ResMed Inc. (RMD): Price and Financial Metrics

RMD Price/Volume Stats

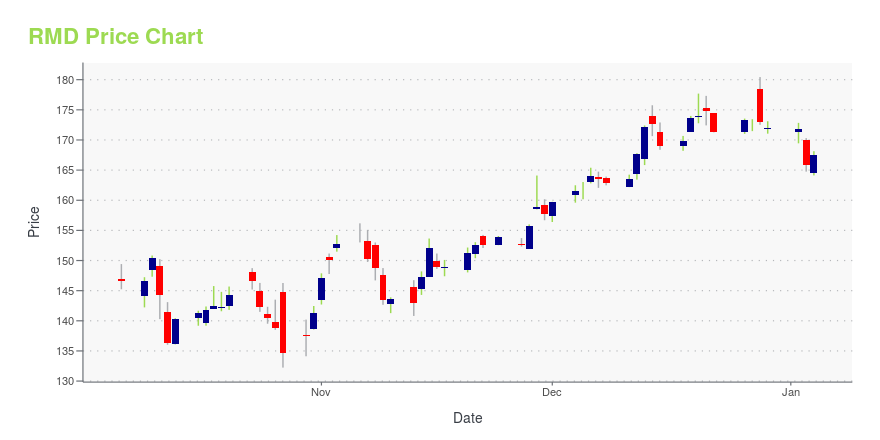

| Current price | $183.75 | 52-week high | $243.52 |

| Prev. close | $186.59 | 52-week low | $132.24 |

| Day low | $181.74 | Volume | 897,000 |

| Day high | $186.07 | Avg. volume | 986,785 |

| 50-day MA | $173.85 | Dividend yield | 1.01% |

| 200-day MA | $181.91 | Market Cap | 27.03B |

RMD Stock Price Chart Interactive Chart >

RMD POWR Grades

- RMD scores best on the Quality dimension, with a Quality rank ahead of 61.79% of US stocks.

- The strongest trend for RMD is in Growth, which has been heading down over the past 26 weeks.

- RMD ranks lowest in Momentum; there it ranks in the 4th percentile.

RMD Stock Summary

- RESMED INC's market capitalization of $24,386,367,759 is ahead of 90.57% of US-listed equities.

- Price to trailing twelve month operating cash flow for RMD is currently 26.08, higher than 83.79% of US stocks with positive operating cash flow.

- With a year-over-year growth in debt of 60.71%, RESMED INC's debt growth rate surpasses 88.21% of about US stocks.

- If you're looking for stocks that are quantitatively similar to RESMED INC, a group of peers worth examining would be LOGI, HOLX, A, EMN, and HXL.

- Visit RMD's SEC page to see the company's official filings. To visit the company's web site, go to www.resmed.com.

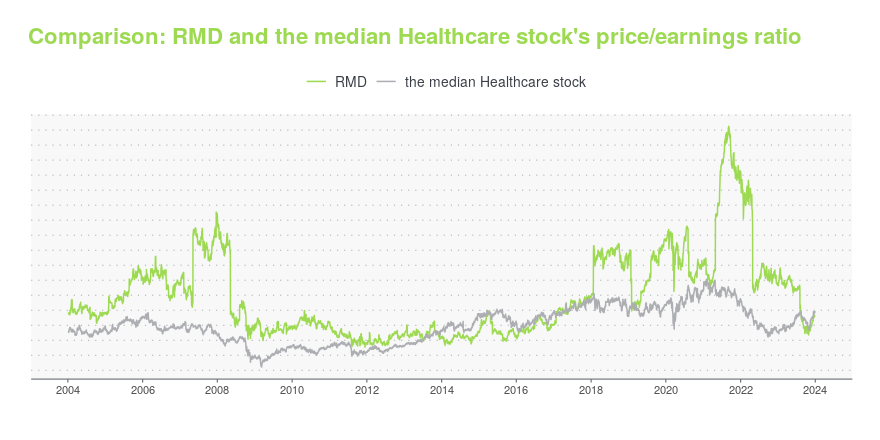

RMD Valuation Summary

- In comparison to the median Healthcare stock, RMD's price/earnings ratio is 4.29% lower, now standing at 27.9.

- Over the past 243 months, RMD's price/sales ratio has gone up 1.

Below are key valuation metrics over time for RMD.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| RMD | 2023-12-29 | 5.8 | 6.0 | 27.9 | 22.8 |

| RMD | 2023-12-28 | 5.8 | 6.0 | 28.1 | 22.9 |

| RMD | 2023-12-27 | 5.8 | 6.0 | 28.1 | 22.9 |

| RMD | 2023-12-26 | 5.8 | 6.0 | 28.1 | 23.0 |

| RMD | 2023-12-22 | 5.8 | 5.9 | 27.8 | 22.7 |

| RMD | 2023-12-21 | 5.9 | 6.0 | 28.4 | 23.1 |

RMD Growth Metrics

- The 4 year net income to common stockholders growth rate now stands at 53.62%.

- The 4 year price growth rate now stands at 133.96%.

- Its year over year cash and equivalents growth rate is now at -12.52%.

The table below shows RMD's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 3,763.275 | 370.223 | 809.465 |

| 2022-09-30 | 3,624.405 | 461.466 | 786.302 |

| 2022-06-30 | 3,578.127 | 351.147 | 779.437 |

| 2022-03-31 | 3,539.492 | 498.186 | 779.476 |

| 2021-12-31 | 3,443.759 | 577.025 | 521.983 |

| 2021-09-30 | 3,348.896 | 527.062 | 499.746 |

RMD's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- RMD has a Quality Grade of C, ranking ahead of 68.39% of graded US stocks.

- RMD's asset turnover comes in at 0.72 -- ranking 50th of 186 Medical Equipment stocks.

- PEYE, MMSI, and SIEN are the stocks whose asset turnover ratios are most correlated with RMD.

The table below shows RMD's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.720 | 0.569 | 0.426 |

| 2021-06-30 | 0.691 | 0.575 | 0.410 |

| 2021-03-31 | 0.673 | 0.582 | 0.379 |

| 2020-12-31 | 0.676 | 0.582 | 0.342 |

| 2020-09-30 | 0.670 | 0.583 | 0.321 |

| 2020-06-30 | 0.672 | 0.581 | 0.300 |

RMD Price Target

For more insight on analysts targets of RMD, see our RMD price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $261.67 | Average Broker Recommendation | 1.91 (Hold) |

ResMed Inc. (RMD) Company Bio

ResMed is a San Diego, California-based medical device company. It primarily provides cloud-connectable CPAP devices and masks for the treatment of sleep apnea, as well as devices and masks for treating chronic obstructive pulmonary disease (COPD), neuromuscular disease, and other respiratory-related conditions. It also provides a self-monitoring digital sensor and app for people who use inhalers to treat COPD or asthma via Propeller Health, which ResMed acquired in 2019. (Source:Wikipedia)

Latest RMD News From Around the Web

Below are the latest news stories about RESMED INC that investors may wish to consider to help them evaluate RMD as an investment opportunity.

ResMed Announces Participation in the 42nd Annual J.P. Morgan Healthcare ConferenceSAN DIEGO, Dec. 27, 2023 (GLOBE NEWSWIRE) -- ResMed (NYSE: RMD, ASX: RMD) today announced Mick Farrell, chief executive officer and chair of the board, will present at the 42nd Annual J.P. Morgan Healthcare Conference on Monday, January 8, 2024, beginning at approximately 2:15 p.m. (Pacific Standard Time) at the Westin St. Francis in San Francisco, CA. More information about this event, including access to the live, audio-only webcast, may be accessed by visiting https://investor.resmed.com. The |

Resmed posts notice about risk of mask magnets interfering with medical implantsLike its rival Philips, Resmed has determined that patients should not wear magnetized masks near some implants. |

ResMed Notifies Customers About Updated Instructions and Labeling for Masks with Magnets Due to Potential Interference with Certain Medical DevicesResMed’s masks with magnets are safe when used in accordance with the updated Instructions for UseSAN DIEGO, Dec. 20, 2023 (GLOBE NEWSWIRE) -- ResMed (NYSE: RMD, ASX: RMD) is conducting a voluntary global field action to update its guides for all masks with magnets to inform users about potential magnetic interference when magnets are near certain implants and medical devices in the body. This voluntary field correction does not require a return of a mask with magnets unless the patient is contr |

Resmed hails ‘significant victory’ as patent board rules in dispute with NYUThe decisions invalidate claims that NYU argued were infringed by Resmed’s sleep apnea devices. |

Here's Why Investors Should Retain ResMed (RMD) Stock for NowInvestors continue to be optimistic about ResMed (RMD) due to the sustained growth in the SaaS business. |

RMD Price Returns

| 1-mo | 3.59% |

| 3-mo | 28.28% |

| 6-mo | 3.24% |

| 1-year | -15.98% |

| 3-year | -6.33% |

| 5-year | 98.43% |

| YTD | 7.09% |

| 2023 | -16.55% |

| 2022 | -19.47% |

| 2021 | 23.41% |

| 2020 | 38.33% |

| 2019 | 37.85% |

RMD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RMD

Want to do more research on Resmed Inc's stock and its price? Try the links below:Resmed Inc (RMD) Stock Price | Nasdaq

Resmed Inc (RMD) Stock Quote, History and News - Yahoo Finance

Resmed Inc (RMD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...