Agilysys, Inc. (AGYS): Price and Financial Metrics

AGYS Price/Volume Stats

| Current price | $88.44 | 52-week high | $91.61 |

| Prev. close | $87.32 | 52-week low | $62.00 |

| Day low | $86.75 | Volume | 129,500 |

| Day high | $88.76 | Avg. volume | 233,411 |

| 50-day MA | $83.25 | Dividend yield | N/A |

| 200-day MA | $75.57 | Market Cap | 2.42B |

AGYS Stock Price Chart Interactive Chart >

AGYS POWR Grades

- Sentiment is the dimension where AGYS ranks best; there it ranks ahead of 98.45% of US stocks.

- The strongest trend for AGYS is in Growth, which has been heading up over the past 26 weeks.

- AGYS's current lowest rank is in the Value metric (where it is better than 6.71% of US stocks).

AGYS Stock Summary

- AGYS's current price/earnings ratio is 164.79, which is higher than 96.46% of US stocks with positive earnings.

- Price to trailing twelve month operating cash flow for AGYS is currently 54.71, higher than 94.01% of US stocks with positive operating cash flow.

- With a year-over-year growth in debt of 80.34%, AGILYSYS INC's debt growth rate surpasses 90.34% of about US stocks.

- Stocks that are quantitatively similar to AGYS, based on their financial statements, market capitalization, and price volatility, are BMRN, HLIT, HQY, PSTG, and POWI.

- Visit AGYS's SEC page to see the company's official filings. To visit the company's web site, go to www.agilysys.com.

AGYS Valuation Summary

- In comparison to the median Technology stock, AGYS's price/sales ratio is 308.33% higher, now standing at 9.8.

- AGYS's EV/EBIT ratio has moved up 143 over the prior 243 months.

Below are key valuation metrics over time for AGYS.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AGYS | 2023-12-08 | 9.8 | 18.3 | 174.5 | 131.3 |

| AGYS | 2023-12-07 | 9.8 | 18.3 | 175.0 | 131.7 |

| AGYS | 2023-12-06 | 10.1 | 18.9 | 180.4 | 135.9 |

| AGYS | 2023-12-05 | 10.1 | 18.8 | 179.3 | 135.0 |

| AGYS | 2023-12-04 | 10.3 | 19.1 | 182.4 | 137.5 |

| AGYS | 2023-12-01 | 10.3 | 19.1 | 182.5 | 137.5 |

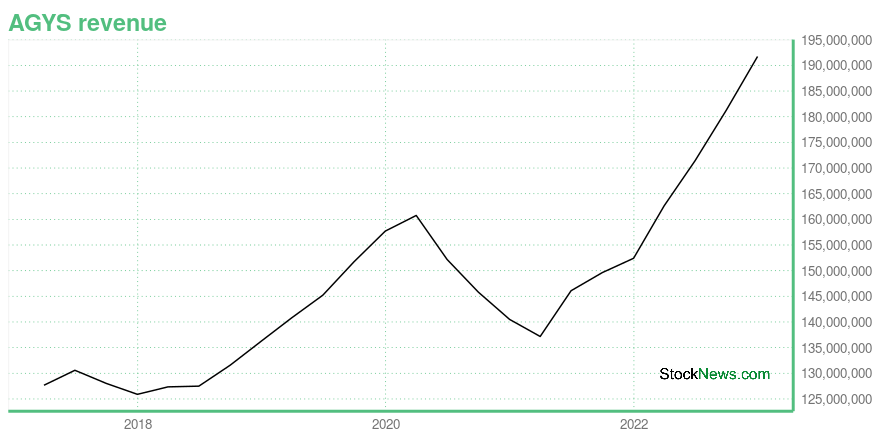

AGYS Growth Metrics

- Its 2 year price growth rate is now at 97.81%.

- Its 5 year revenue growth rate is now at 25.91%.

- The 3 year revenue growth rate now stands at 15.47%.

The table below shows AGYS's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 191.726 | 24.34 | 10.653 |

| 2022-09-30 | 181.266 | 19.919 | 8.303 |

| 2022-06-30 | 171.416 | 20.581 | 5.709 |

| 2022-03-31 | 162.636 | 28.475 | 4.642 |

| 2021-12-31 | 152.413 | 35.138 | -21.621 |

| 2021-09-30 | 149.628 | 33.438 | -25.233 |

AGYS's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AGYS has a Quality Grade of A, ranking ahead of 98.26% of graded US stocks.

- AGYS's asset turnover comes in at 0.791 -- ranking 33rd of 83 Computers stocks.

- OSPN, LOGI, and QBAK are the stocks whose asset turnover ratios are most correlated with AGYS.

The table below shows AGYS's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.791 | 0.647 | -1.425 |

| 2021-06-30 | 0.787 | 0.655 | -0.909 |

| 2021-03-31 | 0.753 | 0.652 | -0.845 |

| 2020-12-31 | 0.810 | 0.609 | -0.843 |

| 2020-09-30 | 0.863 | 0.565 | -0.834 |

| 2020-06-30 | 0.914 | 0.522 | -1.123 |

AGYS Price Target

For more insight on analysts targets of AGYS, see our AGYS price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $62.00 | Average Broker Recommendation | 1.75 (Moderate Buy) |

Agilysys, Inc. (AGYS) Company Bio

Agilysys, Inc. operates as a developer and marketer of hardware and software products, and services to the hospitality industry in North America, Europe, and Asia. It specializes in point-of-sale, property management, inventory and procurement, workforce management, and mobile and wireless solutions that are designed to streamline operations, improve efficiency, and enhance the guest experience. The company was formerly known as Pioneer-Standard Electronics, Inc. and changed its name to Agilysys, Inc. in 2003. The company was founded in 1963 and is based in Alpharetta, Georgia.

Latest AGYS News From Around the Web

Below are the latest news stories about AGILYSYS INC that investors may wish to consider to help them evaluate AGYS as an investment opportunity.

4 Stocks to Watch From the Prospering Technology Solutions IndustryIndustry players like IBM HPE, AGYS and PAR are gaining from the increased demand for integrated solutions and the growing adoption of the multi-cloud model, despite persistent supply chain constraints. |

Black Rock Oceanfront Resort Selects Agilysys Hospitality Technology To Expertly Deliver Luxury Experiences, Elevate Guest Returns and Manage Residence Rentals and Spa OperationsALPHARETTA, Ga., December 18, 2023--The ocean is a remedy for many travelers to relieve tension, stress and anxiety. The tranquility of the Pacific Ocean and its idyllic setting is one of the main reasons thousands of people stay at and return to British Columbia’s Black Rock Oceanfront Resort each year. |

Insider Sell: Director Jerry Jones Offloads Shares of Agilysys IncIn a notable insider transaction, Director Jerry Jones sold 6,294 shares of Agilysys Inc (NASDAQ:AGYS) on December 6, 2023. |

Agilysys Appoints Managing Director to Lead Growth in the Asia Pacific MarketSINGAPORE, December 06, 2023--Agilysys, a leading global provider of hospitality software solutions and services, today announces the appointment of Tony Marshall to the position of Vice President and Managing Director for Asia Pacific. With continued strong demand for its Property Management Systems (PMS), Point-of-Sale (POS) and Inventory and Procurement (I&P) solutions in APAC and other global regions, Agilysys named Marshall to spearhead its regional growth strategy and go-to-market executio |

If EPS Growth Is Important To You, Agilysys (NASDAQ:AGYS) Presents An OpportunityFor beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

AGYS Price Returns

| 1-mo | 15.46% |

| 3-mo | 1.90% |

| 6-mo | 26.20% |

| 1-year | 8.30% |

| 3-year | 84.94% |

| 5-year | 360.63% |

| YTD | 4.27% |

| 2023 | 7.18% |

| 2022 | 78.00% |

| 2021 | 15.84% |

| 2020 | 51.04% |

| 2019 | 77.20% |

Continue Researching AGYS

Want to do more research on Agilysys Inc's stock and its price? Try the links below:Agilysys Inc (AGYS) Stock Price | Nasdaq

Agilysys Inc (AGYS) Stock Quote, History and News - Yahoo Finance

Agilysys Inc (AGYS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...