Vulcan Materials Co. (VMC): Price and Financial Metrics

VMC Price/Volume Stats

| Current price | $238.44 | 52-week high | $239.25 |

| Prev. close | $236.52 | 52-week low | $159.76 |

| Day low | $235.00 | Volume | 882,000 |

| Day high | $239.25 | Avg. volume | 713,819 |

| 50-day MA | $223.20 | Dividend yield | 0.75% |

| 200-day MA | $212.47 | Market Cap | 31.68B |

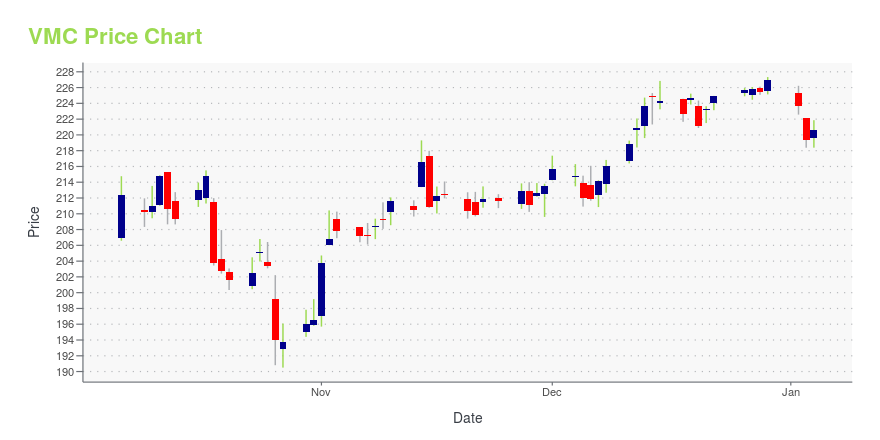

VMC Stock Price Chart Interactive Chart >

VMC POWR Grades

- VMC scores best on the Momentum dimension, with a Momentum rank ahead of 99.42% of US stocks.

- VMC's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- VMC's current lowest rank is in the Value metric (where it is better than 4.08% of US stocks).

VMC Stock Summary

- VMC has a higher market value than 91.68% of US stocks; more precisely, its current market capitalization is $29,143,119,971.

- VULCAN MATERIALS CO's stock had its IPO on January 5, 1988, making it an older stock than 89.57% of US equities in our set.

- The ratio of debt to operating expenses for VULCAN MATERIALS CO is higher than it is for about 89.05% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to VULCAN MATERIALS CO are BR, WY, MLM, FDS, and AME.

- VMC's SEC filings can be seen here. And to visit VULCAN MATERIALS CO's official web site, go to www.vulcanmaterials.com.

VMC Valuation Summary

- VMC's EV/EBIT ratio is 27.6; this is 105.97% higher than that of the median Basic Materials stock.

- VMC's price/sales ratio has moved up 2.1 over the prior 243 months.

Below are key valuation metrics over time for VMC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| VMC | 2023-12-29 | 3.9 | 4.1 | 36.6 | 27.6 |

| VMC | 2023-12-28 | 3.9 | 4.0 | 36.3 | 27.4 |

| VMC | 2023-12-27 | 3.9 | 4.0 | 36.4 | 27.5 |

| VMC | 2023-12-26 | 3.9 | 4.0 | 36.3 | 27.5 |

| VMC | 2023-12-22 | 3.9 | 4.0 | 36.2 | 27.4 |

| VMC | 2023-12-21 | 3.9 | 4.0 | 36.0 | 27.2 |

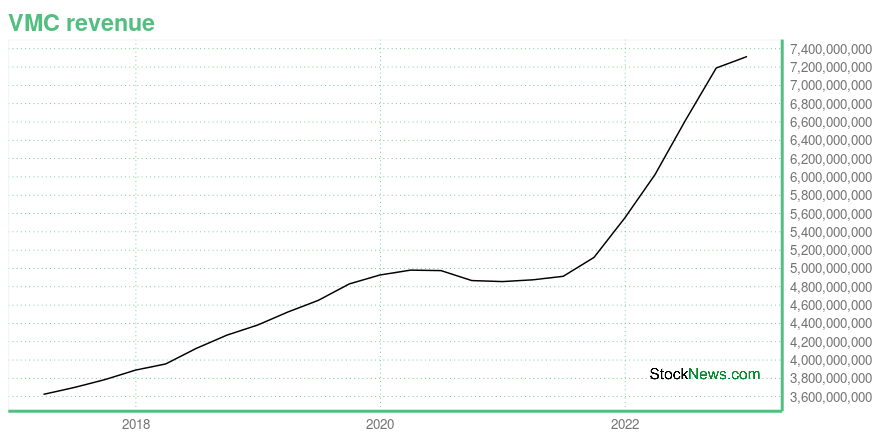

VMC Growth Metrics

- Its 4 year revenue growth rate is now at 37.42%.

- Its year over year price growth rate is now at -6.55%.

- Its 5 year net income to common stockholders growth rate is now at 37.97%.

The table below shows VMC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 7,315.2 | 1,148.2 | 575.6 |

| 2022-09-30 | 7,189.603 | 1,035.384 | 594.135 |

| 2022-06-30 | 6,617.809 | 939.527 | 593.941 |

| 2022-03-31 | 6,024.556 | 1,018.238 | 601.985 |

| 2021-12-31 | 5,552.2 | 1,011.9 | 670.8 |

| 2021-09-30 | 5,121.016 | 1,017.249 | 647.382 |

VMC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- VMC has a Quality Grade of B, ranking ahead of 76.37% of graded US stocks.

- VMC's asset turnover comes in at 0.426 -- ranking 18th of 42 Non-Metallic and Industrial Metal Mining stocks.

- CLF, SCCO, and USLM are the stocks whose asset turnover ratios are most correlated with VMC.

The table below shows VMC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.426 | 0.267 | 0.115 |

| 2021-03-31 | 0.424 | 0.268 | 0.116 |

| 2020-12-31 | 0.429 | 0.264 | 0.098 |

| 2020-09-30 | 0.440 | 0.261 | 0.101 |

| 2020-06-30 | 0.461 | 0.260 | 0.102 |

| 2020-03-31 | 0.471 | 0.254 | 0.099 |

VMC Price Target

For more insight on analysts targets of VMC, see our VMC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $204.11 | Average Broker Recommendation | 1.6 (Moderate Buy) |

Vulcan Materials Co. (VMC) Company Bio

Vulcan Materials Company (NYSE: VMC) is an American company based in Birmingham, Alabama. It is principally engaged in the production, distribution and sale of construction materials. Vulcan is the largest producer of construction materials, primarily gravel, crushed stone, and sand, and employs approximately 7,000 people at over 300 facilities. Vulcan serves 20 states, the District of Columbia and Mexico. Vulcan's innovative Crescent Market project led to construction of a large quarry and deep water seaport on the Yucatán Peninsula of Mexico, just south of Cancun. This quarry supplies Tampa, New Orleans, Houston, and Brownsville, Texas, as well as other Gulf coast seaports, with crushed limestone via large 62,000-ton self-discharging ships. (Source:Wikipedia)

Latest VMC News From Around the Web

Below are the latest news stories about VULCAN MATERIALS CO that investors may wish to consider to help them evaluate VMC as an investment opportunity.

3 (More) stocks to own in 2024Individual stocks rally before the market, and the market rallies before the economy.The S&P 500 is on track for a 26% year-to-date return.3 stocks that you can buy in 2024. This year, the stock market has surprised many who were convinced that 2022's bear market would mean a recession and poor ... |

We're Picking Vulcan for 2024 as Construction Activity Is Expected to Boom2023 was a good year for nonresidential construction, and the Action Alerts PLUS portfolio profited handsomely with the shares of United Rentals , to a lesser extent Vulcan Materials , and indirectly with the shares of Deere . |

While Digging for a Bear Put Spread, My Shovel Hit VulcanSeveral technical indicators are signaling the rise has left the market in an overbought status and vulnerable to profit taking. Today, I am highlighting an out of money bear put spread idea on Vulcan Materials Corporation , a company that is in a somewhat cyclical industry but is priced as if it is secular growth play. Should the economy turn north in 2024, the stock would be vulnerable to a significant pull back. Vulcan Materials' shares look like they might be topping out at current trading levels. |

My 2024 Stock Pick Has All the Right 'Materials' for SuccessLet's see how United Rentals and Vulcan Materials stack up for the new year and see which is my best bet. |

7 Stocks That Might Win on Election Year UncertaintySoon, it will be that favorite time of the quadrennial cycle where American citizens will decide the future of this great nation, subsequently necessitating a discussion about election year stocks. |

VMC Price Returns

| 1-mo | 6.72% |

| 3-mo | 12.65% |

| 6-mo | 6.91% |

| 1-year | 29.89% |

| 3-year | 58.68% |

| 5-year | 141.37% |

| YTD | 5.04% |

| 2023 | 30.75% |

| 2022 | -14.87% |

| 2021 | 41.09% |

| 2020 | 4.15% |

| 2019 | 47.13% |

VMC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VMC

Want to do more research on Vulcan Materials CO's stock and its price? Try the links below:Vulcan Materials CO (VMC) Stock Price | Nasdaq

Vulcan Materials CO (VMC) Stock Quote, History and News - Yahoo Finance

Vulcan Materials CO (VMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...