Arrow Electronics, Inc. (ARW): Price and Financial Metrics

ARW Price/Volume Stats

| Current price | $113.40 | 52-week high | $147.42 |

| Prev. close | $108.98 | 52-week low | $108.77 |

| Day low | $110.01 | Volume | 1,288,400 |

| Day high | $113.49 | Avg. volume | 606,478 |

| 50-day MA | $117.75 | Dividend yield | N/A |

| 200-day MA | $124.85 | Market Cap | 6.14B |

ARW Stock Price Chart Interactive Chart >

ARW POWR Grades

- ARW scores best on the Value dimension, with a Value rank ahead of 93.95% of US stocks.

- The strongest trend for ARW is in Value, which has been heading up over the past 26 weeks.

- ARW ranks lowest in Growth; there it ranks in the 15th percentile.

ARW Stock Summary

- ARROW ELECTRONICS INC's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than 93.5% of US listed stocks.

- With a price/earnings ratio of 6.04, ARROW ELECTRONICS INC P/E ratio is greater than that of about only 7.05% of stocks in our set with positive earnings.

- With a price/sales ratio of 0.18, ARROW ELECTRONICS INC has a higher such ratio than merely 4.98% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to ARROW ELECTRONICS INC are SNX, LAD, BXC, WCC, and GMS.

- ARW's SEC filings can be seen here. And to visit ARROW ELECTRONICS INC's official web site, go to www.arrow.com.

ARW Valuation Summary

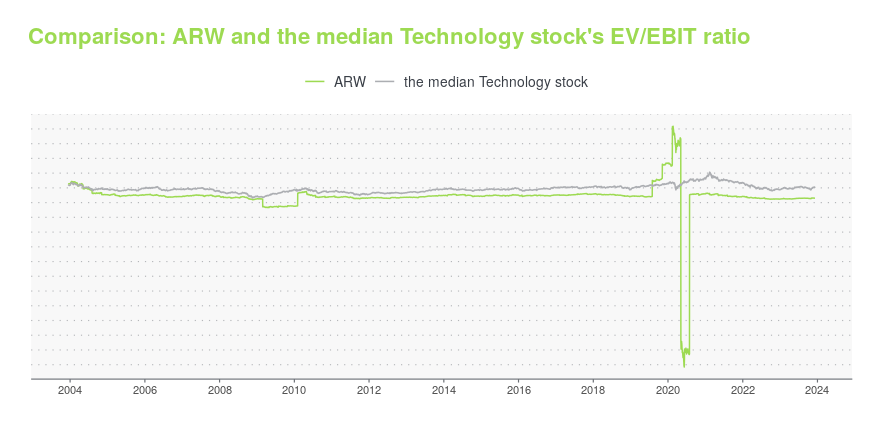

- ARW's EV/EBIT ratio is 6.1; this is 71.23% lower than that of the median Technology stock.

- Over the past 243 months, ARW's price/earnings ratio has gone down 312.4.

Below are key valuation metrics over time for ARW.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| ARW | 2023-12-08 | 0.2 | 1.2 | 6.1 | 6.1 |

| ARW | 2023-12-07 | 0.2 | 1.2 | 6.0 | 6.1 |

| ARW | 2023-12-06 | 0.2 | 1.2 | 6.0 | 6.1 |

| ARW | 2023-12-05 | 0.2 | 1.2 | 6.1 | 6.1 |

| ARW | 2023-12-04 | 0.2 | 1.2 | 6.1 | 6.1 |

| ARW | 2023-12-01 | 0.2 | 1.2 | 6.1 | 6.1 |

ARW Growth Metrics

- The 3 year net income to common stockholders growth rate now stands at 76.45%.

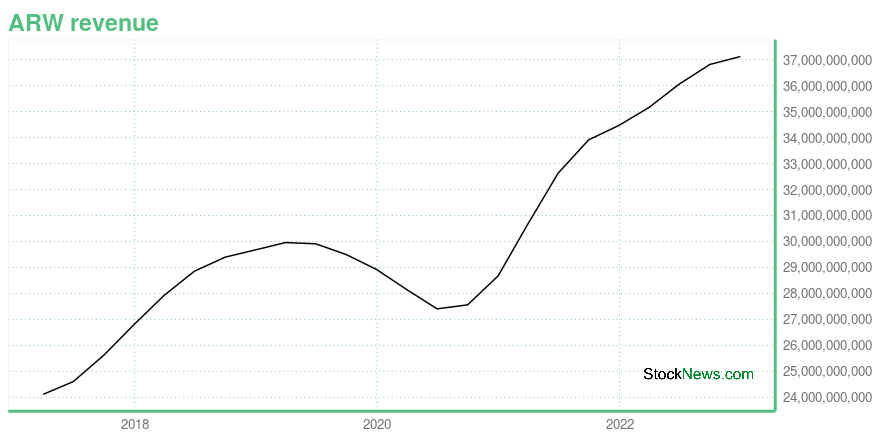

- Its 3 year revenue growth rate is now at 17.39%.

- Its year over year price growth rate is now at 8.9%.

The table below shows ARW's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 37,124.42 | -33.077 | 1,426.884 |

| 2022-09-30 | 36,817.48 | -113.871 | 1,448.69 |

| 2022-06-30 | 36,063.43 | -140.691 | 1,396.318 |

| 2022-03-31 | 35,165.22 | 223.271 | 1,266.625 |

| 2021-12-31 | 34,477.02 | 418.983 | 1,108.197 |

| 2021-09-30 | 33,915.13 | 591.096 | 973.06 |

ARW's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- ARW has a Quality Grade of C, ranking ahead of 66.92% of graded US stocks.

- ARW's asset turnover comes in at 1.991 -- ranking 38th of 105 Wholesale stocks.

- RELL, STKL, and BCC are the stocks whose asset turnover ratios are most correlated with ARW.

The table below shows ARW's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-07-03 | 1.991 | 0.112 | 0.164 |

| 2021-04-03 | 1.908 | 0.111 | 0.145 |

| 2020-12-31 | 1.805 | 0.111 | 0.121 |

| 2020-09-26 | 1.753 | 0.112 | 0.103 |

| 2020-06-27 | 1.738 | 0.113 | 0.089 |

| 2020-03-28 | 1.773 | 0.112 | -0.004 |

ARW Price Target

For more insight on analysts targets of ARW, see our ARW price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $127.00 | Average Broker Recommendation | 2 (Hold) |

Arrow Electronics, Inc. (ARW) Company Bio

Arrow Electronics provider of products, services and solutions to industrial and commercial users of electronic components and enterprise computing solutions. The company was founded in 1935 and is based in Centennial, Colorado.

Latest ARW News From Around the Web

Below are the latest news stories about ARROW ELECTRONICS INC that investors may wish to consider to help them evaluate ARW as an investment opportunity.

Agricultural Solutions Sweep the 2023 Call for Code CompetitionBOULDER, CO / ACCESSWIRE / December 18, 2023 / Arrow Electronics: New AI-powered technologies related to agriculture issues ranging from contaminated soil and crop management to food waste were selected as winners of the sixth annual Call for Code ... |

What Is Arrow Electronics, Inc.'s (NYSE:ARW) Share Price Doing?Arrow Electronics, Inc. ( NYSE:ARW ), is not the largest company out there, but it saw a double-digit share price rise... |

Arrow Electronics and Infinidat Announce Manufacturing and Fulfillment Services AgreementCENTENNIAL, Colo. & WALTHAM, Mass., December 14, 2023--Global technology provider Arrow Electronics and Infinidat, a leading provider of enterprise storage solutions, have announced an agreement, enabling Infinidat to use Arrow as its primary manufacturing and fulfillment operations collaborator globally, benefiting from a global manufacturing supply chain and increased efficiencies. |

Arrow Electronics Establishes High-Power Centre of Excellence in UK to Accelerate Electrification and SustainabilityCENTENNIAL, Colo., December 12, 2023--Arrow Electronics, Inc. (NYSE:ARW), a global provider of technology solutions, and its engineering services company, eInfochips, have announced the establishment of a High-Power Centre of Excellence (CoE) in Swindon, United Kingdom. The purpose of this High-Power CoE is to assist customers in the development of high-power solutions, a critical component in advancing electrification and sustainability initiatives. |

Arrow Electronics’ ArrowSphere Supports the Move to XaaS with New Cloud Sustainability, Cost Optimization and Security DashboardsCENTENNIAL, Colo., December 07, 2023--Global technology provider Arrow Electronics (NYSE:ARW) introduced a series of significant updates to its cloud management platform ArrowSphere to help ease multicloud and hybrid cloud monitoring. The updates are focused on three key pillars of cloud business excellence: sustainability (GreenOps), cost optimization (FinOps) and security (SecOps). |

ARW Price Returns

| 1-mo | -1.72% |

| 3-mo | -5.92% |

| 6-mo | -11.43% |

| 1-year | -11.81% |

| 3-year | 10.43% |

| 5-year | 43.11% |

| YTD | -7.24% |

| 2023 | 16.91% |

| 2022 | -22.12% |

| 2021 | 38.00% |

| 2020 | 14.82% |

| 2019 | 22.90% |

Continue Researching ARW

Want to do more research on Arrow Electronics Inc's stock and its price? Try the links below:Arrow Electronics Inc (ARW) Stock Price | Nasdaq

Arrow Electronics Inc (ARW) Stock Quote, History and News - Yahoo Finance

Arrow Electronics Inc (ARW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...