VAALCO Energy, Inc. (EGY): Price and Financial Metrics

EGY Price/Volume Stats

| Current price | $4.23 | 52-week high | $5.22 |

| Prev. close | $4.17 | 52-week low | $3.51 |

| Day low | $4.15 | Volume | 935,800 |

| Day high | $4.23 | Avg. volume | 675,074 |

| 50-day MA | $4.45 | Dividend yield | 6.11% |

| 200-day MA | $4.28 | Market Cap | 444.82M |

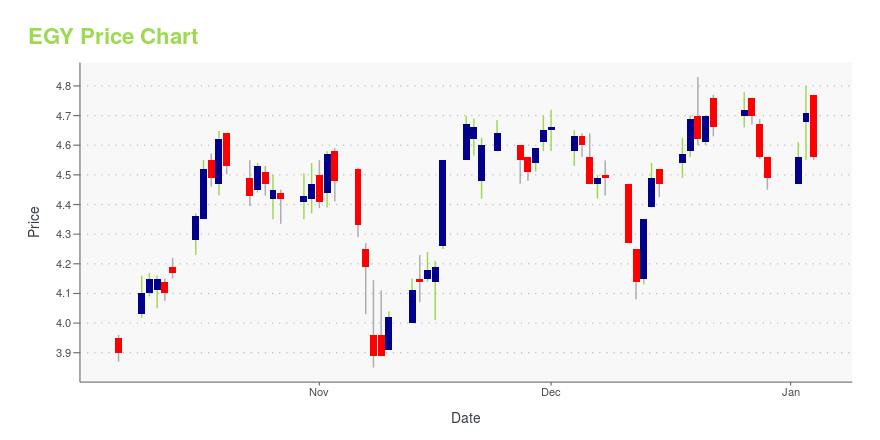

EGY Stock Price Chart Interactive Chart >

EGY POWR Grades

- EGY scores best on the Quality dimension, with a Quality rank ahead of 80.5% of US stocks.

- The strongest trend for EGY is in Quality, which has been heading up over the past 26 weeks.

- EGY ranks lowest in Stability; there it ranks in the 15th percentile.

EGY Stock Summary

- The price/operating cash flow metric for VAALCO ENERGY INC is higher than only 8.95% of stocks in our set with a positive cash flow.

- Of note is the ratio of VAALCO ENERGY INC's sales and general administrative expense to its total operating expenses; only 3.8% of US stocks have a lower such ratio.

- With a year-over-year growth in debt of 2,614.9%, VAALCO ENERGY INC's debt growth rate surpasses 99.55% of about US stocks.

- If you're looking for stocks that are quantitatively similar to VAALCO ENERGY INC, a group of peers worth examining would be VRCA, HCKT, VLRS, MBIN, and TSBK.

- Visit EGY's SEC page to see the company's official filings. To visit the company's web site, go to www.vaalco.com.

EGY Valuation Summary

- EGY's price/sales ratio is 1.2; this is 11.11% lower than that of the median Energy stock.

- EGY's price/earnings ratio has moved up 8.7 over the prior 243 months.

Below are key valuation metrics over time for EGY.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| EGY | 2023-12-28 | 1.2 | 1.1 | 14.1 | 4.6 |

| EGY | 2023-12-27 | 1.2 | 1.1 | 14.5 | 4.8 |

| EGY | 2023-12-26 | 1.2 | 1.1 | 14.5 | 4.8 |

| EGY | 2023-12-22 | 1.2 | 1.1 | 14.4 | 4.7 |

| EGY | 2023-12-21 | 1.2 | 1.1 | 14.5 | 4.8 |

| EGY | 2023-12-20 | 1.2 | 1.1 | 14.2 | 4.7 |

EGY Growth Metrics

- Its 2 year cash and equivalents growth rate is now at -60.37%.

- Its 4 year cash and equivalents growth rate is now at 142.66%.

- Its 4 year net income to common stockholders growth rate is now at -298.78%.

The table below shows EGY's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 314.117 | 133.095 | 68.498 |

| 2022-06-30 | 291.919 | 105.964 | 93.351 |

| 2022-03-31 | 227.957 | 47.617 | 84.131 |

| 2021-12-31 | 199.075 | 50.117 | 81.836 |

| 2021-09-30 | 155.253 | 55.11 | 43.879 |

| 2021-06-30 | 117.61 | 20.371 | 19.776 |

EGY's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- EGY has a Quality Grade of B, ranking ahead of 87.46% of graded US stocks.

- EGY's asset turnover comes in at 0.74 -- ranking 23rd of 136 Petroleum and Natural Gas stocks.

- KEGX, XPRO, and NCSM are the stocks whose asset turnover ratios are most correlated with EGY.

The table below shows EGY's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.740 | 0.592 | 0.246 |

| 2021-03-31 | 0.589 | 0.507 | 0.140 |

| 2020-12-31 | 0.453 | 0.445 | -0.284 |

| 2020-09-30 | 0.462 | 0.469 | -0.121 |

| 2020-06-30 | 0.412 | 0.453 | -0.120 |

| 2020-03-31 | 0.420 | 0.528 | -0.023 |

EGY Price Target

For more insight on analysts targets of EGY, see our EGY price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $4.25 | Average Broker Recommendation | 1.25 (Strong Buy) |

VAALCO Energy, Inc. (EGY) Company Bio

VAALCO Energy, Inc., an independent energy company, acquires, explores for, develops, and produces crude oil and natural gas. The company holds Etame production sharing contract related to the Etame Marin block located offshore in the Republic of Gabon, West Africa. It also owns interests in an undeveloped block offshore Equatorial Guinea, West Africa. VAALCO Energy, Inc. was founded in 1985 and is headquartered in Houston, Texas.

Latest EGY News From Around the Web

Below are the latest news stories about VAALCO ENERGY INC that investors may wish to consider to help them evaluate EGY as an investment opportunity.

Investors in VAALCO Energy (NYSE:EGY) have seen strong returns of 263% over the past five yearsThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a... |

13 Cheap Penny Stocks to Buy According to Hedge FundsIn this article, we will take a detailed look at the 13 Cheap Penny Stocks to Buy According to Hedge Funds. To see more such stocks, click 5 Cheap Penny Stocks to Buy According to Hedge Funds. Stocks are roaring as investors celebrate the Fed’s latest announcement saying it’s ready to begin cutting interest rates next year. […] |

Are VAALCO Energy, Inc. (NYSE:EGY) Investors Paying Above The Intrinsic Value?Key Insights VAALCO Energy's estimated fair value is US$3.44 based on Dividend Discount Model VAALCO Energy's US$4.63... |

VAALCO Energy, Inc. (NYSE:EGY) Looks Interesting, And It's About To Pay A DividendIt looks like VAALCO Energy, Inc. ( NYSE:EGY ) is about to go ex-dividend in the next 4 days. The ex-dividend date is... |

3 Undervalued Growth Stocks to Double Your Wealth in 2024While a certain confidence in betting with the masses exist, investors wanting to up the ante may consider undervalued growth stocks. |

EGY Price Returns

| 1-mo | -4.30% |

| 3-mo | 6.66% |

| 6-mo | -13.74% |

| 1-year | -1.00% |

| 3-year | 54.51% |

| 5-year | 163.73% |

| YTD | -5.79% |

| 2023 | 4.39% |

| 2022 | 45.37% |

| 2021 | 81.35% |

| 2020 | -20.27% |

| 2019 | 51.02% |

EGY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EGY

Want to do more research on Vaalco Energy Inc's stock and its price? Try the links below:Vaalco Energy Inc (EGY) Stock Price | Nasdaq

Vaalco Energy Inc (EGY) Stock Quote, History and News - Yahoo Finance

Vaalco Energy Inc (EGY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...