City Office REIT, Inc. (CIO): Price and Financial Metrics

CIO Price/Volume Stats

| Current price | $4.73 | 52-week high | $9.78 |

| Prev. close | $4.61 | 52-week low | $3.45 |

| Day low | $4.61 | Volume | 144,600 |

| Day high | $4.79 | Avg. volume | 271,385 |

| 50-day MA | $5.70 | Dividend yield | 8.6% |

| 200-day MA | $5.06 | Market Cap | 188.91M |

CIO Stock Price Chart Interactive Chart >

CIO POWR Grades

- CIO scores best on the Sentiment dimension, with a Sentiment rank ahead of 94.99% of US stocks.

- The strongest trend for CIO is in Growth, which has been heading up over the past 26 weeks.

- CIO's current lowest rank is in the Quality metric (where it is better than 20.82% of US stocks).

CIO Stock Summary

- Of note is the ratio of CITY OFFICE REIT INC's sales and general administrative expense to its total operating expenses; only 5.46% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for CITY OFFICE REIT INC is higher than it is for about 88.41% of US stocks.

- Over the past twelve months, CIO has reported earnings growth of -95.88%, putting it ahead of merely 13.8% of US stocks in our set.

- If you're looking for stocks that are quantitatively similar to CITY OFFICE REIT INC, a group of peers worth examining would be HPP, GSL, INN, PGRE, and MPLN.

- Visit CIO's SEC page to see the company's official filings. To visit the company's web site, go to www.cityofficereit.com.

CIO Valuation Summary

- In comparison to the median Real Estate stock, CIO's EV/EBIT ratio is 44.93% higher, now standing at 42.9.

- CIO's price/sales ratio has moved down 2.6 over the prior 118 months.

Below are key valuation metrics over time for CIO.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CIO | 2023-12-29 | 1.4 | 0.3 | -12.3 | 42.9 |

| CIO | 2023-12-28 | 1.4 | 0.3 | -12.5 | 43.1 |

| CIO | 2023-12-27 | 1.4 | 0.3 | -12.5 | 43.1 |

| CIO | 2023-12-26 | 1.4 | 0.3 | -12.5 | 43.1 |

| CIO | 2023-12-22 | 1.4 | 0.3 | -12.6 | 43.2 |

| CIO | 2023-12-21 | 1.4 | 0.3 | -12.9 | 43.5 |

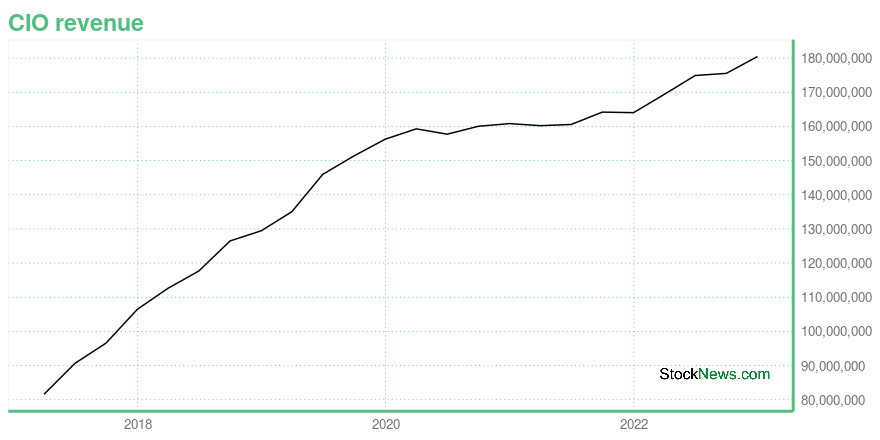

CIO Growth Metrics

- The 3 year net cashflow from operations growth rate now stands at 67.46%.

- Its 2 year revenue growth rate is now at 6.33%.

- Its 2 year net income to common stockholders growth rate is now at 12304.85%.

The table below shows CIO's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 180.485 | 106.677 | 9.57 |

| 2022-09-30 | 175.544 | 104.643 | 455.038 |

| 2022-06-30 | 174.911 | 112.506 | 453.915 |

| 2022-03-31 | 169.377 | 72.357 | 452.678 |

| 2021-12-31 | 164.041 | 73.222 | 476.975 |

| 2021-09-30 | 164.209 | 78.023 | 44.298 |

CIO's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CIO has a Quality Grade of C, ranking ahead of 41.78% of graded US stocks.

- CIO's asset turnover comes in at 0.145 -- ranking 128th of 444 Trading stocks.

- CIM, BX, and CG are the stocks whose asset turnover ratios are most correlated with CIO.

The table below shows CIO's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.145 | 0.646 | 0.046 |

| 2021-06-30 | 0.141 | 0.640 | 0.048 |

| 2021-03-31 | 0.138 | 0.640 | 0.047 |

| 2020-12-31 | 0.133 | 0.637 | 0.018 |

| 2020-09-30 | 0.130 | 0.636 | 0.020 |

| 2020-06-30 | 0.128 | 0.634 | 0.018 |

CIO Price Target

For more insight on analysts targets of CIO, see our CIO price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $17.67 | Average Broker Recommendation | 1.57 (Moderate Buy) |

City Office REIT, Inc. (CIO) Company Bio

City Office REIT, Inc is an equity real estate investment trust. The fund invests in the real estate markets of the United States. It acquires, own and operate high-quality office properties. The company was founded in 2013 and is based in Vancouver, BC.

Latest CIO News From Around the Web

Below are the latest news stories about CITY OFFICE REIT INC that investors may wish to consider to help them evaluate CIO as an investment opportunity.

City Office REIT declares $0.10 dividendMore on City Office REIT |

City Office REIT Announces Dividends for Fourth Quarter 2023City Office REIT, Inc. (NYSE: CIO) ("City Office," "CIO" or the "Company") announced today that its Board of Directors has authorized a quarterly dividend amount of $0.10 per share of common stock and common unit of partnership interest for the fourth quarter of 2023. |

Low-Priced Office REITs Are On Fire This WeekOn Nov. 14, when the October consumer price index (CPI) came in flat, real estate investment trust (REIT) investors rejoiced. Inflation and the subsequent resulting higher interest rates have led to the slashing of REIT share prices since April 2022. But the weaker-than-expected CPI reading this week most likely means there will be no Federal Reserve rate hike in December and raises hopes for an interest rate cut or two in 2024. Although all REITs were up big this week on the news, office REITs |

City Office REIT, Inc. (NYSE:CIO) Q3 2023 Earnings Call TranscriptCity Office REIT, Inc. (NYSE:CIO) Q3 2023 Earnings Call Transcript November 9, 2023 City Office REIT, Inc. misses on earnings expectations. Reported EPS is $-0.05 EPS, expectations were $0.33. Operator: Good morning, and welcome to the City Office REIT, Inc. Third Quarter 2023 Earnings Conference Call. [Operator Instructions]. As a reminder this conference call is […] |

City Office REIT Inc (CIO) Reports Solid Q3 2023 Results Amidst Challenging Market ConditionsLeasing Demand and Portfolio Strength Drive Performance |

CIO Price Returns

| 1-mo | -24.56% |

| 3-mo | 15.79% |

| 6-mo | -4.80% |

| 1-year | -46.40% |

| 3-year | -43.53% |

| 5-year | -43.25% |

| YTD | -21.35% |

| 2023 | -19.70% |

| 2022 | -54.98% |

| 2021 | 112.07% |

| 2020 | -22.24% |

| 2019 | 42.43% |

CIO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CIO

Want to see what other sources are saying about City Office REIT Inc's financials and stock price? Try the links below:City Office REIT Inc (CIO) Stock Price | Nasdaq

City Office REIT Inc (CIO) Stock Quote, History and News - Yahoo Finance

City Office REIT Inc (CIO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...