AMC Networks Inc. - (AMCX): Price and Financial Metrics

AMCX Price/Volume Stats

| Current price | $17.04 | 52-week high | $27.46 |

| Prev. close | $17.00 | 52-week low | $9.96 |

| Day low | $16.77 | Volume | 431,200 |

| Day high | $17.23 | Avg. volume | 357,615 |

| 50-day MA | $18.03 | Dividend yield | N/A |

| 200-day MA | $14.06 | Market Cap | 742.21M |

AMCX Stock Price Chart Interactive Chart >

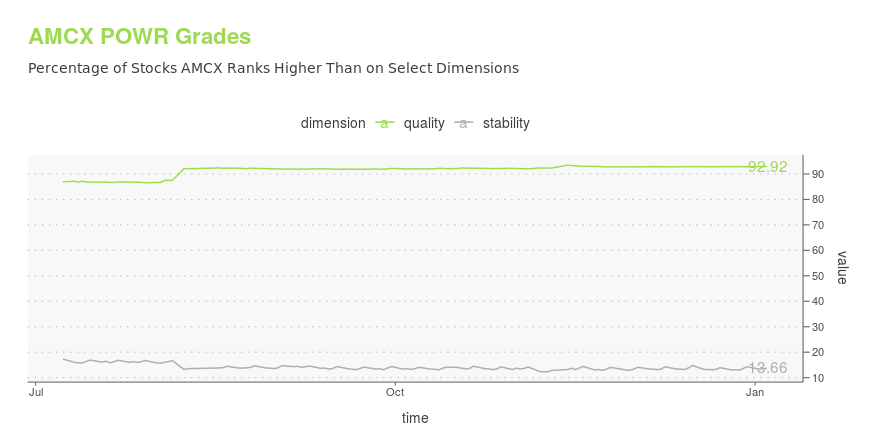

AMCX POWR Grades

- Quality is the dimension where AMCX ranks best; there it ranks ahead of 92.92% of US stocks.

- The strongest trend for AMCX is in Quality, which has been heading up over the past 26 weeks.

- AMCX's current lowest rank is in the Stability metric (where it is better than 13.66% of US stocks).

AMCX Stock Summary

- Price to trailing twelve month operating cash flow for AMCX is currently 2.9, higher than only 9.02% of US stocks with positive operating cash flow.

- With a price/sales ratio of 0.27, AMC NETWORKS INC has a higher such ratio than merely 8.22% of stocks in our set.

- In terms of twelve month growth in earnings before interest and taxes, AMC NETWORKS INC is reporting a growth rate of -88.24%; that's higher than merely 15.24% of US stocks.

- Stocks that are quantitatively similar to AMCX, based on their financial statements, market capitalization, and price volatility, are PENN, JBLU, KAR, SBT, and HAIN.

- AMCX's SEC filings can be seen here. And to visit AMC NETWORKS INC's official web site, go to www.amcnetworks.com.

AMCX Valuation Summary

- AMCX's price/earnings ratio is -29.9; this is 267.98% lower than that of the median Communication Services stock.

- Over the past 153 months, AMCX's price/sales ratio has gone down 2.1.

Below are key valuation metrics over time for AMCX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| AMCX | 2023-12-29 | 0.3 | 0.8 | -29.9 | 44.2 |

| AMCX | 2023-12-28 | 0.3 | 0.8 | -29.8 | 44.2 |

| AMCX | 2023-12-27 | 0.3 | 0.8 | -29.4 | 44.0 |

| AMCX | 2023-12-26 | 0.3 | 0.8 | -29.1 | 43.9 |

| AMCX | 2023-12-22 | 0.3 | 0.8 | -29.0 | 43.8 |

| AMCX | 2023-12-21 | 0.3 | 0.8 | -30.6 | 44.5 |

AMCX Growth Metrics

- The year over year net income to common stockholders growth rate now stands at 3.65%.

- Its 3 year net cashflow from operations growth rate is now at -98.13%.

- Its 2 year cash and equivalents growth rate is now at 16.69%.

The table below shows AMCX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 3,096.545 | 181.834 | 7.594 |

| 2022-09-30 | 2,935.734 | 136.081 | 289.322 |

| 2022-06-30 | 3,064.657 | 29.481 | 315.307 |

| 2022-03-31 | 3,098.024 | 12.356 | 267.763 |

| 2021-12-31 | 3,077.608 | 143.474 | 250.596 |

| 2021-09-30 | 3,054.174 | 148.633 | 328.268 |

AMCX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- AMCX has a Quality Grade of B, ranking ahead of 92.82% of graded US stocks.

- AMCX's asset turnover comes in at 0.543 -- ranking 15th of 64 Communication stocks.

- TMUS, ROKU, and CMCSA are the stocks whose asset turnover ratios are most correlated with AMCX.

The table below shows AMCX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.543 | 0.519 | 0.136 |

| 2021-03-31 | 0.523 | 0.517 | 0.128 |

| 2020-12-31 | 0.530 | 0.502 | 0.124 |

| 2020-09-30 | 0.522 | 0.508 | 0.092 |

| 2020-06-30 | 0.528 | 0.512 | 0.094 |

| 2020-03-31 | 0.545 | 0.498 | 0.117 |

AMCX Price Target

For more insight on analysts targets of AMCX, see our AMCX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $51.51 | Average Broker Recommendation | 2.12 (Hold) |

AMC Networks Inc. - (AMCX) Company Bio

AMC Networks owns and operates various cable televisions brands delivering content to audiences, and a platform to distributors and advertisers in the United States and internationally. The company was founded in 1980 and is based in New York, New York.

Latest AMCX News From Around the Web

Below are the latest news stories about AMC NETWORKS INC that investors may wish to consider to help them evaluate AMCX as an investment opportunity.

Is Accel Entertainment (ACEL) Outperforming Other Consumer Discretionary Stocks This Year?Here is how Accel Entertainment (ACEL) and AMC Networks (AMCX) have performed compared to their sector so far this year. |

AMC Networks Inc Director Matthew Blank Sells 50,000 SharesOn December 22, 2023, Matthew Blank, a director at AMC Networks Inc (NASDAQ:AMCX), sold 50,000 shares of the company's stock, according to a recent SEC Filing. |

AMC Networks (AMCX) Is Attractively Priced Despite Fast-paced MomentumAMC Networks (AMCX) made it through our 'Fast-Paced Momentum at a Bargain' screen and could be a great choice for investors looking for stocks that have gained strong momentum recently but are still trading at reasonable prices. |

AMC Networks Inc EVP and General Counsel James Gallagher Sells 22,000 SharesJames Gallagher, EVP and General Counsel of AMC Networks Inc (NASDAQ:AMCX), has sold 22,000 shares of the company on December 19, 2023, according to a recent SEC Filing. |

Small Stocks Are On A Tear — Investors Race To Buy These 10Small stocks are blasting past the S&P 500 — and investors are loading up on a handful of them fast. |

AMCX Price Returns

| 1-mo | -10.41% |

| 3-mo | 22.15% |

| 6-mo | 35.78% |

| 1-year | -5.54% |

| 3-year | -63.91% |

| 5-year | -72.58% |

| YTD | -9.31% |

| 2023 | 19.91% |

| 2022 | -54.50% |

| 2021 | -3.72% |

| 2020 | -9.44% |

| 2019 | -28.02% |

Continue Researching AMCX

Want to do more research on AMC Networks Inc's stock and its price? Try the links below:AMC Networks Inc (AMCX) Stock Price | Nasdaq

AMC Networks Inc (AMCX) Stock Quote, History and News - Yahoo Finance

AMC Networks Inc (AMCX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...