OneSpan Inc. (OSPN): Price and Financial Metrics

OSPN Price/Volume Stats

| Current price | $10.28 | 52-week high | $19.25 |

| Prev. close | $10.03 | 52-week low | $7.64 |

| Day low | $10.10 | Volume | 213,300 |

| Day high | $10.44 | Avg. volume | 273,019 |

| 50-day MA | $10.37 | Dividend yield | N/A |

| 200-day MA | $11.91 | Market Cap | 410.04M |

OSPN Stock Price Chart Interactive Chart >

OSPN POWR Grades

- Growth is the dimension where OSPN ranks best; there it ranks ahead of 72.52% of US stocks.

- OSPN's strongest trending metric is Stability; it's been moving down over the last 26 weeks.

- OSPN's current lowest rank is in the Quality metric (where it is better than 26.84% of US stocks).

OSPN Stock Summary

- The ratio of debt to operating expenses for ONESPAN INC is higher than it is for about just 7.22% of US stocks.

- With a year-over-year growth in debt of -37.84%, ONESPAN INC's debt growth rate surpasses merely 8.22% of about US stocks.

- Over the past twelve months, OSPN has reported earnings growth of 95.23%, putting it ahead of 89.15% of US stocks in our set.

- If you're looking for stocks that are quantitatively similar to ONESPAN INC, a group of peers worth examining would be TRUE, AMSC, KERN, QTRX, and KRMD.

- Visit OSPN's SEC page to see the company's official filings. To visit the company's web site, go to www.onespan.com.

OSPN Valuation Summary

- In comparison to the median Technology stock, OSPN's price/earnings ratio is 145.4% lower, now standing at -12.1.

- Over the past 243 months, OSPN's price/sales ratio has gone down 1.9.

Below are key valuation metrics over time for OSPN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| OSPN | 2023-12-08 | 1.8 | 2.3 | -12.1 | -10.9 |

| OSPN | 2023-12-07 | 1.7 | 2.2 | -11.8 | -10.5 |

| OSPN | 2023-12-06 | 1.7 | 2.2 | -11.7 | -10.4 |

| OSPN | 2023-12-05 | 1.7 | 2.2 | -12.0 | -10.7 |

| OSPN | 2023-12-04 | 1.8 | 2.3 | -12.0 | -10.8 |

| OSPN | 2023-12-01 | 1.8 | 2.3 | -12.3 | -11.0 |

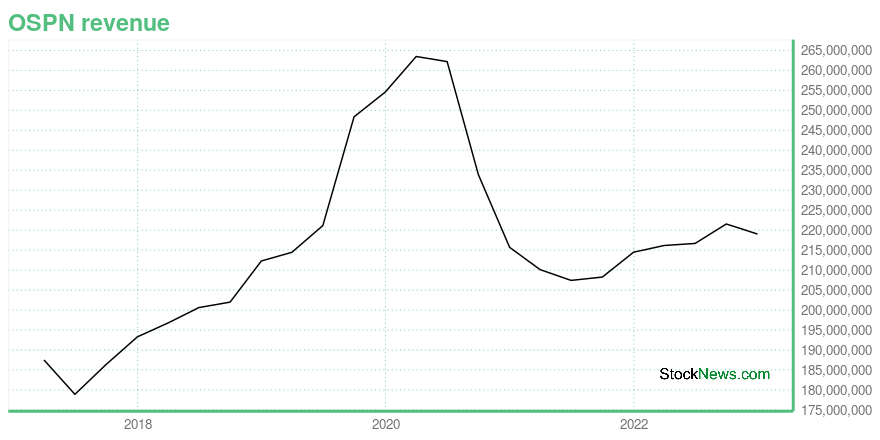

OSPN Growth Metrics

- Its 2 year cash and equivalents growth rate is now at 5.05%.

- The 5 year price growth rate now stands at 32.87%.

- Its 4 year net cashflow from operations growth rate is now at -27.23%.

The table below shows OSPN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 219.006 | -5.786 | -14.434 |

| 2022-09-30 | 221.537 | -11.995 | -25.11 |

| 2022-06-30 | 216.666 | -15.213 | -18.884 |

| 2022-03-31 | 216.153 | -2.668 | -16.219 |

| 2021-12-31 | 214.481 | -2.745 | -30.584 |

| 2021-09-30 | 208.256 | 3.064 | -18.567 |

OSPN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- OSPN has a Quality Grade of C, ranking ahead of 63.41% of graded US stocks.

- OSPN's asset turnover comes in at 0.581 -- ranking 49th of 83 Computers stocks.

- AGYS, LOGI, and QBAK are the stocks whose asset turnover ratios are most correlated with OSPN.

The table below shows OSPN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.581 | 0.710 | -0.204 |

| 2021-06-30 | 0.568 | 0.706 | -0.200 |

| 2021-03-31 | 0.569 | 0.702 | -0.133 |

| 2020-12-31 | 0.579 | 0.706 | -0.032 |

| 2020-09-30 | 0.624 | 0.696 | 0.051 |

| 2020-06-30 | 0.701 | 0.686 | 0.204 |

OSPN Price Target

For more insight on analysts targets of OSPN, see our OSPN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $30.67 | Average Broker Recommendation | 1.38 (Strong Buy) |

OneSpan Inc. (OSPN) Company Bio

OneSpan (formerly VASCO Data Security International) designs, develops, markets, and supports hardware and software security systems that manage and secure access to information assets worldwide. The company offers patented digital security hardware, software, and digital-signature technology protect electronic financial transactions over corporate networks and the Internet.The company was founded in 1991 and is based in Oakbrook Terrace, Illinois.

Latest OSPN News From Around the Web

Below are the latest news stories about ONESPAN INC that investors may wish to consider to help them evaluate OSPN as an investment opportunity.

OneSpan Inc. Announces Final Results of Tender OfferBOSTON, December 14, 2023--OneSpan Inc. (Nasdaq: OSPN) ("OneSpan" or the "Company") today announced the final results of its modified "Dutch auction" tender offer, which expired at 12:00 midnight, at the end of the day, New York City time, on December 11, 2023. |

OneSpan Inc. Announces Preliminary Results of Tender OfferBOSTON, December 12, 2023--OneSpan Inc. (Nasdaq: OSPN) ("OneSpan" or the "Company") announced today the preliminary results of its modified "Dutch auction" tender offer to purchase up to $20 million of its common stock, par value $0.001 per share (the "common stock" or the "shares"), subject to its right to purchase up to an additional 2% of its outstanding shares of common stock, for cash at a price per share not less than $9.50 and not greater than $11.00. The tender offer expired at 12:00 mid |

OneSpan Introduces New Partner Network Program to Broaden Delivery of Secure and Seamless Customer ExperiencesBOSTON, December 06, 2023--OneSpan™ (NASDAQ: OSPN), the digital agreements security company, today announced the launch of a new partner network program that now provides a comprehensive set of benefits that will drive growth and help OneSpan partners deliver seamless and secure customer experiences. Members of the global partner network can expand their security and e-signature portfolio with market-leading solutions, financial incentives, training, and certification, along with technical, sale |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

Uber Technologies, Jabil and Builders FirstSource Set to Join S&P 500; Others to Join S&P MidCap 400 and S&P SmallCap 600S&P Dow Jones Indices ("S&P DJI") will make the following changes to the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices effective prior to the open of trading on Monday, December 18, to coincide with the quarterly rebalance. The changes ensure each index is more representative of its market capitalization range. All companies being added to the S&P 500 are more representative of the large-cap market space, all companies being added to the S&P MidCap 400 are more representative of the mid- |

OSPN Price Returns

| 1-mo | 6.20% |

| 3-mo | 7.98% |

| 6-mo | -4.24% |

| 1-year | -28.41% |

| 3-year | -58.26% |

| 5-year | -32.37% |

| YTD | -4.10% |

| 2023 | -4.20% |

| 2022 | -33.90% |

| 2021 | -18.13% |

| 2020 | 20.79% |

| 2019 | 32.20% |

Continue Researching OSPN

Want to see what other sources are saying about OneSpan Inc's financials and stock price? Try the links below:OneSpan Inc (OSPN) Stock Price | Nasdaq

OneSpan Inc (OSPN) Stock Quote, History and News - Yahoo Finance

OneSpan Inc (OSPN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...