Medical Properties Trust, Inc. common stock (MPW): Price and Financial Metrics

MPW Price/Volume Stats

| Current price | $3.28 | 52-week high | $13.14 |

| Prev. close | $3.26 | 52-week low | $2.92 |

| Day low | $3.22 | Volume | 13,735,000 |

| Day high | $3.38 | Avg. volume | 27,995,512 |

| 50-day MA | $4.16 | Dividend yield | 18.93% |

| 200-day MA | $6.53 | Market Cap | 1.96B |

MPW Stock Price Chart Interactive Chart >

MPW POWR Grades

- Growth is the dimension where MPW ranks best; there it ranks ahead of 73.43% of US stocks.

- MPW's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- MPW's current lowest rank is in the Sentiment metric (where it is better than 5.07% of US stocks).

MPW Stock Summary

- Of note is the ratio of MEDICAL PROPERTIES TRUST INC's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- For MPW, its debt to operating expenses ratio is greater than that reported by 98.56% of US equities we're observing.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for MPW comes in at 14.15% -- higher than that of 88.13% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to MEDICAL PROPERTIES TRUST INC are GHI, BNL, AIU, ASR, and GAIN.

- MPW's SEC filings can be seen here. And to visit MEDICAL PROPERTIES TRUST INC's official web site, go to www.medicalpropertiestrust.com.

MPW Valuation Summary

- MPW's EV/EBIT ratio is 52; this is 75.68% higher than that of the median Real Estate stock.

- Over the past 225 months, MPW's price/sales ratio has gone down 15.8.

Below are key valuation metrics over time for MPW.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MPW | 2023-12-29 | 2.1 | 0.4 | -89.1 | 52.0 |

| MPW | 2023-12-28 | 2.2 | 0.4 | -92.2 | 52.4 |

| MPW | 2023-12-27 | 2.1 | 0.4 | -88.9 | 51.9 |

| MPW | 2023-12-26 | 2.1 | 0.4 | -89.1 | 52.0 |

| MPW | 2023-12-22 | 2.1 | 0.4 | -89.3 | 52.0 |

| MPW | 2023-12-21 | 2.2 | 0.4 | -89.7 | 52.0 |

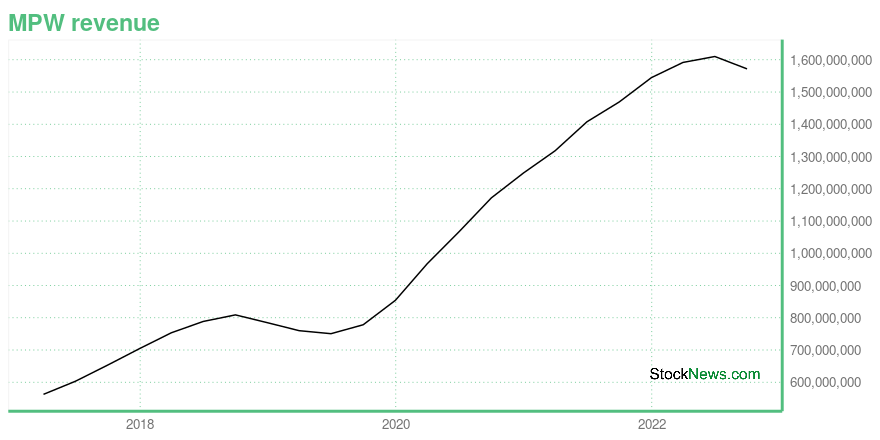

MPW Growth Metrics

- Its 2 year cash and equivalents growth rate is now at -50.25%.

- Its year over year net cashflow from operations growth rate is now at 14.71%.

- Its 3 year net income to common stockholders growth rate is now at 12.18%.

The table below shows MPW's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 1,571.698 | 792.084 | 1,249.607 |

| 2022-06-30 | 1,610.138 | 790.414 | 1,198.951 |

| 2022-03-31 | 1,591.704 | 802.313 | 1,123.919 |

| 2021-12-31 | 1,544.669 | 811.656 | 656.021 |

| 2021-09-30 | 1,469.142 | 752.905 | 559.369 |

| 2021-06-30 | 1,407.821 | 693.828 | 519.338 |

MPW's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MPW has a Quality Grade of C, ranking ahead of 41.82% of graded US stocks.

- MPW's asset turnover comes in at 0.08 -- ranking 258th of 444 Trading stocks.

- STAG, JEF, and TCI are the stocks whose asset turnover ratios are most correlated with MPW.

The table below shows MPW's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.080 | 0.766 | 0.036 |

| 2021-03-31 | 0.079 | 0.768 | 0.035 |

| 2020-12-31 | 0.079 | 0.769 | 0.033 |

| 2020-09-30 | 0.077 | 0.773 | 0.035 |

| 2020-06-30 | 0.074 | 0.779 | 0.034 |

| 2020-03-31 | 0.074 | 0.787 | 0.035 |

MPW Price Target

For more insight on analysts targets of MPW, see our MPW price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $23.46 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Medical Properties Trust, Inc. common stock (MPW) Company Bio

Medical Properties Trust is a self-advised real estate investment trust formed to capitalize on the changing trends in healthcare delivery by acquiring and developing net-leased healthcare facilities. The company was founded in 2003 and is based in Birmingham, Alabama.

Latest MPW News From Around the Web

Below are the latest news stories about MEDICAL PROPERTIES TRUST INC that investors may wish to consider to help them evaluate MPW as an investment opportunity.

3 Lower-Priced REITs With Higher Yields Seeing Renewed BuyingOn Dec. 13, a major change in investor sentiment toward real estate investment trusts (REITs) took place as the Federal Reserve announced another pause in interest rate hikes and suggested there would be three rate cuts in 2024. The REIT sector, which has performed well since early November, took off for several days, before pulling back after Dec. 14. Many low-priced REITs that have been laggards throughout the first 10 months of 2023 are now seeing renewed buying. It seems like investors are b |

2 High-Yield Dividend Stocks That Could Climb 29% and 24% in 2024, According to Wall Street.These dividend payers offer attention-getting yields and a chance for significant growth of your principal investment. |

Why I Recently Bet Another $800 That This Beleaguered High-Yield Dividend Stock Will Turn Things AroundI am convinced that Medical Properties Trust will get through its current rough patch. |

13 Penny Stocks that Captured the Attention of BillionairesIn this article, we will take a detailed look at the 13 Penny Stocks that Captured the Attention of Billionaires. For a quick overview of such stocks, read our article 5 Penny Stocks that Captured the Attention of Billionaires. Investors are jubilant after the Fed’s clear signal that it would begin cutting interest rates in 2024. Markets have remained under […] |

Why Medical Properties Trust Stock Is Soaring TodayInvestors continue to react to news that the Fed could cut interest rates next year. |

MPW Price Returns

| 1-mo | -10.38% |

| 3-mo | -20.31% |

| 6-mo | -57.20% |

| 1-year | -70.03% |

| 3-year | -81.06% |

| 5-year | -74.60% |

| YTD | -33.20% |

| 2023 | -50.35% |

| 2022 | -49.03% |

| 2021 | 14.30% |

| 2020 | 8.94% |

| 2019 | 38.54% |

MPW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MPW

Want to do more research on Medical Properties Trust Inc's stock and its price? Try the links below:Medical Properties Trust Inc (MPW) Stock Price | Nasdaq

Medical Properties Trust Inc (MPW) Stock Quote, History and News - Yahoo Finance

Medical Properties Trust Inc (MPW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...