Alexandria Real Estate Equities Inc. (ARE): Price and Financial Metrics

ARE Price/Volume Stats

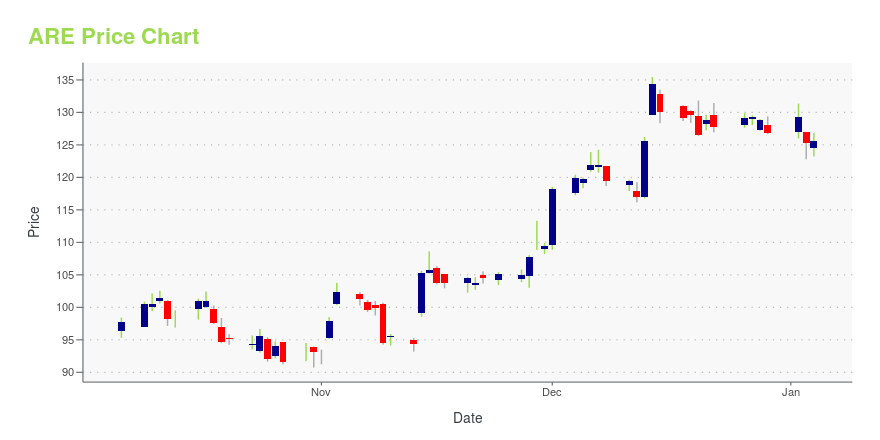

| Current price | $117.90 | 52-week high | $167.72 |

| Prev. close | $117.22 | 52-week low | $90.73 |

| Day low | $116.48 | Volume | 1,028,000 |

| Day high | $118.89 | Avg. volume | 1,115,867 |

| 50-day MA | $123.36 | Dividend yield | 4.3% |

| 200-day MA | $114.86 | Market Cap | 20.63B |

ARE Stock Price Chart Interactive Chart >

ARE POWR Grades

- ARE scores best on the Growth dimension, with a Growth rank ahead of 75.28% of US stocks.

- The strongest trend for ARE is in Growth, which has been heading up over the past 26 weeks.

- ARE's current lowest rank is in the Value metric (where it is better than 11.26% of US stocks).

ARE Stock Summary

- ARE has a higher market value than 89.82% of US stocks; more precisely, its current market capitalization is $21,782,753,410.

- ARE's current price/earnings ratio is 92.24, which is higher than 93.29% of US stocks with positive earnings.

- For ARE, its debt to operating expenses ratio is greater than that reported by 95.73% of US equities we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to ALEXANDRIA REAL ESTATE EQUITIES INC are REXR, SBAC, REG, DOC, and UDR.

- ARE's SEC filings can be seen here. And to visit ALEXANDRIA REAL ESTATE EQUITIES INC's official web site, go to www.are.com.

ARE Valuation Summary

- In comparison to the median Real Estate stock, ARE's price/earnings ratio is 202.43% higher, now standing at 93.3.

- ARE's EV/EBIT ratio has moved up 84.9 over the prior 243 months.

Below are key valuation metrics over time for ARE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| ARE | 2023-12-29 | 7.9 | 1.2 | 93.3 | 106.7 |

| ARE | 2023-12-28 | 8.0 | 1.2 | 94.8 | 107.9 |

| ARE | 2023-12-27 | 8.0 | 1.2 | 95.1 | 108.1 |

| ARE | 2023-12-26 | 8.0 | 1.2 | 95.0 | 108.0 |

| ARE | 2023-12-22 | 7.9 | 1.2 | 94.0 | 107.3 |

| ARE | 2023-12-21 | 8.0 | 1.2 | 94.8 | 107.9 |

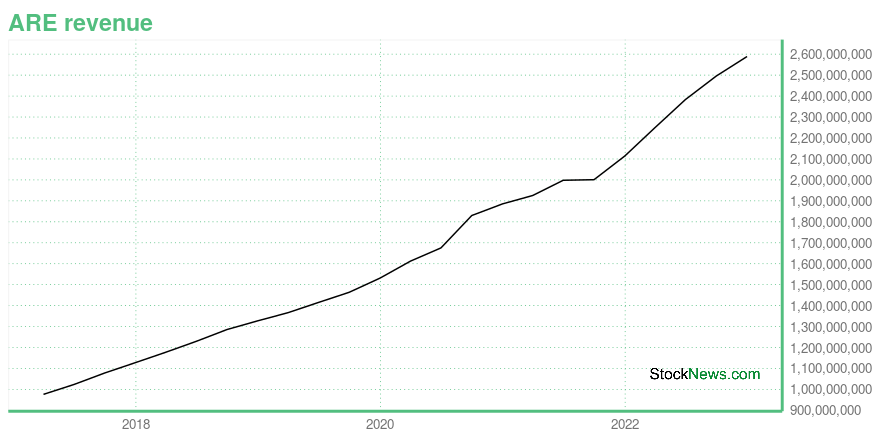

ARE Growth Metrics

- The 3 year cash and equivalents growth rate now stands at 175.54%.

- The 5 year net cashflow from operations growth rate now stands at 85.44%.

- Its 3 year revenue growth rate is now at 64.65%.

The table below shows ARE's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,588.962 | 1,294.321 | 513.268 |

| 2022-09-30 | 2,495.604 | 1,142.718 | 531.866 |

| 2022-06-30 | 2,383.511 | 1,088.503 | 291.691 |

| 2022-03-31 | 2,249.366 | 989.23 | 402.974 |

| 2021-12-31 | 2,114.15 | 1,010.197 | 563.399 |

| 2021-09-30 | 2,000.947 | 934.206 | 924.554 |

ARE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- ARE has a Quality Grade of C, ranking ahead of 29.61% of graded US stocks.

- ARE's asset turnover comes in at 0.077 -- ranking 268th of 444 Trading stocks.

- PIPR, BSIG, and MKTX are the stocks whose asset turnover ratios are most correlated with ARE.

The table below shows ARE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.077 | 0.708 | 0.032 |

| 2021-06-30 | 0.082 | 0.720 | 0.033 |

| 2021-03-31 | 0.086 | 0.720 | 0.031 |

| 2020-12-31 | 0.089 | 0.719 | 0.033 |

| 2020-09-30 | 0.091 | 0.718 | 0.026 |

| 2020-06-30 | 0.089 | 0.707 | 0.023 |

ARE Price Target

For more insight on analysts targets of ARE, see our ARE price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $216.68 | Average Broker Recommendation | 1.32 (Strong Buy) |

Alexandria Real Estate Equities Inc. (ARE) Company Bio

Alexandria Real Estate Equities, Inc. is an American real estate investment trust that invests in office buildings and laboratories leased to tenants in the life science and technology industries. (Source:Wikipedia)

Latest ARE News From Around the Web

Below are the latest news stories about ALEXANDRIA REAL ESTATE EQUITIES INC that investors may wish to consider to help them evaluate ARE as an investment opportunity.

Is It Too Late to Buy These 2 Brilliant Passive Income Stocks?With generous yields and beaten-down shares, investors still have time to buy these two passive income stocks. |

Alexandria (ARE) Inks Leases at its Campuses Amid Solid DemandAmid the booming demand for life-science assets, Alexandria (ARE) inks leases with Novo Nordisk and CARGO at its mega campuses in Greater Boston and San Carlos in the San Francisco Bay Area. |

3 Real Estate Stocks Still Worth Buying in Today’s Uncertain Housing MarketThere are still benefits to investing in real estate stocks. |

Insider Sell Alert: Co-President Daniel Ryan Sells 10,000 Shares of Alexandria Real Estate ...In the realm of real estate investment trusts (REITs), insider transactions are closely monitored for insights into the company's financial health and management's confidence in the firm's future prospects. |

3 Stocks Wall Street Bulls Are Betting On Big-TimeIt’s not easy finding Wall Street’s favorite stocks. |

ARE Price Returns

| 1-mo | -8.13% |

| 3-mo | 24.47% |

| 6-mo | -1.26% |

| 1-year | -25.74% |

| 3-year | -23.71% |

| 5-year | 3.62% |

| YTD | -7.00% |

| 2023 | -9.11% |

| 2022 | -32.63% |

| 2021 | 28.09% |

| 2020 | 13.27% |

| 2019 | 44.04% |

ARE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ARE

Here are a few links from around the web to help you further your research on Alexandria Real Estate Equities Inc's stock as an investment opportunity:Alexandria Real Estate Equities Inc (ARE) Stock Price | Nasdaq

Alexandria Real Estate Equities Inc (ARE) Stock Quote, History and News - Yahoo Finance

Alexandria Real Estate Equities Inc (ARE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...