Eagle Bulk Shipping Inc. (EGLE): Price and Financial Metrics

EGLE Price/Volume Stats

| Current price | $57.39 | 52-week high | $67.09 |

| Prev. close | $57.48 | 52-week low | $39.15 |

| Day low | $56.94 | Volume | 99,000 |

| Day high | $57.62 | Avg. volume | 167,963 |

| 50-day MA | $52.79 | Dividend yield | 0.72% |

| 200-day MA | $45.70 | Market Cap | 570.00M |

EGLE Stock Price Chart Interactive Chart >

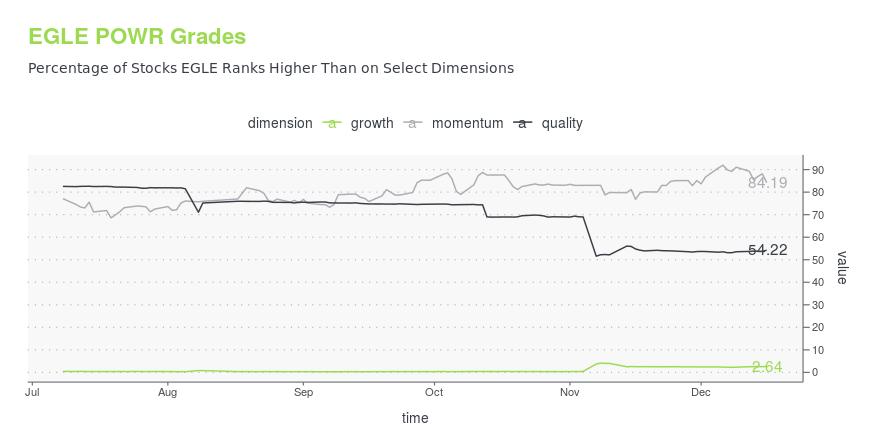

EGLE POWR Grades

- Momentum is the dimension where EGLE ranks best; there it ranks ahead of 84.19% of US stocks.

- EGLE's strongest trending metric is Quality; it's been moving down over the last 161 days.

- EGLE's current lowest rank is in the Growth metric (where it is better than 2.64% of US stocks).

EGLE Stock Summary

- The ratio of debt to operating expenses for EAGLE BULK SHIPPING INC is higher than it is for about 84.38% of US stocks.

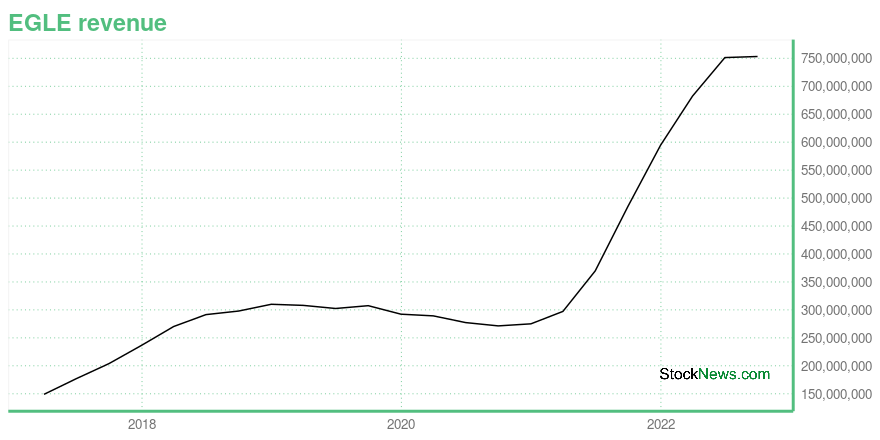

- As for revenue growth, note that EGLE's revenue has grown -41.49% over the past 12 months; that beats the revenue growth of merely 6.23% of US companies in our set.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for EGLE comes in at 20.16% -- higher than that of 91.68% of stocks in our set.

- Stocks that are quantitatively similar to EGLE, based on their financial statements, market capitalization, and price volatility, are ESEA, BRY, CXW, SUM, and RLJ.

- EGLE's SEC filings can be seen here. And to visit EAGLE BULK SHIPPING INC's official web site, go to www.eagleships.com.

EGLE Valuation Summary

- EGLE's price/sales ratio is 1.2; this is 0% higher than that of the median Industrials stock.

- Over the past 225 months, EGLE's price/sales ratio has gone NA NA.

Below are key valuation metrics over time for EGLE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| EGLE | 2023-12-29 | 1.2 | 0.9 | 14.0 | 15.9 |

| EGLE | 2023-12-28 | 1.2 | 0.9 | 13.9 | 15.9 |

| EGLE | 2023-12-27 | 1.2 | 0.9 | 13.6 | 15.7 |

| EGLE | 2023-12-26 | 1.2 | 0.9 | 13.6 | 15.7 |

| EGLE | 2023-12-22 | 1.2 | 0.9 | 13.9 | 15.9 |

| EGLE | 2023-12-21 | 1.2 | 0.9 | 13.9 | 15.9 |

EGLE Growth Metrics

- Its 2 year cash and equivalents growth rate is now at 15.88%.

- Its 3 year price growth rate is now at 51.66%.

- Its 2 year price growth rate is now at 439.56%.

The table below shows EGLE's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 753.1282 | 330.7468 | 312.2253 |

| 2022-06-30 | 751.2079 | 318.7994 | 313.3495 |

| 2022-03-31 | 682.3635 | 237.0916 | 228.1216 |

| 2021-12-31 | 594.5377 | 209.1708 | 184.8979 |

| 2021-09-30 | 484.9966 | 135.8568 | 97.53051 |

| 2021-06-30 | 369.7862 | 58.35347 | 8.029953 |

EGLE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- EGLE has a Quality Grade of C, ranking ahead of 28.74% of graded US stocks.

- EGLE's asset turnover comes in at 0.363 -- ranking 50th of 137 Transportation stocks.

- SNDR, LSTR, and INSW are the stocks whose asset turnover ratios are most correlated with EGLE.

The table below shows EGLE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.363 | 0.450 | 0.032 |

| 2021-03-31 | 0.296 | 0.335 | 0.010 |

| 2020-12-31 | 0.274 | 0.283 | 0.000 |

| 2020-09-30 | 0.268 | 0.251 | -0.008 |

| 2020-06-30 | 0.275 | 0.251 | -0.004 |

| 2020-03-31 | 0.300 | 0.271 | 0.006 |

EGLE Price Target

For more insight on analysts targets of EGLE, see our EGLE price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $25.98 | Average Broker Recommendation | 1.4 (Strong Buy) |

Eagle Bulk Shipping Inc. (EGLE) Company Bio

Eagle Bulk Shipping Inc. is a US-based owner and operator of dry bulk vessels, providing its customers with global transportation services for the carriage of bulk commodities including: coal, grain, iron ore, steel, cement, and forest products, among others.

Latest EGLE News From Around the Web

Below are the latest news stories about EAGLE BULK SHIPPING INC that investors may wish to consider to help them evaluate EGLE as an investment opportunity.

What Does Star Bulk Carrier's Purchase of Eagle Bulk Shipping Mean for Investors?An examination of recent events and how the merger may play out in the turbulent shipping industry |

Why Are Shipping Stocks ZIM, GNK, EGLE, SBLK Up Today?Shipping stocks are up on Monday after BP announced that it will no longer be using shipping routes that travel through the Red Sea. |

Dow Up Triple Digits As Oil Prices PlummetThe S&P 500 Index and Nasdaq Composite are also higher, as investors await tomorrow's interest rate decision. |

EGLE Stock Pops as Star Bulk Buys Eagle Bulk for $500 MillionEagle Bulk Shipping stock is climbing higher on Tuesday after EGLE investors learned of a merger agreement with Star Bulk Carriers. |

Why Is Aditxt (ADTX) Stock Up 58% Today?Aditxt stock is up on Tuesday as investors in ADTX shares react to the company announcing plans to acquire Evofem Biosciences. |

EGLE Price Returns

| 1-mo | 7.39% |

| 3-mo | 38.39% |

| 6-mo | 28.25% |

| 1-year | 2.22% |

| 3-year | 230.53% |

| 5-year | 152.73% |

| YTD | 3.59% |

| 2023 | 14.28% |

| 2022 | 25.96% |

| 2021 | 151.65% |

| 2020 | -40.99% |

| 2019 | -0.22% |

EGLE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EGLE

Want to do more research on Eagle Bulk Shipping Inc's stock and its price? Try the links below:Eagle Bulk Shipping Inc (EGLE) Stock Price | Nasdaq

Eagle Bulk Shipping Inc (EGLE) Stock Quote, History and News - Yahoo Finance

Eagle Bulk Shipping Inc (EGLE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...