, ET, PSA, E, and CNQ.

- Visit PXD's SEC page to see the company's official filings. To visit the company's web site, go to www.pxd.com.

PXD Valuation Summary

- PXD's price/earnings ratio is 10.3; this is 20.47% higher than that of the median Energy stock.

- PXD's price/earnings ratio has moved down 0.1 over the prior 243 months.

Below are key valuation metrics over time for PXD.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PXD | 2023-12-28 | 2.7 | 2.3 | 10.3 | 8.7 |

| PXD | 2023-12-27 | 2.8 | 2.3 | 10.5 | 8.8 |

| PXD | 2023-12-26 | 2.8 | 2.4 | 10.5 | 8.9 |

| PXD | 2023-12-22 | 2.8 | 2.3 | 10.4 | 8.8 |

| PXD | 2023-12-21 | 2.8 | 2.3 | 10.5 | 8.8 |

| PXD | 2023-12-20 | 2.8 | 2.3 | 10.4 | 8.8 |

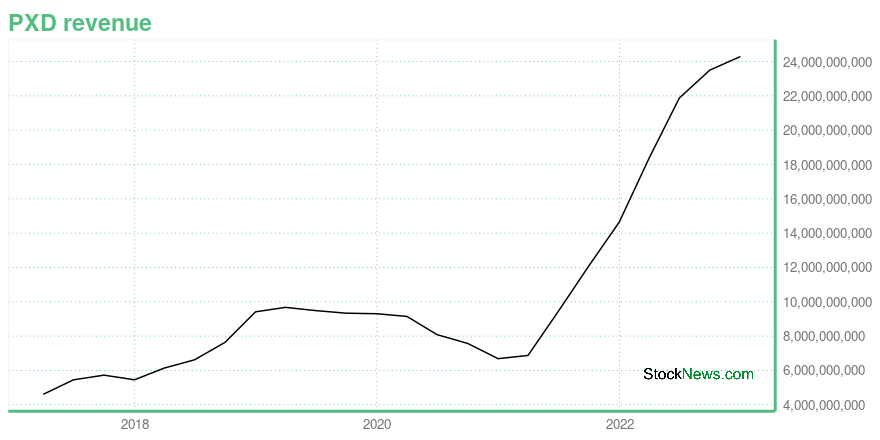

PXD Growth Metrics

- The 2 year revenue growth rate now stands at 100.82%.

- The year over year net income to common stockholders growth rate now stands at 850.81%.

- Its 2 year net cashflow from operations growth rate is now at 147.78%.

The table below shows PXD's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 24,294 | 11,348 | 7,845 |

| 2022-09-30 | 23,502 | 10,974 | 7,127 |

| 2022-06-30 | 21,872 | 10,021 | 6,188 |

| 2022-03-31 | 18,371 | 8,266 | 4,197 |

| 2021-12-31 | 14,643 | 6,059 | 2,118 |

| 2021-09-30 | 12,081 | 4,372 | 1,325 |

PXD's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PXD has a Quality Grade of C, ranking ahead of 45.45% of graded US stocks.

- PXD's asset turnover comes in at 0.358 -- ranking 74th of 137 Petroleum and Natural Gas stocks.

- RNGR, CLMT, and SNMP are the stocks whose asset turnover ratios are most correlated with PXD.

The table below shows PXD's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.358 | 0.342 | 0.017 |

| 2021-03-31 | 0.318 | 0.287 | -0.025 |

| 2020-12-31 | 0.356 | 0.318 | -0.007 |

| 2020-09-30 | 0.404 | 0.358 | 0.021 |

| 2020-06-30 | 0.436 | 0.372 | 0.039 |

| 2020-03-31 | 0.492 | 0.379 | 0.057 |

PXD Price Target

For more insight on analysts targets of PXD, see our PXD price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $206.91 | Average Broker Recommendation | 1.49 (Moderate Buy) |

Pioneer Natural Resources Co. (PXD) Company Bio

Pioneer Natural Resources Company is an American company engaged in hydrocarbon exploration headquartered in Irving, Texas. It operates in the Cline Shale, which is part of the Spraberry Trend of the Permian Basin, where the company is the largest acreage holder. (Source:Wikipedia)

Latest PXD News From Around the Web

Below are the latest news stories about PIONEER NATURAL RESOURCES CO that investors may wish to consider to help them evaluate PXD as an investment opportunity.

Pioneer Natural Resources Company (PXD) Is a Trending Stock: Facts to Know Before Betting on ItRecently, Zacks.com users have been paying close attention to Pioneer Natural Resources (PXD). This makes it worthwhile to examine what the stock has in store. |

Pioneer Natural Resources Company (PXD) Rose with Oil PricesChartwell Investment Partners, LLC, an affiliate of Carillon Tower Advisers, Inc., released the “Carillon Chartwell Mid Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. Equities rose early in the quarter on the back of a broader appetite for risk, however, they eventually fell when interest rates crossed 4%. […] |

Does The Energy Sector Have The Energy To Offer Good Investments?While some companies have struggled in recent years, there are opportunities for growth and attractive valuations. |

M&A market: What will it look like in 2024?The top three U.S. M&A deals of 2023 by deal value include, Exxon (XOM) acquiring Pioneer (PXD), Chevron's (CVX) acquisition of Hess (HES), and Pfizer (PFE) acquiring Seagen (SGEN), according to Dealogic. The KPMG 2024 M&A Outlook Survey found that 7 in 10 dealmakers are working currently on deals and 2 out of 3 said 2024 will be more active. KPMG Head of Deal Advisory & Strategy Carole Streicher joins Yahoo Finance Live to discuss the survey's findings and what 2024 will look like for mergers and acquisitions. "If you unpack what we think '24 is going to look like, based on the survey respondents, it's quite interesting compared to our private equity versus corporate," Streicher notes. "If you look at the first half of the year, our corporates are saying that they're going to be more a... |

Here’s What Boosted Pioneer Natural Resources Company (PXD) Share Price in Q3TimesSquare Capital Management, an equity investment management company, released its “U.S. Mid Cap Growth Strategy” third-quarter investor letter. A copy of the same can be downloaded here. In the third quarter, the strategy outperformed the Russell Midcap Growth Index and returned -4.11% (net) while the index return was -5.22%. The third quarter saw a decline in […] |

PXD Price Returns

| 1-mo | 3.87% |

| 3-mo | 0.59% |

| 6-mo | -0.01% |

| 1-year | 11.11% |

| 3-year | 115.70% |

| 5-year | 118.71% |

| YTD | 3.06% |

| 2023 | 5.68% |

| 2022 | 39.10% |

| 2021 | 66.33% |

| 2020 | -22.85% |

| 2019 | 16.08% |

PXD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PXD

Want to do more research on Pioneer Natural Resources Co's stock and its price? Try the links below:Pioneer Natural Resources Co (PXD) Stock Price | Nasdaq

Pioneer Natural Resources Co (PXD) Stock Quote, History and News - Yahoo Finance

Pioneer Natural Resources Co (PXD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...