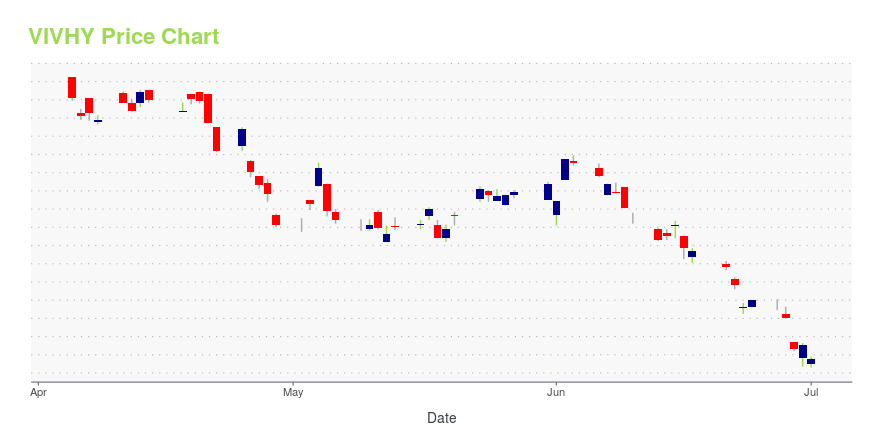

Vivendi (VIVHY): Price and Financial Metrics

VIVHY Price/Volume Stats

| Current price | $10.93 | 52-week high | $11.56 |

| Prev. close | $10.99 | 52-week low | $8.40 |

| Day low | $10.91 | Volume | 11,300 |

| Day high | $10.99 | Avg. volume | 27,419 |

| 50-day MA | $10.47 | Dividend yield | 1.76% |

| 200-day MA | $9.52 | Market Cap | 11.26B |

VIVHY Stock Price Chart Interactive Chart >

Vivendi (VIVHY) Company Bio

Vivendi, through its subsidiaries, conducts operations ranging from music, games, and television to film and telecommunications. The Company provides digital and pay television services, sells music compact discs (CDs), develops and distributes interactive entertainment, and operates mobile and fixed-line telecommunications.

Latest VIVHY News From Around the Web

Below are the latest news stories about Vivendi that investors may wish to consider to help them evaluate VIVHY as an investment opportunity.

Telecom Italia to decide on KKR approach by mid-MarchTelecom Italia (TIM) is expected to make a decision on a 10.8 billion euro ($12.2 billion) takeover proposal from U.S. private equity firm KKR by the middle of next month. But KKR has been forced to play a waiting game as Telecom Italia overhauled its management, ousting its fourth chief executive in six years after a string of profit warnings. New boss Pietro Labriola is working on a standalone plan to be presented to investors next week as an alternative to a KKR deal, with the backing of Telecom Italia top investors Vivendi and state lender CDP. |

Vivendi Weighs Raising Offer Price for Rival Lagardere(Bloomberg) -- Vivendi is considering raising the price of its cash offer for rival media company Lagardere SA, in its bid to create a media giant.Most Read from BloombergMorgan Stanley Relationships on Wall Street Snared in ProbeLavrov Agrees to Meet Blinken, U.S. Says: Ukraine UpdateIndia Protests Against Singapore PM’s Comments on LawmakersThousands of Cars Including Audis, Porsches Adrift on Burning Cargo ShipThe Housing Boom’s Mortgage Rate Threat Is Worse Than It SeemsVivendi, which is cur |

VIVHY or TU: Which Is the Better Value Stock Right Now?VIVHY vs. TU: Which Stock Is the Better Value Option? |

UPDATE 2-In shadow of KKR approach, Telecom Italia presses ahead with alternative planTelecom Italia (TIM) directors discussed on Monday an overhaul of Italy's biggest telecoms group, as newly appointed Chief Executive Pietro Labriola draws up an alternative to a takeover bid by U.S. fund KKR. TIM must find a way to shore up its business after a string of profit warnings last year due to lower-than-expected revenue from a deal with DAZN to show soccer matches in Italy and stiff competition at home which puts pressure on margins. TIM's board on Monday discussed Labriola's standalone plan in response to KKR's 10.8 billion euro ($12.2 billion) approach, which the group's top shareholder, French media company Vivendi , has said is too low. |

In shadow of KKR approach, Telecom Italia to discuss overhaulTelecom Italia (TIM) directors will on Monday discuss a plan to reorganise Italy's biggest telecoms group as newly appointed Chief Executive Pietro Labriola tries to forge an alternative to a takeover approach by U.S. fund KKR . Labriola, who previously ran TIM's Brazilian business, is working on a standalone plan in response to the 10.8 billion euro ($12.2 billion) approach from KKR, which TIM's top shareholder, French media company Vivendi, has said is too low. Under Labriola's plans, which still have to be finalised and would be presented to investors on March 3, the so-called NetCo would include the whole of Telecom Italia's fibre and copper network infrastructure and submarine cable unit Sparkle, sources have said. |

VIVHY Price Returns

| 1-mo | 1.39% |

| 3-mo | 19.19% |

| 6-mo | 23.50% |

| 1-year | 5.49% |

| 3-year | 10.38% |

| 5-year | 41.86% |

| YTD | 2.67% |

| 2023 | 14.23% |

| 2022 | -28.47% |

| 2021 | 28.02% |

| 2020 | 13.29% |

| 2019 | 21.58% |

VIVHY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...