Healthpeak Properties Inc. (PEAK): Price and Financial Metrics

PEAK Price/Volume Stats

| Current price | $17.99 | 52-week high | $27.00 |

| Prev. close | $17.87 | 52-week low | $15.24 |

| Day low | $17.78 | Volume | 6,994,000 |

| Day high | $18.12 | Avg. volume | 5,517,893 |

| 50-day MA | $19.17 | Dividend yield | 6.74% |

| 200-day MA | $19.45 | Market Cap | 9.84B |

PEAK Stock Price Chart Interactive Chart >

PEAK POWR Grades

- Growth is the dimension where PEAK ranks best; there it ranks ahead of 91.97% of US stocks.

- The strongest trend for PEAK is in Growth, which has been heading up over the past 26 weeks.

- PEAK ranks lowest in Quality; there it ranks in the 29th percentile.

PEAK Stock Summary

- HEALTHPEAK PROPERTIES INC's stock had its IPO on November 5, 1987, making it an older stock than 90.86% of US equities in our set.

- Of note is the ratio of HEALTHPEAK PROPERTIES INC's sales and general administrative expense to its total operating expenses; only 5.01% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for HEALTHPEAK PROPERTIES INC is higher than it is for about 88.78% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to HEALTHPEAK PROPERTIES INC are STAG, AMH, CPT, SITC, and OHI.

- Visit PEAK's SEC page to see the company's official filings. To visit the company's web site, go to www.healthpeak.com.

PEAK Valuation Summary

- In comparison to the median Real Estate stock, PEAK's price/earnings ratio is 46.52% higher, now standing at 45.2.

- PEAK's EV/EBIT ratio has moved up 19.9 over the prior 243 months.

Below are key valuation metrics over time for PEAK.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PEAK | 2023-12-29 | 5.0 | 1.7 | 45.2 | 40.0 |

| PEAK | 2023-12-28 | 5.1 | 1.7 | 46.0 | 40.4 |

| PEAK | 2023-12-27 | 5.1 | 1.7 | 45.7 | 40.2 |

| PEAK | 2023-12-26 | 5.1 | 1.7 | 45.5 | 40.2 |

| PEAK | 2023-12-22 | 5.0 | 1.7 | 44.9 | 39.8 |

| PEAK | 2023-12-21 | 4.9 | 1.6 | 44.2 | 39.5 |

PEAK Growth Metrics

- The year over year net cashflow from operations growth rate now stands at 10.25%.

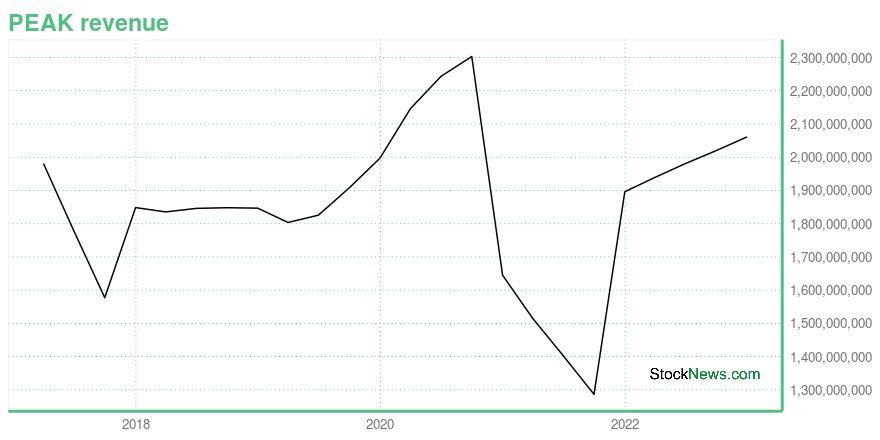

- Its 3 year revenue growth rate is now at 7.52%.

- Its 2 year net income to common stockholders growth rate is now at 64.56%.

The table below shows PEAK's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 2,061.178 | 900.261 | 497.792 |

| 2022-09-30 | 2,019.915 | 917.219 | 519.553 |

| 2022-06-30 | 1,980.974 | 885.322 | 220.629 |

| 2022-03-31 | 1,939.28 | 866.705 | 428.565 |

| 2021-12-31 | 1,896.184 | 795.248 | 502.271 |

| 2021-09-30 | 1,286.525 | 790.042 | 619.901 |

PEAK's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PEAK has a Quality Grade of D, ranking ahead of 20.57% of graded US stocks.

- PEAK's asset turnover comes in at 0.092 -- ranking 230th of 444 Trading stocks.

- NYC, CG, and PW are the stocks whose asset turnover ratios are most correlated with PEAK.

The table below shows PEAK's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.092 | 0.670 | 0.035 |

| 2021-03-31 | 0.096 | 0.612 | 0.024 |

| 2020-12-31 | 0.103 | 0.524 | 0.029 |

| 2020-09-30 | 0.148 | 0.455 | 0.025 |

| 2020-06-30 | 0.148 | 0.470 | 0.025 |

| 2020-03-31 | 0.148 | 0.494 | 0.022 |

Healthpeak Properties Inc. (PEAK) Company Bio

Healthpeak Properties, Inc. is a real estate investment trust that invests in real estate related to the healthcare industry including senior housing, life science, and medical offices. It is organized in Maryland and headquartered in Denver, Colorado with offices in Nashville and San Francisco. As of December 31, 2019, the company owned interests in 617 properties. (Source:Wikipedia)

Latest PEAK News From Around the Web

Below are the latest news stories about HEALTHPEAK PROPERTIES INC that investors may wish to consider to help them evaluate PEAK as an investment opportunity.

Top 3 Real Estate Stock Picks for the New YearReal estate stocks are set to top the charts in 2024 since they typically outperform standard stocks after a Fed tightening cycle ends. |

Healthpeak Properties Receives Entitlements for an Additional 1.3 Million Square Feet of Development at the Vantage Campus in South San FranciscoDENVER, December 19, 2023--Healthpeak Properties, Inc. (NYSE: PEAK) ("Healthpeak"), a leading owner, operator, and developer of real estate for healthcare discovery and delivery, today announced it has received approval of entitlements for Phases II and III of its purpose-built lab development campus, Vantage, in South San Francisco. |

Judith A. Reinsdorf and Katherine M. Sandstrom Named to Toll Brothers Board of DirectorsFORT WASHINGTON, Pa., Dec. 13, 2023 (GLOBE NEWSWIRE) -- Toll Brothers, Inc. (NYSE: TOL) (TollBrothers.com), the nation’s leading builder of luxury homes, today announced that Judith A. Reinsdorf and Katherine M. Sandstrom have joined the Company’s Board of Directors. In addition, Carl B. Marbach, age 82, has informed the Company that he will not stand for re-election and will step down from the Board at its next annual meeting of stockholders in March 2024. Ms. Reinsdorf, age 59, most recently s |

Cohen & Steers Announces Changes to Realty IndexesCohen & Steers, Inc. (NYSE: CNS) announced today pending changes to its Realty Majors Portfolio Index (RMP) and Global Realty Majors Portfolio Index (GRM), effective as of the close of business on November 17, 2023. |

It's Merger Monday for Real-Estate Investment TrustsMerger mania swept the beleaguered real-estate sector on Monday with the announcement of two multi-billion dollar deals. San Diego's **Realty Income** ([O](https://www.wsj.com/market-data/quotes/O)) agreed to buy Dallas-based **Spirit Realty Capital** ([SRC](https://www. |

PEAK Price Returns

| 1-mo | -9.60% |

| 3-mo | 12.86% |

| 6-mo | -12.40% |

| 1-year | -29.52% |

| 3-year | -31.95% |

| 5-year | -27.39% |

| YTD | -9.14% |

| 2023 | -16.40% |

| 2022 | -27.53% |

| 2021 | 23.74% |

| 2020 | -7.69% |

| 2019 | 29.16% |

PEAK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...