Ocwen Financial Corporation NEW (OCN): Price and Financial Metrics

OCN Price/Volume Stats

| Current price | $28.57 | 52-week high | $36.97 |

| Prev. close | $28.77 | 52-week low | $21.15 |

| Day low | $28.44 | Volume | 6,800 |

| Day high | $28.77 | Avg. volume | 13,422 |

| 50-day MA | $28.83 | Dividend yield | N/A |

| 200-day MA | $28.19 | Market Cap | 219.33M |

OCN Stock Price Chart Interactive Chart >

OCN POWR Grades

- Momentum is the dimension where OCN ranks best; there it ranks ahead of 78.59% of US stocks.

- OCN's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- OCN ranks lowest in Quality; there it ranks in the 8th percentile.

OCN Stock Summary

- The ratio of debt to operating expenses for OCWEN FINANCIAL CORP is higher than it is for about 95.43% of US stocks.

- OCN's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 98.68% of US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for OCN comes in at -166.2% -- higher than that of just 2.61% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to OCWEN FINANCIAL CORP are AEL, THC, SLM, BKD, and KLXE.

- OCN's SEC filings can be seen here. And to visit OCWEN FINANCIAL CORP's official web site, go to www.ocwen.com.

OCN Valuation Summary

- In comparison to the median Financial Services stock, OCN's price/sales ratio is 92.59% lower, now standing at 0.2.

- Over the past 243 months, OCN's price/earnings ratio has gone up 58.7.

Below are key valuation metrics over time for OCN.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| OCN | 2023-12-22 | 0.2 | 0.5 | -2.4 | 32.3 |

| OCN | 2023-12-21 | 0.2 | 0.5 | -2.4 | 32.3 |

| OCN | 2023-12-20 | 0.2 | 0.5 | -2.4 | 32.3 |

| OCN | 2023-12-19 | 0.2 | 0.5 | -2.4 | 32.3 |

| OCN | 2023-12-18 | 0.2 | 0.5 | -2.3 | 32.3 |

| OCN | 2023-12-15 | 0.2 | 0.5 | -2.3 | 32.3 |

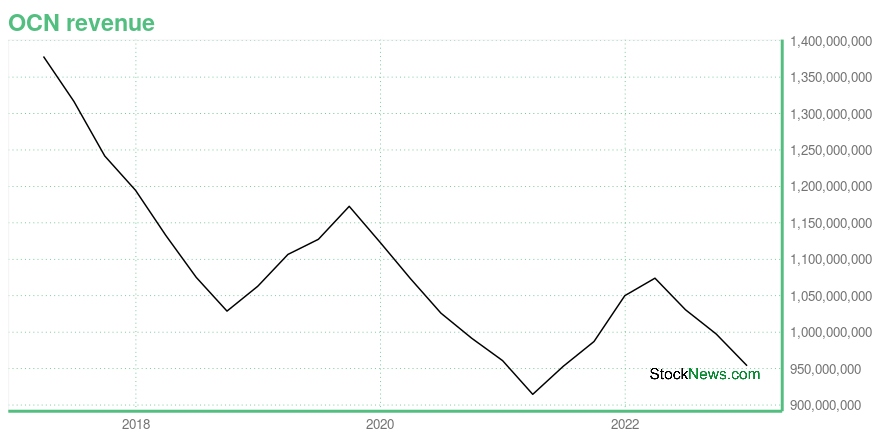

OCN Growth Metrics

- Its 5 year net income to common stockholders growth rate is now at -1.62%.

- Its 5 year net cashflow from operations growth rate is now at -47.01%.

- Its year over year revenue growth rate is now at 17.43%.

The table below shows OCN's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 953.9 | 173.2 | 25.7 |

| 2022-09-30 | 997.403 | 200.295 | 103.68 |

| 2022-06-30 | 1,030.782 | 42.956 | 88.293 |

| 2022-03-31 | 1,074.068 | -155.774 | 67.617 |

| 2021-12-31 | 1,050.099 | -472.155 | 18.078 |

| 2021-09-30 | 987.151 | -399.901 | 12.55 |

OCN's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- OCN has a Quality Grade of F, ranking ahead of 2.74% of graded US stocks.

- OCN's asset turnover comes in at 0.087 -- ranking 54th of 428 Banking stocks.

- FRBK, FCNCA, and BCOR are the stocks whose asset turnover ratios are most correlated with OCN.

The table below shows OCN's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.087 | 1 | 0.014 |

| 2021-03-31 | 0.087 | 1 | 0.015 |

| 2020-12-31 | 0.093 | 1 | 0.008 |

| 2020-09-30 | 0.096 | 1 | 0.011 |

| 2020-06-30 | 0.101 | 1 | 0.021 |

| 2020-03-31 | 0.107 | 1 | 0.015 |

OCN Price Target

For more insight on analysts targets of OCN, see our OCN price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $39.33 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Ocwen Financial Corporation NEW (OCN) Company Bio

Ocwen Financial engages in servicing and origination of mortgage loans in the United States. Its Servicing segment provides residential and commercial mortgage loan servicing, special servicing, and asset management services to owners of mortgage loans and foreclosed real estate. The company was founded in 1988 and is based in Atlanta, Georgia.

Latest OCN News From Around the Web

Below are the latest news stories about OCWEN FINANCIAL CORP that investors may wish to consider to help them evaluate OCN as an investment opportunity.

Zacks Industry Outlook Highlights Federal Agricultural Mortgage, LendingTree and Ocwen FinancialFederal Agricultural Mortgage, LendingTree and Ocwen Financial have been highlighted in this Industry Outlook article. |

3 Mortgage & Related Services Stocks to Watch Amid Ongoing WoesDespite high mortgage rates and low origination volumes, AGM, TREE and OCN are set to hold ground on robust servicing opportunities and a focus on improving operating leverage. |

Why Fast-paced Mover Ocwen (OCN) Is a Great Choice for Value InvestorsOcwen (OCN) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

Ocwen Financial Corporation (NYSE:OCN) is definitely on the radar of institutional investors who own 48% of the companyKey Insights Significantly high institutional ownership implies Ocwen Financial's stock price is sensitive to their... |

PHH Mortgage Announces New Subservicing Agreement With Zillow Home LoansAgreement expands existing correspondent relationship to strategic servicing partner Initial onboarding of loans completed in August 2023 WEST PALM BEACH, Fla., Nov. 13, 2023 (GLOBE NEWSWIRE) -- PHH Mortgage Corporation (“PHH” or the “Company”), a subsidiary of Ocwen Financial Corporation (NYSE: OCN) and a leading non-bank mortgage servicer and originator, today announced that it has entered into a mortgage subservicing agreement with Zillow Home Loans, LLC (“Zillow Home Loans”). Earlier this ye |

OCN Price Returns

| 1-mo | -1.14% |

| 3-mo | 19.14% |

| 6-mo | -6.85% |

| 1-year | -18.88% |

| 3-year | 0.25% |

| 5-year | 5.23% |

| YTD | -7.12% |

| 2023 | 0.59% |

| 2022 | -23.49% |

| 2021 | 38.26% |

| 2020 | 40.68% |

| 2019 | 2.24% |

Continue Researching OCN

Want to see what other sources are saying about Ocwen Financial Corp's financials and stock price? Try the links below:Ocwen Financial Corp (OCN) Stock Price | Nasdaq

Ocwen Financial Corp (OCN) Stock Quote, History and News - Yahoo Finance

Ocwen Financial Corp (OCN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...