Broadridge Financial Solutions Inc. (BR): Price and Financial Metrics

BR Price/Volume Stats

| Current price | $199.00 | 52-week high | $210.24 |

| Prev. close | $198.25 | 52-week low | $133.97 |

| Day low | $198.15 | Volume | 583,400 |

| Day high | $200.00 | Avg. volume | 593,970 |

| 50-day MA | $199.25 | Dividend yield | 1.61% |

| 200-day MA | $177.31 | Market Cap | 23.44B |

BR Stock Price Chart Interactive Chart >

BR POWR Grades

- Momentum is the dimension where BR ranks best; there it ranks ahead of 96.6% of US stocks.

- BR's strongest trending metric is Momentum; it's been moving up over the last 26 weeks.

- BR's current lowest rank is in the Quality metric (where it is better than 50.63% of US stocks).

BR Stock Summary

- With a market capitalization of $23,190,584,131, BROADRIDGE FINANCIAL SOLUTIONS INC has a greater market value than 90.32% of US stocks.

- BROADRIDGE FINANCIAL SOLUTIONS INC's capital turnover -- a measure of revenue relative to shareholder's equity -- is better than 81.65% of US listed stocks.

- Of note is the ratio of BROADRIDGE FINANCIAL SOLUTIONS INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- If you're looking for stocks that are quantitatively similar to BROADRIDGE FINANCIAL SOLUTIONS INC, a group of peers worth examining would be K, LW, FDS, AVY, and GPN.

- BR's SEC filings can be seen here. And to visit BROADRIDGE FINANCIAL SOLUTIONS INC's official web site, go to www.broadridge.com.

BR Valuation Summary

- BR's price/sales ratio is 3.6; this is 33.33% higher than that of the median Technology stock.

- Over the past 203 months, BR's price/sales ratio has gone up 2.2.

Below are key valuation metrics over time for BR.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BR | 2023-12-08 | 3.6 | 10.7 | 33.6 | 26.1 |

| BR | 2023-12-07 | 3.6 | 10.7 | 33.7 | 26.2 |

| BR | 2023-12-06 | 3.6 | 10.7 | 33.6 | 26.1 |

| BR | 2023-12-05 | 3.7 | 10.8 | 34.1 | 26.5 |

| BR | 2023-12-04 | 3.7 | 10.9 | 34.2 | 26.6 |

| BR | 2023-12-01 | 3.7 | 10.9 | 34.3 | 26.6 |

BR Growth Metrics

- Its 3 year net cashflow from operations growth rate is now at -31.41%.

- Its 2 year cash and equivalents growth rate is now at -31.06%.

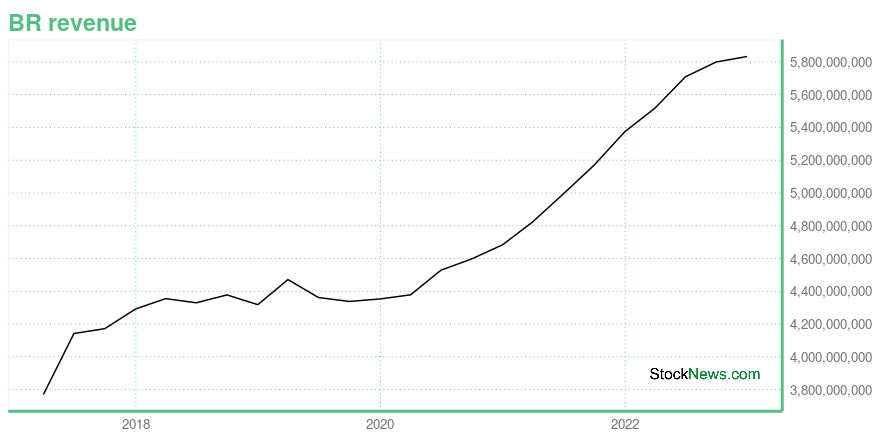

- Its 4 year revenue growth rate is now at 16.1%.

The table below shows BR's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 5,832.8 | 456.7 | 532.6 |

| 2022-09-30 | 5,799.5 | 374.4 | 522.3 |

| 2022-06-30 | 5,709.1 | 443.5 | 539.1 |

| 2022-03-31 | 5,517.8 | 436.7 | 551.4 |

| 2021-12-31 | 5,373.9 | 462.2 | 539.8 |

| 2021-09-30 | 5,169.2 | 548.9 | 548.9 |

BR's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BR has a Quality Grade of C, ranking ahead of 33.48% of graded US stocks.

- BR's asset turnover comes in at 0.789 -- ranking 188th of 563 Business Services stocks.

- BOX, PRGS, and SMSI are the stocks whose asset turnover ratios are most correlated with BR.

The table below shows BR's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.789 | 0.285 | 0.173 |

| 2021-06-30 | 0.872 | 0.285 | 0.201 |

| 2021-03-31 | 0.980 | 0.287 | 0.231 |

| 2020-12-31 | 0.965 | 0.285 | 0.236 |

| 2020-09-30 | 0.971 | 0.277 | 0.228 |

| 2020-06-30 | 0.984 | 0.279 | 0.237 |

BR Price Target

For more insight on analysts targets of BR, see our BR price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $185.14 | Average Broker Recommendation | 1.79 (Moderate Buy) |

Broadridge Financial Solutions Inc. (BR) Company Bio

Broadridge Financial Solutions is a public corporate services and financial technology company founded in 2007 as a spin-off from management software company Automatic Data Processing. Broadridge supplies public companies with proxy statements, annual reports and other financial documents, and shareholder communications solutions, such as virtual annual meetings. (Source:Wikipedia)

Latest BR News From Around the Web

Below are the latest news stories about BROADRIDGE FINANCIAL SOLUTIONS INC that investors may wish to consider to help them evaluate BR as an investment opportunity.

Reasons Why You Should Retain ABM Industries (ABM) Stock NowStrategic partnerships and the execution of the plan called ELEVATE are boding well for ABM Industries (ABM). |

Reasons Why You Should Hold on to Stericycle (SRCL) NowStericycle (SRCL) is gaining from its transformation initiative launched in 2017 and its robust acquisition strategy. |

Why This 1 Business Services Stock Could Be a Great Addition to Your PortfolioFinding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service. |

Broadridge Financial Solutions Inc Insider Sells Company SharesChristopher Perry, President of Broadridge Financial Solutions Inc (NYSE:BR), executed a sale of 9,365 shares in the company on December 26, 2023, according to a recent SEC Filing. |

Broadridge Financial Solutions (NYSE:BR) Could Be Struggling To Allocate CapitalTo find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to... |

BR Price Returns

| 1-mo | -0.50% |

| 3-mo | 12.82% |

| 6-mo | 10.32% |

| 1-year | 38.10% |

| 3-year | 46.45% |

| 5-year | 122.61% |

| YTD | -3.28% |

| 2023 | 56.23% |

| 2022 | -25.26% |

| 2021 | 21.12% |

| 2020 | 26.28% |

| 2019 | 30.59% |

BR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BR

Want to see what other sources are saying about Broadridge Financial Solutions Inc's financials and stock price? Try the links below:Broadridge Financial Solutions Inc (BR) Stock Price | Nasdaq

Broadridge Financial Solutions Inc (BR) Stock Quote, History and News - Yahoo Finance

Broadridge Financial Solutions Inc (BR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...