APA Corp. (APA): Price and Financial Metrics

APA Price/Volume Stats

| Current price | $30.47 | 52-week high | $46.15 |

| Prev. close | $30.55 | 52-week low | $29.47 |

| Day low | $30.30 | Volume | 6,213,700 |

| Day high | $30.81 | Avg. volume | 5,808,126 |

| 50-day MA | $33.64 | Dividend yield | 3.35% |

| 200-day MA | $37.07 | Market Cap | 9.35B |

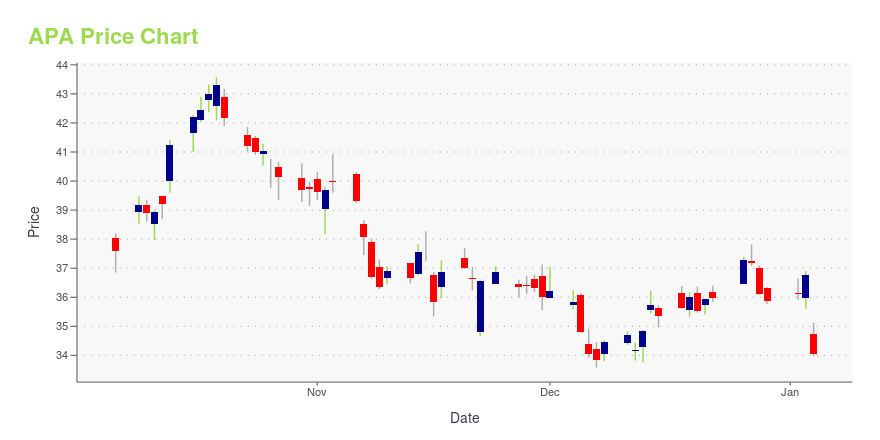

APA Stock Price Chart Interactive Chart >

APA POWR Grades

- Quality is the dimension where APA ranks best; there it ranks ahead of 93.17% of US stocks.

- APA's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- APA's current lowest rank is in the Sentiment metric (where it is better than 21.42% of US stocks).

APA Stock Summary

- APA CORP's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than 95.26% of US listed stocks.

- APA's went public 38.03 years ago, making it older than 92.92% of listed US stocks we're tracking.

- Equity multiplier, or assets relative to shareholders' equity, comes in at 20.03 for APA CORP; that's greater than it is for 97.77% of US stocks.

- If you're looking for stocks that are quantitatively similar to APA CORP, a group of peers worth examining would be DVA, LDI, QRTEA, HA, and BKU.

- APA's SEC filings can be seen here. And to visit APA CORP's official web site, go to www.apachecorp.com.

APA Valuation Summary

- In comparison to the median Energy stock, APA's price/earnings ratio is 14.62% lower, now standing at 7.3.

- Over the past 243 months, APA's price/sales ratio has gone down 2.1.

Below are key valuation metrics over time for APA.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| APA | 2023-12-28 | 1.3 | 10.3 | 7.3 | 5.3 |

| APA | 2023-12-27 | 1.3 | 10.6 | 7.5 | 5.5 |

| APA | 2023-12-26 | 1.3 | 10.6 | 7.5 | 5.5 |

| APA | 2023-12-22 | 1.3 | 10.2 | 7.2 | 5.3 |

| APA | 2023-12-21 | 1.3 | 10.2 | 7.2 | 5.3 |

| APA | 2023-12-20 | 1.3 | 10.1 | 7.1 | 5.3 |

APA Growth Metrics

- The 4 year net cashflow from operations growth rate now stands at 6.21%.

- Its 5 year net cashflow from operations growth rate is now at 6.21%.

- Its 2 year revenue growth rate is now at 62.69%.

The table below shows APA's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 12,132 | 4,943 | 3,674 |

| 2022-09-30 | 12,155 | 4,615 | 3,613 |

| 2022-06-30 | 10,934 | 4,282 | 3,078 |

| 2022-03-31 | 9,664 | 3,716 | 2,468 |

| 2021-12-31 | 7,928 | 3,496 | 973 |

| 2021-09-30 | 6,814 | 2,909 | 601 |

APA's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- APA has a Quality Grade of A, ranking ahead of 96.94% of graded US stocks.

- APA's asset turnover comes in at 0.483 -- ranking 49th of 136 Petroleum and Natural Gas stocks.

- SD, CPE, and DWSN are the stocks whose asset turnover ratios are most correlated with APA.

The table below shows APA's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.483 | 0.335 | 0.076 |

| 2021-03-31 | 0.396 | 0.213 | 0.027 |

| 2020-12-31 | 0.331 | 0.088 | -0.223 |

| 2020-09-30 | 0.324 | -0.017 | -0.343 |

| 2020-06-30 | 0.300 | -0.025 | -0.318 |

| 2020-03-31 | 0.318 | 0.095 | -0.277 |

APA Price Target

For more insight on analysts targets of APA, see our APA price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $27.59 | Average Broker Recommendation | 1.74 (Moderate Buy) |

APA Corp. (APA) Company Bio

PA Corporation is the holding company for Apache Corporation, an American company engaged in hydrocarbon exploration.[2] It is organized in Delaware and headquartered in Houston. The company is ranked 431st on the Fortune 500. (Source:Wikipedia)

Latest APA News From Around the Web

Below are the latest news stories about APA CORP that investors may wish to consider to help them evaluate APA as an investment opportunity.

APA (NASDAQ:APA) Is Paying Out A Dividend Of $0.25APA Corporation's ( NASDAQ:APA ) investors are due to receive a payment of $0.25 per share on 22nd of February. This... |

APA Corporation Declares Cash Dividend on Common SharesHOUSTON, Dec. 12, 2023 (GLOBE NEWSWIRE) -- The board of directors of APA Corporation (Nasdaq: APA) has declared a regular cash dividend on the company's common shares. The dividend on common shares is payable Feb. 22, 2024, to stockholders of record on Jan. 22, 2024, at a rate of 25 cents per share on the corporation’s common stock. About APAAPA Corporation owns consolidated subsidiaries that explore for and produce oil and natural gas in the United States, Egypt and the United Kingdom and that |

Apache Corporation Partners with Borderlands Research Institute on Well Pad Restoration Research Project in the Permian BasinHOUSTON, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Apache Corporation (Nasdaq: APA) today announced a partnership with the Borderlands Research Institute (BRI) at Sul Ross State University in Alpine, Texas, to launch a well pad restoration research project. Through this multiyear partnership, researchers at BRI and Texas Native Seeds, a project of the Caesar Kleberg Wildlife Research Institute at Texas A&M Kingsville, will investigate methods to improve habitat restoration efforts in the Permian Basin w |

An Intrinsic Calculation For APA Corporation (NASDAQ:APA) Suggests It's 23% UndervaluedKey Insights APA's estimated fair value is US$48.09 based on 2 Stage Free Cash Flow to Equity APA is estimated to be... |

Why Are Oil Stocks Down Today?Oil stocks are in the red across the board after OPEC+ opted to push back a key meeting. |

APA Price Returns

| 1-mo | -6.82% |

| 3-mo | -16.79% |

| 6-mo | -31.15% |

| 1-year | -25.68% |

| 3-year | 80.28% |

| 5-year | 12.65% |

| YTD | -14.38% |

| 2023 | -21.24% |

| 2022 | 76.44% |

| 2021 | 90.76% |

| 2020 | -43.71% |

| 2019 | 1.12% |

APA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching APA

Want to see what other sources are saying about Apache Corp's financials and stock price? Try the links below:Apache Corp (APA) Stock Price | Nasdaq

Apache Corp (APA) Stock Quote, History and News - Yahoo Finance

Apache Corp (APA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...