Dover Corp. (DOV): Price and Financial Metrics

DOV Price/Volume Stats

| Current price | $160.11 | 52-week high | $162.48 |

| Prev. close | $160.47 | 52-week low | $127.25 |

| Day low | $158.19 | Volume | 1,036,400 |

| Day high | $161.00 | Avg. volume | 976,000 |

| 50-day MA | $149.59 | Dividend yield | 1.28% |

| 200-day MA | $143.30 | Market Cap | 22.40B |

DOV Stock Price Chart Interactive Chart >

DOV POWR Grades

- DOV scores best on the Quality dimension, with a Quality rank ahead of 81.68% of US stocks.

- The strongest trend for DOV is in Momentum, which has been heading down over the past 26 weeks.

- DOV ranks lowest in Growth; there it ranks in the 42nd percentile.

DOV Stock Summary

- DOV has a higher market value than 89.6% of US stocks; more precisely, its current market capitalization is $20,749,905,060.

- DOVER CORP's stock had its IPO on January 1, 1986, making it an older stock than 92.92% of US equities in our set.

- The volatility of DOVER CORP's share price is greater than that of merely 2.06% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to DOVER CORP are HRL, BLDR, HUBB, POOL, and K.

- Visit DOV's SEC page to see the company's official filings. To visit the company's web site, go to www.dovercorporation.com.

DOV Valuation Summary

- In comparison to the median Industrials stock, DOV's price/earnings ratio is 7.08% lower, now standing at 21.

- Over the past 243 months, DOV's price/earnings ratio has gone down 14.8.

Below are key valuation metrics over time for DOV.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| DOV | 2023-12-29 | 2.5 | 4.5 | 21.0 | 17.4 |

| DOV | 2023-12-28 | 2.5 | 4.5 | 21.1 | 17.5 |

| DOV | 2023-12-27 | 2.5 | 4.5 | 21.1 | 17.5 |

| DOV | 2023-12-26 | 2.6 | 4.5 | 21.1 | 17.5 |

| DOV | 2023-12-22 | 2.5 | 4.4 | 20.9 | 17.4 |

| DOV | 2023-12-21 | 2.5 | 4.4 | 20.8 | 17.3 |

DOV Growth Metrics

- Its 5 year price growth rate is now at 6.02%.

- Its year over year cash and equivalents growth rate is now at -45.95%.

- Its 4 year price growth rate is now at 6.02%.

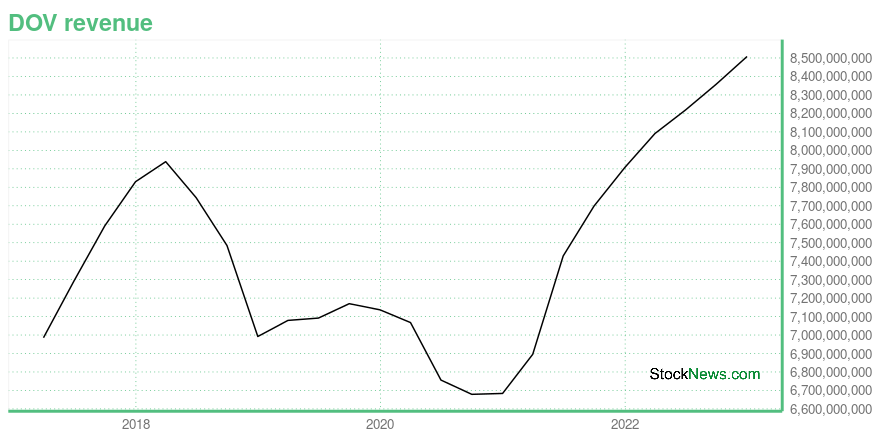

The table below shows DOV's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 8,508.088 | 805.724 | 1,065.376 |

| 2022-09-30 | 8,358.142 | 794.36 | 1,164.582 |

| 2022-06-30 | 8,218.12 | 881.064 | 1,142.312 |

| 2022-03-31 | 8,091.081 | 962.364 | 1,117.202 |

| 2021-12-31 | 7,907.081 | 1,115.865 | 1,123.818 |

| 2021-09-30 | 7,698.236 | 1,206.477 | 943.139 |

DOV's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- DOV has a Quality Grade of B, ranking ahead of 86.63% of graded US stocks.

- DOV's asset turnover comes in at 0.811 -- ranking 37th of 104 Machinery stocks.

- LECO, DE, and NVT are the stocks whose asset turnover ratios are most correlated with DOV.

The table below shows DOV's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.811 | 0.377 | 0.256 |

| 2021-06-30 | 0.802 | 0.377 | 0.242 |

| 2021-03-31 | 0.755 | 0.375 | 0.211 |

| 2020-12-31 | 0.739 | 0.370 | 0.196 |

| 2020-09-30 | 0.748 | 0.370 | 0.193 |

| 2020-06-30 | 0.763 | 0.368 | 0.196 |

DOV Price Target

For more insight on analysts targets of DOV, see our DOV price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $181.18 | Average Broker Recommendation | 1.71 (Moderate Buy) |

Dover Corp. (DOV) Company Bio

Dover Corporation is an American conglomerate manufacturer of industrial products. The Downers Grove, Illinois-based company was founded in 1955. As of 2021, Dover's business was divided into five segments: Engineered Products, Clean Energy and Fueling, Imaging & Identification, Pumps & Process Solutions and Climate and Sustainability Technologies. Dover is a constituent of the S&P 500 index and trades on the New York Stock Exchange under "DOV". Dover was ranked 429th in the 2020 Fortune 500. The company relocated its headquarters to Illinois from New York in mid-2010. (Source:Wikipedia)

Latest DOV News From Around the Web

Below are the latest news stories about DOVER CORP that investors may wish to consider to help them evaluate DOV as an investment opportunity.

The 3 Best Industrial Stocks to Buy for 2024Industrial stocks present value despite short-term challenges. |

Those who invested in Dover (NYSE:DOV) five years ago are up 136%The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

Markem-Imaje Achieves BRC Global Standard Grade AA Packaging Materials CertificationMarkem-Imaje, part of Dover (NYSE: DOV) and a global provider of end-to-end supply chain solutions and industrial marking and coding systems, announced that it has received the BRC Global Standard (BRCGS) Grade AA Packaging Materials Certification. This award reflects the exceptional standards at the Markem-Imaje manufacturing site for Continuous Inkjet (CIJ) inks in Bourg-Lès-Valence, France. Markem-Imaje is the first coding company in Europe to achieve a BRC Global Standard. |

Caldera Announces New RIP Software Version 17Caldera, part of Dover (NYSE: DOV), today announced the launch of Version 17 of its award-winning raster image processor ("RIP") software for large-format digital printing and cutting. Version 17 includes the official support of macOS® Sonoma, the integration of Adobe® PDF Print Engine 6.2, more than 30 new drivers, and an extended range of new features to facilitate color management, printing and cutting tasks. |

Are Robust Financials Driving The Recent Rally In Dover Corporation's (NYSE:DOV) Stock?Most readers would already be aware that Dover's (NYSE:DOV) stock increased significantly by 10% over the past month... |

DOV Price Returns

| 1-mo | 8.49% |

| 3-mo | 22.08% |

| 6-mo | 12.79% |

| 1-year | 5.36% |

| 3-year | 38.11% |

| 5-year | 99.84% |

| YTD | 4.10% |

| 2023 | 15.22% |

| 2022 | -24.34% |

| 2021 | 45.73% |

| 2020 | 11.53% |

| 2019 | 65.80% |

DOV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DOV

Here are a few links from around the web to help you further your research on DOVER Corp's stock as an investment opportunity:DOVER Corp (DOV) Stock Price | Nasdaq

DOVER Corp (DOV) Stock Quote, History and News - Yahoo Finance

DOVER Corp (DOV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...