Ramaco Resources, Inc. (METC): Price and Financial Metrics

METC Price/Volume Stats

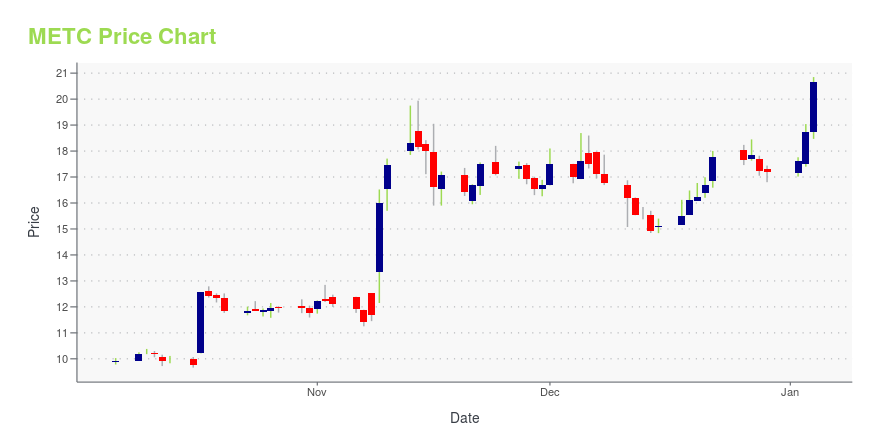

| Current price | $16.61 | 52-week high | $22.70 |

| Prev. close | $16.34 | 52-week low | $7.26 |

| Day low | $15.77 | Volume | 726,900 |

| Day high | $16.94 | Avg. volume | 1,171,922 |

| 50-day MA | $17.96 | Dividend yield | 2.93% |

| 200-day MA | $11.84 | Market Cap | 875.11M |

METC Stock Price Chart Interactive Chart >

METC POWR Grades

- Momentum is the dimension where METC ranks best; there it ranks ahead of 95.48% of US stocks.

- METC's strongest trending metric is Growth; it's been moving up over the last 135 days.

- METC's current lowest rank is in the Stability metric (where it is better than 6.23% of US stocks).

METC Stock Summary

- With a year-over-year growth in debt of -12.33%, RAMACO RESOURCES INC's debt growth rate surpasses merely 24.13% of about US stocks.

- Revenue growth over the past 12 months for RAMACO RESOURCES INC comes in at 20.86%, a number that bests 77.41% of the US stocks we're tracking.

- The volatility of RAMACO RESOURCES INC's share price is greater than that of 86.47% US stocks with at least 200 days of trading history.

- Stocks that are quantitatively similar to METC, based on their financial statements, market capitalization, and price volatility, are BRY, MP, EPSN, RNGR, and POWW.

- Visit METC's SEC page to see the company's official filings. To visit the company's web site, go to www.ramacoresources.com.

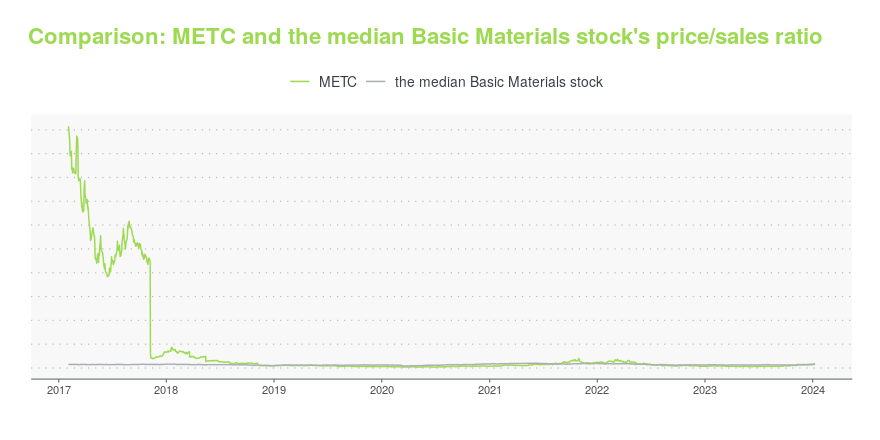

METC Valuation Summary

- METC's price/sales ratio is 1.4; this is 6.67% lower than that of the median Basic Materials stock.

- Over the past 84 months, METC's EV/EBIT ratio has gone up 81.1.

Below are key valuation metrics over time for METC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| METC | 2023-12-29 | 1.4 | 2.6 | 13.6 | 10.6 |

| METC | 2023-12-28 | 1.4 | 2.6 | 13.6 | 10.7 |

| METC | 2023-12-27 | 1.5 | 2.7 | 14.1 | 11.0 |

| METC | 2023-12-26 | 1.5 | 2.6 | 14.0 | 10.9 |

| METC | 2023-12-22 | 1.5 | 2.7 | 14.1 | 11.0 |

| METC | 2023-12-21 | 1.4 | 2.5 | 13.2 | 10.4 |

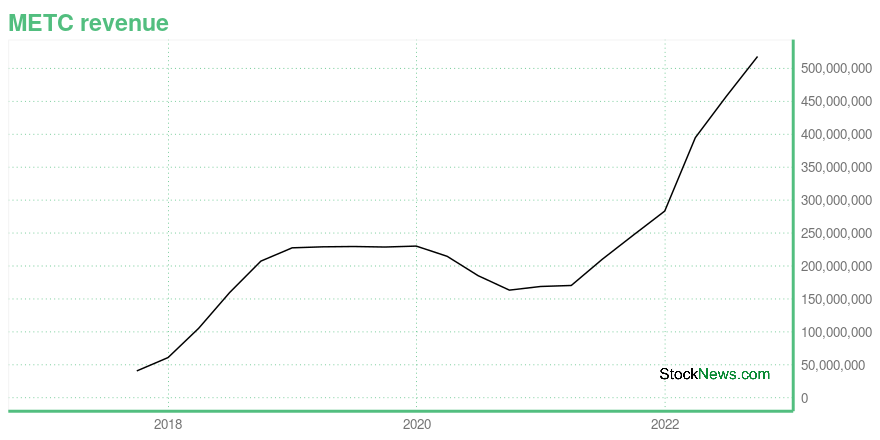

METC Growth Metrics

- The 4 year cash and equivalents growth rate now stands at 194.77%.

- Its 2 year cash and equivalents growth rate is now at 366.56%.

- The 5 year revenue growth rate now stands at 4016.22%.

The table below shows METC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 517.967 | 174.382 | 120.295 |

| 2022-06-30 | 457.419 | 129.719 | 100.425 |

| 2022-03-31 | 394.821 | 130.21 | 77.087 |

| 2021-12-31 | 283.394 | 53.34 | 39.759 |

| 2021-09-30 | 247.035 | 50.122 | 16.375 |

| 2021-06-30 | 210.117 | 39.401 | 4.564 |

METC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- METC has a Quality Grade of B, ranking ahead of 75.22% of graded US stocks.

- METC's asset turnover comes in at 0.973 -- ranking 2nd of 9 Coal stocks.

- BTU, ARLP, and ARCH are the stocks whose asset turnover ratios are most correlated with METC.

The table below shows METC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.973 | 0.221 | 0.073 |

| 2021-06-30 | 0.877 | 0.175 | 0.004 |

| 2021-03-31 | 0.715 | 0.145 | -0.024 |

| 2020-12-31 | 0.706 | 0.139 | -0.032 |

| 2020-09-30 | 0.684 | 0.204 | 0.015 |

| 2020-06-30 | 0.787 | 0.248 | 0.075 |

METC Price Target

For more insight on analysts targets of METC, see our METC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $4.99 | Average Broker Recommendation | 1.7 (Moderate Buy) |

Ramaco Resources, Inc. (METC) Company Bio

Ramaco Resources, Inc. owns and operates coal mining properties. The company was founded in 2016 and is headquartered in Lexington, Kentucky.

Latest METC News From Around the Web

Below are the latest news stories about RAMACO RESOURCES INC that investors may wish to consider to help them evaluate METC as an investment opportunity.

Estimating The Intrinsic Value Of Ramaco Resources, Inc. (NASDAQ:METC)Key Insights Using the 2 Stage Free Cash Flow to Equity, Ramaco Resources fair value estimate is US$21.84 With US$17.78... |

Here's Why Ramaco Resources (METC) Looks Ripe for Bottom FishingRamaco Resources (METC) appears to have found support after losing some value lately, as indicated by the formation of a hammer chart. In addition to this technical chart pattern, strong agreement among Wall Street analysts in revising earnings estimates higher enhances the stock's potential for a turnaround in the near term. |

Zacks Industry Outlook Highlights Arch Resources, Warrior Met Coal and Ramco ResourcesArch Resources, Warrior Met Coal and Ramco Resources are part of the Zacks Industry Outlook article. |

3 Coal Stocks to Watch From the Challenging IndustryDespite the expected drop in U.S. coal production volumes, high-quality coal producers like Arch Resources (ARCH), Warrior Met Coal (HCC) and Ramaco Resources (METC) are likely to remain competitive with improving export volumes. |

Ramaco Resources (NASDAQ:METC) Will Pay A Larger Dividend Than Last Year At $0.1375Ramaco Resources, Inc. ( NASDAQ:METC ) will increase its dividend from last year's comparable payment on the 15th of... |

METC Price Returns

| 1-mo | -25.85% |

| 3-mo | -4.20% |

| 6-mo | 107.85% |

| 1-year | 113.73% |

| 3-year | 501.46% |

| 5-year | 273.01% |

| YTD | -3.32% |

| 2023 | 151.75% |

| 2022 | -32.95% |

| 2021 | 372.23% |

| 2020 | -19.55% |

| 2019 | -27.68% |

METC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching METC

Want to see what other sources are saying about Ramaco Resources Inc's financials and stock price? Try the links below:Ramaco Resources Inc (METC) Stock Price | Nasdaq

Ramaco Resources Inc (METC) Stock Quote, History and News - Yahoo Finance

Ramaco Resources Inc (METC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...