Regions Financial Corp. (RF): Price and Financial Metrics

RF Price/Volume Stats

| Current price | $17.89 | 52-week high | $24.02 |

| Prev. close | $17.84 | 52-week low | $13.72 |

| Day low | $17.61 | Volume | 8,686,200 |

| Day high | $17.99 | Avg. volume | 9,592,107 |

| 50-day MA | $18.47 | Dividend yield | 5.35% |

| 200-day MA | $17.80 | Market Cap | 16.64B |

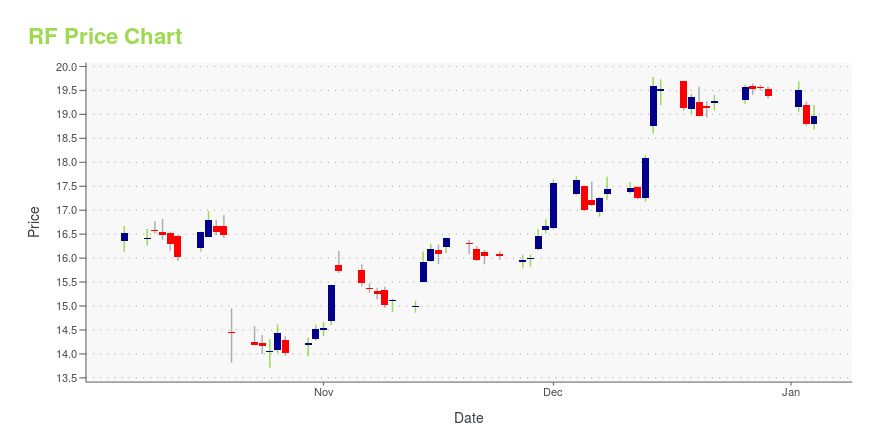

RF Stock Price Chart Interactive Chart >

RF POWR Grades

- Value is the dimension where RF ranks best; there it ranks ahead of 72.17% of US stocks.

- The strongest trend for RF is in Value, which has been heading up over the past 26 weeks.

- RF ranks lowest in Sentiment; there it ranks in the 3rd percentile.

RF Stock Summary

- RF has a market capitalization of $17,485,220,834 -- more than approximately 88.08% of US stocks.

- Equity multiplier, or assets relative to shareholders' equity, comes in at 9.43 for REGIONS FINANCIAL CORP; that's greater than it is for 88.6% of US stocks.

- With a year-over-year growth in debt of 176.6%, REGIONS FINANCIAL CORP's debt growth rate surpasses 95.08% of about US stocks.

- If you're looking for stocks that are quantitatively similar to REGIONS FINANCIAL CORP, a group of peers worth examining would be PEBO, FGBI, PB, USCB, and MPB.

- Visit RF's SEC page to see the company's official filings. To visit the company's web site, go to www.regions.com.

RF Valuation Summary

- In comparison to the median Financial Services stock, RF's price/sales ratio is 7.41% lower, now standing at 2.5.

- RF's price/sales ratio has moved down 0.5 over the prior 243 months.

Below are key valuation metrics over time for RF.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| RF | 2023-12-22 | 2.5 | 1.1 | 7.9 | 5.2 |

| RF | 2023-12-21 | 2.5 | 1.1 | 7.8 | 5.2 |

| RF | 2023-12-20 | 2.4 | 1.1 | 7.8 | 5.1 |

| RF | 2023-12-19 | 2.5 | 1.1 | 7.9 | 5.3 |

| RF | 2023-12-18 | 2.5 | 1.1 | 7.8 | 5.2 |

| RF | 2023-12-15 | 2.5 | 1.1 | 8.0 | 5.3 |

RF Growth Metrics

- Its 5 year revenue growth rate is now at -3.34%.

- The year over year net cashflow from operations growth rate now stands at 28.32%.

- The 2 year revenue growth rate now stands at 32.82%.

The table below shows RF's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 6,944 | 3,102 | 2,146 |

| 2022-09-30 | 6,579 | 2,587 | 1,900 |

| 2022-06-30 | 6,616 | 3,107 | 2,120 |

| 2022-03-31 | 6,847 | 2,895 | 2,310 |

| 2021-12-31 | 6,962 | 3,030 | 2,400 |

| 2021-09-30 | 7,162 | 2,268 | 2,574 |

RF's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- RF has a Quality Grade of C, ranking ahead of 48.22% of graded US stocks.

- RF's asset turnover comes in at 0.047 -- ranking 104th of 428 Banking stocks.

- WFC, AUB, and HWC are the stocks whose asset turnover ratios are most correlated with RF.

The table below shows RF's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.047 | 1 | 0.026 |

| 2021-06-30 | 0.046 | 1 | 0.024 |

| 2021-03-31 | 0.038 | 1 | 0.014 |

| 2020-12-31 | 0.035 | 1 | 0.009 |

| 2020-09-30 | 0.034 | 1 | 0.007 |

| 2020-06-30 | 0.034 | 1 | 0.006 |

RF Price Target

For more insight on analysts targets of RF, see our RF price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $22.67 | Average Broker Recommendation | 1.73 (Moderate Buy) |

Regions Financial Corp. (RF) Company Bio

Regions Financial Corporation is a bank holding company headquartered in the Regions Center in Birmingham, Alabama. The company provides retail banking and commercial banking, trust, stockbrokerage, and mortgage services. Its banking subsidiary, Regions Bank, operates 1,952 automated teller machines and 1,454 branches in 16 states in the Southern and Midwestern United States. (Source:Wikipedia)

Latest RF News From Around the Web

Below are the latest news stories about REGIONS FINANCIAL CORP that investors may wish to consider to help them evaluate RF as an investment opportunity.

Innovating To Lift Up CommunitiesRegions Community Development Corporation collaborated with internal partners to create technology enhancements and process improvements to better support mission-driven clients. NORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / Regions Bank By Candace ... |

How Regions Is Helping Strengthen Communities From the Ground UpNORTHAMPTON, MA / ACCESSWIRE / December 21, 2023 / Regions Bank: Affordable housing is crucial in a vibrant, growing community. But in some places, it's getting harder to find. By Jennifer Elmore The Bottom Line Affordable housing is crucial. But ... |

Service and Support: Regions Bank and the Regions Foundation Announce Tornado Response PlanCLARKSVILLE, TN / ACCESSWIRE / December 19, 2023 / Regions BankRegions Foundation funding to support community recovery; Regions Bank services designed to help people impacted by recent storms in Tennessee and Kentucky. By Jeremy King Regions Bank ... |

Regions Financial to Announce Fourth Quarter and Full-Year 2023 Financial Results on Jan. 19, 2024BIRMINGHAM, Ala., December 19, 2023--Regions Financial Corp. announced the company is scheduled to release its fourth quarter and full-year 2023 results on Friday, Jan. 19, 2024. |

Bank Stocks Cheer for Lower RatesBank stocks are enjoying the chatter about potential [interest-rate cuts](https://www.wsj.com/economy/central-banking/fed-holds-rates-steady-and-sees-cuts-next-year-4d554e9f) at the Fed. The KBW Nasdaq Bank Index of big lenders was recently up 5%, while the Regional Bank version of the index was up 4%. |

RF Price Returns

| 1-mo | -6.43% |

| 3-mo | 20.00% |

| 6-mo | -10.85% |

| 1-year | -21.30% |

| 3-year | 2.45% |

| 5-year | 41.18% |

| YTD | -7.69% |

| 2023 | -5.69% |

| 2022 | 2.33% |

| 2021 | 39.39% |

| 2020 | -1.61% |

| 2019 | 33.35% |

RF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RF

Want to do more research on Regions Financial Corp's stock and its price? Try the links below:Regions Financial Corp (RF) Stock Price | Nasdaq

Regions Financial Corp (RF) Stock Quote, History and News - Yahoo Finance

Regions Financial Corp (RF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...