Welltower Inc. (WELL): Price and Financial Metrics

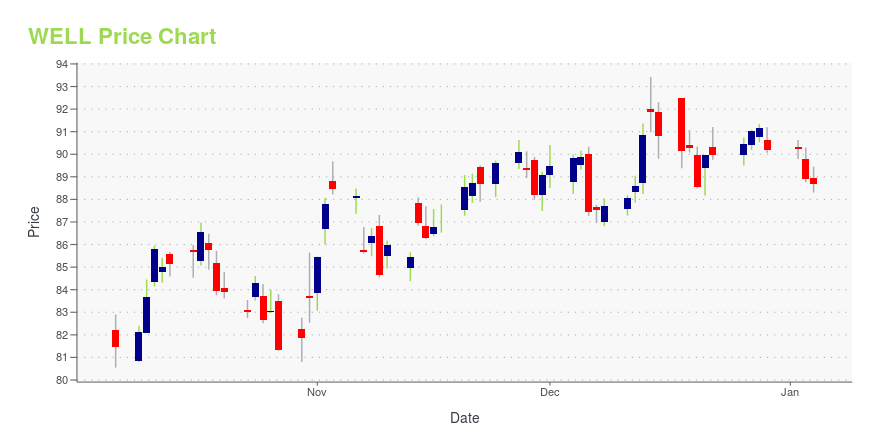

WELL Price/Volume Stats

| Current price | $86.98 | 52-week high | $93.42 |

| Prev. close | $86.76 | 52-week low | $65.18 |

| Day low | $85.96 | Volume | 2,161,800 |

| Day high | $87.43 | Avg. volume | 2,290,115 |

| 50-day MA | $89.02 | Dividend yield | 2.82% |

| 200-day MA | $83.53 | Market Cap | 48.14B |

WELL Stock Price Chart Interactive Chart >

WELL POWR Grades

- Sentiment is the dimension where WELL ranks best; there it ranks ahead of 96.51% of US stocks.

- The strongest trend for WELL is in Stability, which has been heading down over the past 26 weeks.

- WELL ranks lowest in Quality; there it ranks in the 8th percentile.

WELL Stock Summary

- WELL's one year PEG ratio, measuring expected growth in earnings next year relative to current common stock price is 1,097.66 -- higher than 96.96% of US-listed equities with positive expected earnings growth.

- With a price/earnings ratio of 188.76, WELLTOWER INC P/E ratio is greater than that of about 96.92% of stocks in our set with positive earnings.

- Of note is the ratio of WELLTOWER INC's sales and general administrative expense to its total operating expenses; only 3.72% of US stocks have a lower such ratio.

- If you're looking for stocks that are quantitatively similar to WELLTOWER INC, a group of peers worth examining would be NTST, BRSP, O, CWEN, and ARE.

- WELL's SEC filings can be seen here. And to visit WELLTOWER INC's official web site, go to www.welltower.com.

WELL Valuation Summary

- In comparison to the median Real Estate stock, WELL's price/sales ratio is 56.25% higher, now standing at 7.5.

- Over the past 243 months, WELL's price/sales ratio has gone down 1.9.

Below are key valuation metrics over time for WELL.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| WELL | 2023-12-29 | 7.5 | 2.1 | 191.4 | 72.5 |

| WELL | 2023-12-28 | 7.6 | 2.1 | 193.5 | 73.1 |

| WELL | 2023-12-27 | 7.6 | 2.1 | 193.3 | 73.0 |

| WELL | 2023-12-26 | 7.6 | 2.1 | 192.0 | 72.7 |

| WELL | 2023-12-22 | 7.5 | 2.1 | 191.0 | 72.4 |

| WELL | 2023-12-21 | 7.5 | 2.1 | 191.0 | 72.3 |

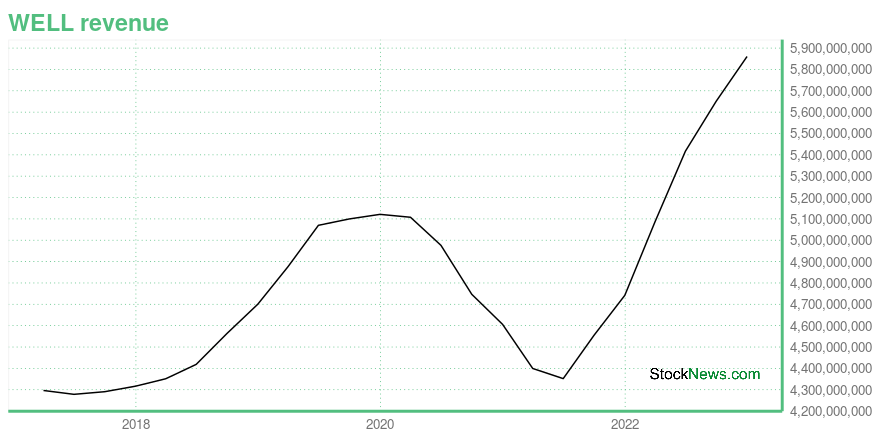

WELL Growth Metrics

- Its 3 year net cashflow from operations growth rate is now at -16.87%.

- Its 3 year revenue growth rate is now at 4.31%.

- Its 3 year net income to common stockholders growth rate is now at -45.68%.

The table below shows WELL's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 5,860.615 | 1,328.708 | 141.214 |

| 2022-09-30 | 5,651.348 | 1,358.652 | 203.614 |

| 2022-06-30 | 5,417.301 | 1,355.743 | 390.044 |

| 2022-03-31 | 5,085.757 | 1,296.187 | 326.517 |

| 2021-12-31 | 4,742.115 | 1,275.325 | 336.138 |

| 2021-09-30 | 4,554.867 | 1,247.167 | 441.195 |

WELL's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- WELL has a Quality Grade of D, ranking ahead of 13.13% of graded US stocks.

- WELL's asset turnover comes in at 0.134 -- ranking 139th of 444 Trading stocks.

- RLJ, FCRD, and TCPC are the stocks whose asset turnover ratios are most correlated with WELL.

The table below shows WELL's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.134 | 0.422 | 0.024 |

| 2021-03-31 | 0.134 | 0.424 | 0.028 |

| 2020-12-31 | 0.141 | 0.436 | 0.033 |

| 2020-09-30 | 0.144 | 0.444 | 0.034 |

| 2020-06-30 | 0.152 | 0.465 | 0.040 |

| 2020-03-31 | 0.156 | 0.471 | 0.039 |

Welltower Inc. (WELL) Company Bio

Welltower Inc. is a real estate investment trust that invests in healthcare infrastructure. It ranked 561st on the Fortune 1000 in 2021, and is a component of the S&P 500. As of early 2021, the firm had an enterprise value of $50 billion and is the world's largest healthcare real estate investment trust. (Source:Wikipedia)

Latest WELL News From Around the Web

Below are the latest news stories about WELLTOWER INC that investors may wish to consider to help them evaluate WELL as an investment opportunity.

JP Morgan Upgrades Six REITs To Start The WeekWith real estate investment trusts (REITs) showing strength following the Federal Reserve's recent announcement of three possible rate cuts in 2024, analysts are scurrying to update their ratings on REITs. A positive start to the week was solidified by two analysts at JP Morgan upgrading six REITs from a cross-section of REIT subsectors. All six REITs were upgraded from Neutral to Overweight. Take a look at the six REITs receiving upgrades this week. EPR Properties (NYSE:EPR) is a Kansas City, M |

November’s Surprising Sector WinnerReal estate investment trusts (REITs), which have been beaten down by surging interest rates and economic uncertainty, are now showing signs of strength. |

7 Top-Rated Growth Stocks That Analysts Are Loving NowAs the market rally continues to build steam, you may be looking for top-rated growth stocks now. |

Why Is Welltower (WELL) Up 6.8% Since Last Earnings Report?Welltower (WELL) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Shopify downgraded to Underweight at Piper Sandler: 4 big analyst cutsHere is your Pro Recap of the biggest analyst cuts you may have missed since yesterday: downgrades at Shopify, ChargePoint, Welltower, and American Axle & Manufacturing. Unlock the potential of InvestingPro for up to 55% off this Cyber Monday and never miss out on a market winner again. Shopify (NYSE:SHOP) fell more than 2% pre-market today after Piper Sandler downgraded the company to Underweight from Neutral and cut its price target to $56.00 from $58.00, as reported in real-time on InvestingPro. |

WELL Price Returns

| 1-mo | -2.91% |

| 3-mo | 1.89% |

| 6-mo | 4.72% |

| 1-year | 19.54% |

| 3-year | 50.97% |

| 5-year | 35.27% |

| YTD | -3.54% |

| 2023 | 41.79% |

| 2022 | -21.18% |

| 2021 | 36.98% |

| 2020 | -17.19% |

| 2019 | 23.04% |

WELL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WELL

Want to do more research on Welltower Inc's stock and its price? Try the links below:Welltower Inc (WELL) Stock Price | Nasdaq

Welltower Inc (WELL) Stock Quote, History and News - Yahoo Finance

Welltower Inc (WELL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...